Form 982

What is the Form 982

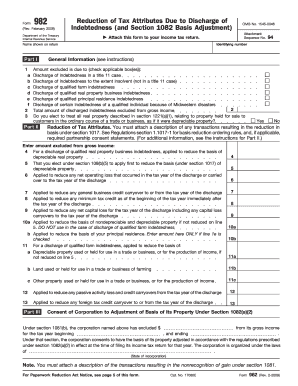

The Form 982, also known as the Reduction of Tax Attributes Due to Discharge of Indebtedness, is a tax form used by taxpayers in the United States to report the discharge of debt. This form is particularly relevant for individuals who have had debt forgiven or canceled, as it allows them to exclude that forgiven debt from their taxable income under certain conditions. The form is essential for ensuring compliance with IRS regulations regarding the treatment of discharged debt and its impact on tax attributes.

How to use the Form 982

Using the Form 982 involves several steps to accurately report any discharged debt. Taxpayers must first determine if they qualify for the exclusion of discharged debt from their taxable income. Once eligibility is established, the form must be filled out with specific details regarding the debt discharged, including the amount and the reason for the discharge. It is important to attach the completed Form 982 to the taxpayer's income tax return for the year in which the debt was discharged.

Steps to complete the Form 982

Completing the Form 982 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the discharged debt, including the amount and the creditor's details.

- Determine eligibility for the exclusion based on IRS guidelines.

- Fill out the form, ensuring to include all required information accurately.

- Attach the completed Form 982 to your tax return for the relevant tax year.

- Keep a copy of the form and any supporting documents for your records.

Legal use of the Form 982

The legal use of Form 982 is governed by IRS regulations. Taxpayers must ensure that they meet the criteria for excluding discharged debt from their taxable income. Failure to comply with these regulations can result in penalties or additional taxes owed. It is advisable to consult with a tax professional if there are uncertainties regarding the form's legal implications or the eligibility criteria for debt exclusion.

Filing Deadlines / Important Dates

Filing deadlines for Form 982 coincide with the deadlines for filing income tax returns. Typically, individual taxpayers must submit their returns by April 15 of the year following the tax year in which the debt was discharged. If additional time is needed, taxpayers can file for an extension, but they must still attach Form 982 to their return by the extended deadline. Staying aware of these dates is crucial to avoid late filing penalties.

Required Documents

To complete Form 982 accurately, several documents may be required. Taxpayers should have the following on hand:

- Documentation of the discharged debt, such as cancellation letters or statements from creditors.

- Previous tax returns that may provide context for the taxpayer's financial situation.

- Any relevant IRS publications or guidelines that pertain to the exclusion of discharged debt.

Eligibility Criteria

Eligibility for using Form 982 hinges on specific criteria set by the IRS. Generally, taxpayers must demonstrate that the debt was discharged in a bankruptcy case or that they meet certain income limitations. It is essential to review IRS guidelines to confirm eligibility, as improper use of the form can lead to complications during tax filing.

Quick guide on how to complete form 982 1653780

Complete Form 982 effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Form 982 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Form 982 with ease

- Find Form 982 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 982 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 982 1653780

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 982 and how can airSlate SignNow help with it?

Form 982 is used to claim a reduction in tax attributes due to a discharge of indebtedness. airSlate SignNow simplifies the process of signing and submitting form 982 by providing a user-friendly platform that allows for quick eSigning, ensuring compliance and efficiency.

-

Is there a cost associated with using airSlate SignNow to manage form 982?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan allows you to efficiently manage documents like form 982 with features such as templates, bulk sending, and enhanced security, all at competitive rates.

-

What features does airSlate SignNow offer for signing form 982?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all designed to streamline the signing process for form 982. You can easily send, sign, and store your documents, making it a reliable choice for busy professionals.

-

Can I integrate airSlate SignNow with other software while managing form 982?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and Salesforce, allowing you to manage form 982 seamlessly. These integrations foster better workflow and enhance productivity by connecting your document management systems.

-

What are the benefits of using airSlate SignNow for form 982?

Using airSlate SignNow for form 982 offers numerous benefits, such as reducing processing time, enhancing security through encrypted signatures, and eliminating paper-based workflows. This makes it easier for businesses to handle important documentation efficiently and cost-effectively.

-

How secure is my information when using airSlate SignNow for form 982?

airSlate SignNow ensures top-notch security for your data, including form 982, through features like AES 256-bit encryption and secure authentication protocols. Your documents are protected throughout the signing process, giving you peace of mind regarding sensitive information.

-

What is the process for creating a template for form 982 in airSlate SignNow?

Creating a template for form 982 in airSlate SignNow is straightforward. You can start by uploading your form, customizing the fields for signatures and dates, and then saving it as a template. This allows for quick future access and streamlined signing for similar documents.

Get more for Form 982

- Bottrelldolan family educational scholarship langdon area school langdon k12 nd form

- Cua transcript form

- 16 see rule 311a certificate under section 203 of the incometax act 1961 for tax deducted at source from income chargeable form

- How to apply for a blue badge in county durham form

- Personal history form p 11 ohchr cambodia

- Application for leave of absence loa form upou office of the

- Employee cell phone agreement template form

- Employee commission agreement template form

Find out other Form 982

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile