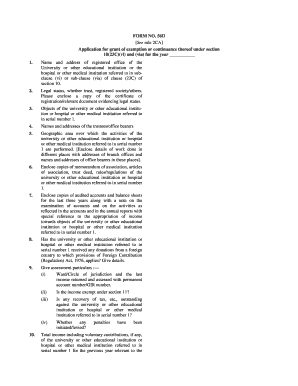

Form 56d of Income Tax Act

What is the Form 56d of Income Tax Act

The Form 56d of the Income Tax Act is a document utilized in the United States for specific tax-related purposes. This form is essential for reporting certain types of income or deductions that may not be captured through standard tax forms. It is primarily used by individuals or entities that need to declare additional financial information to comply with federal tax regulations. Understanding the purpose and requirements of Form 56d is crucial for accurate tax reporting and compliance.

How to use the Form 56d of Income Tax Act

Using the Form 56d involves several steps that ensure proper completion and submission. First, gather all necessary financial documents that pertain to the income or deductions you are reporting. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the guidelines provided by the IRS.

Steps to complete the Form 56d of Income Tax Act

Completing the Form 56d requires attention to detail. Follow these steps:

- Collect all relevant financial documents.

- Obtain the latest version of the Form 56d from the IRS website.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check for any errors or omissions.

- Submit the form electronically or by mail, following the IRS submission guidelines.

Legal use of the Form 56d of Income Tax Act

The legal use of Form 56d is governed by federal tax laws. When completed accurately, this form serves as a legally binding document that supports the information reported on your tax return. Compliance with IRS regulations is essential to avoid penalties. It is advisable to retain a copy of the completed form for your records, as it may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 56d can vary based on individual circumstances and the type of income being reported. Generally, forms must be submitted by the tax filing deadline, which is typically April 15 for most taxpayers. It is important to stay informed about any changes to deadlines that may occur due to legislative updates or IRS announcements.

Required Documents

To complete the Form 56d, certain documents are required. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts or documentation for deductions being claimed.

- Any prior tax returns that may provide relevant information.

Having these documents ready will facilitate a smoother completion process and ensure accuracy in your reporting.

Quick guide on how to complete form 56d

Prepare form 56d with ease on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Handle form 56d on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign form no 56 effortlessly

- Find form 56d of income tax act and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight necessary sections of your documents or obscure confidential information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all information carefully and then click the Done button to save your changes.

- Choose how you prefer to share your form, via email, text (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Modify and eSign form 56 of income tax act to ensure clear communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 56

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 56 of income tax act

-

What is Form 56D and how does airSlate SignNow support it?

Form 56D is a document used for various business transactions, and airSlate SignNow streamlines its completion and eSigning process. With our platform, you can easily create, send, and track Form 56D in a secure environment, ensuring compliance and efficiency in your workflows.

-

Is airSlate SignNow affordable for small businesses looking to use Form 56D?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to small businesses. This makes it affordable for teams looking to efficiently manage documents like Form 56D without compromising on features or usability.

-

What features does airSlate SignNow provide for managing Form 56D?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure electronic signatures specifically tailored for Form 56D. These features help streamline document management and improve collaboration among users.

-

How can airSlate SignNow improve my team's workflow with Form 56D?

By using airSlate SignNow for Form 56D, you can automate routine tasks, track document status, and reduce turnaround times. This results in a more efficient workflow, allowing your team to focus on more critical business activities.

-

What integrations does airSlate SignNow offer for Form 56D?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Slack, and CRM systems to facilitate the management of Form 56D. These integrations enhance collaboration and data storage capabilities, making it easier to access and share documents.

-

Is it safe to use airSlate SignNow for sending sensitive Form 56D documents?

Absolutely, airSlate SignNow prioritizes security by using advanced encryption and compliance measures. This ensures that all your sensitive Form 56D documents are transmitted securely and remain private throughout the signing process.

-

What benefits does eSigning Form 56D with airSlate SignNow offer?

eSigning Form 56D with airSlate SignNow provides several benefits, including faster execution times, reduced paper waste, and improved tracking of document statuses. These advantages lead to a more streamlined and environmentally friendly approach to document management.

Get more for form 56d

- Form nc 864lt

- Has a child or children form

- Summary or informal administration

- State of minnesota hereinafter referred to as the trustor whether one or more form

- Control number sd 00llc form

- State of south dakota hereinafter referred to as the trustor and the trustee form

- State of west virginia hereinafter referred to as the trustor and the trustee form

- Notice of satisfaction of mortgage form

Find out other form no 56

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal