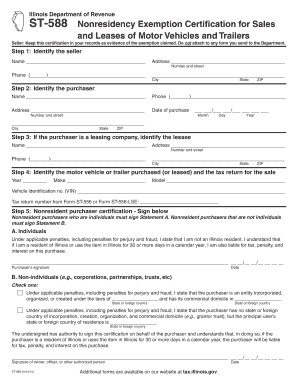

St588 Form

What is the ST588?

The ST588 form is a tax-related document used in the United States, primarily for reporting sales and use tax exemptions. It is essential for businesses and individuals who qualify for tax exemptions on certain purchases. By completing the ST588, taxpayers can assert their eligibility for these exemptions, thus avoiding unnecessary tax liabilities. This form is especially relevant for organizations and entities that frequently engage in transactions where tax exemptions apply.

How to use the ST588

Using the ST588 form involves several straightforward steps. First, ensure that you meet the eligibility criteria for tax exemption. Next, accurately fill out the form with the required information, including your name, address, and details of the purchase. It is important to provide correct information to avoid delays or issues with your exemption claim. Once completed, submit the form to the seller at the time of purchase to validate your tax-exempt status.

Steps to complete the ST588

Completing the ST588 form requires careful attention to detail. Follow these steps for a successful submission:

- Gather necessary information, including your business name, address, and tax identification number.

- Clearly indicate the nature of the purchase and the reason for the tax exemption.

- Review the form for accuracy, ensuring all fields are filled out correctly.

- Sign and date the form to validate your exemption claim.

- Provide the completed form to the seller at the time of the transaction.

Legal use of the ST588

The ST588 form is legally binding when completed accurately and submitted in accordance with state tax laws. It serves as a declaration of your eligibility for tax exemptions, and misuse of the form can lead to penalties. Compliance with the relevant tax regulations is crucial to ensure that the exemptions claimed are legitimate and justifiable. Always keep a copy of the submitted form for your records, as it may be required for future reference or audits.

Key elements of the ST588

Several key elements must be included in the ST588 form to ensure its validity:

- Taxpayer Information: Full name, address, and tax identification number.

- Purchase Details: A description of the items or services being purchased.

- Exemption Reason: A clear statement explaining the basis for the tax exemption.

- Signature: The form must be signed and dated by the taxpayer or an authorized representative.

Examples of using the ST588

There are various scenarios where the ST588 form can be utilized. For instance, a nonprofit organization purchasing supplies for charitable activities may use the form to claim an exemption from sales tax. Similarly, a manufacturer acquiring raw materials for production can also submit the ST588 to avoid paying sales tax on those purchases. Each situation must clearly demonstrate the eligibility for the exemption to ensure compliance with tax regulations.

Quick guide on how to complete st588

Effortlessly Prepare St588 on Any Device

The management of online documents has gained popularity among both businesses and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage St588 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign St588 with Ease

- Obtain St588 and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize key sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign St588 to ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st588

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is st588 and how does it relate to airSlate SignNow?

The st588 is a unique identifier for features available in airSlate SignNow. It helps users understand the functionality related to electronic signatures and document management. By leveraging st588, businesses can streamline their workflow and enhance efficiency.

-

What are the pricing options for airSlate SignNow using st588?

airSlate SignNow offers competitive pricing plans that cater to different business needs, ensuring that the st588 services are accessible to all. Customers can choose from monthly or annual subscriptions based on their usage. This flexibility allows businesses to optimize costs while enjoying top-notch features.

-

What features does airSlate SignNow offer under st588?

Under st588, airSlate SignNow provides a range of features that include electronic signatures, document templates, and real-time tracking. These capabilities enhance document workflows and signNowly reduce turnaround times. Users benefit from a user-friendly interface that makes it easy to manage and send important documents.

-

How can st588 benefit my business?

Utilizing st588 through airSlate SignNow can help businesses save time and reduce costs associated with manual document handling. The benefits include increased efficiency, improved accuracy, and enhanced collaboration among teams. With eSigning capabilities, companies can expedite contract processes signNowly.

-

Does airSlate SignNow integrate with other software using st588?

Yes, airSlate SignNow's st588 features are designed to seamlessly integrate with various software tools, enhancing its functionality. Integrations with platforms like Google Drive, Salesforce, and more enable users to streamline their processes. This integration capability ensures that users can manage their documents in one centralized location.

-

Is st588 compliant with legal standards for electronic signatures?

Absolutely, airSlate SignNow adheres to legal standards and regulations for electronic signatures, including compliance with the ESIGN Act and UETA. The st588 features are designed to meet the highest security and legal requirements, ensuring that your documents are legally binding. This compliance instills trust and reliability in your business transactions.

-

What support options are available for st588 users?

AirSlate SignNow provides comprehensive support for users leveraging st588 features through various channels like live chat, email, and a detailed FAQ section. Customers can access resources that help them maximize their usage of the platform. Dedicated customer support teams are available to assist with any queries or issues that may arise.

Get more for St588

- Lifeline agent contract agent full cycle distributors form

- Forma pauperis north carolina

- Phs 6134 100126794 form

- High mileage discount application form personal property high mileage form va

- Printable auto accident information forms

- Replacement paramedic card georgia form

- Lidocaine patch prior authorization request form

- Poster submission form excipientfest

Find out other St588

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document