City of Tempe Sales Tax Return Form

What is the City Of Tempe Sales Tax Return Form

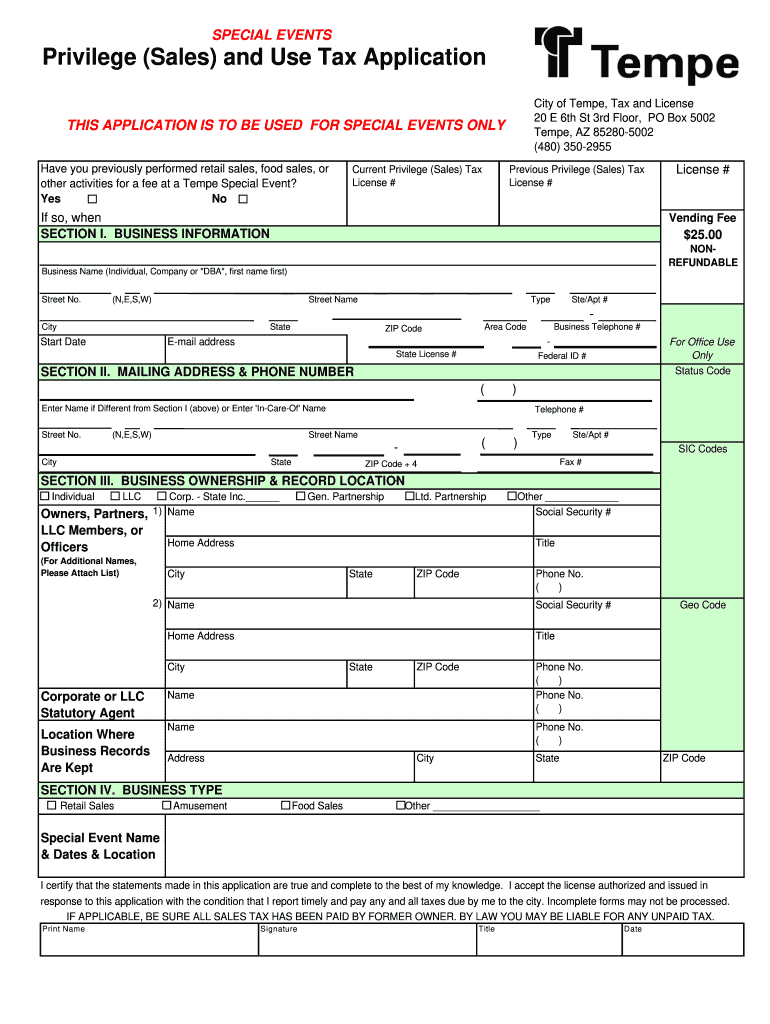

The City of Tempe Sales Tax Return Form is a crucial document for businesses operating within Tempe, Arizona. This form is used to report and remit sales tax collected from customers to the city. Businesses, including limited companies, must accurately complete this form to ensure compliance with local tax regulations. The form includes various sections that require detailed information about sales transactions, tax collected, and any applicable deductions or exemptions.

How to use the City Of Tempe Sales Tax Return Form

Using the City of Tempe Sales Tax Return Form involves several key steps. First, gather all necessary financial records, including sales receipts and tax collected. Next, accurately fill out the form by entering total sales, taxable sales, and the corresponding tax amounts. Be sure to review the form for accuracy before submission. Finally, submit the completed form either online, by mail, or in person, depending on your preference and the options available. Utilizing signNow can streamline this process by allowing you to fill out and eSign the form digitally.

Steps to complete the City Of Tempe Sales Tax Return Form

Completing the City of Tempe Sales Tax Return Form requires careful attention to detail. Follow these steps for a successful submission:

- Gather all sales records for the reporting period.

- Determine the total sales and taxable sales amounts.

- Calculate the total sales tax collected.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form by the designated deadline.

Legal use of the City Of Tempe Sales Tax Return Form

The legal use of the City of Tempe Sales Tax Return Form is essential for compliance with local tax laws. Businesses must ensure that the information provided is truthful and accurate, as submitting false information can lead to penalties. The form serves as a legal document that demonstrates a business's compliance with the city’s sales tax regulations. Keeping records of submitted forms and supporting documents is also advisable for future reference and audits.

Filing Deadlines / Important Dates

Filing deadlines for the City of Tempe Sales Tax Return Form are critical for businesses to avoid penalties. Typically, the form is due on a monthly or quarterly basis, depending on the business's sales volume. It is important to check the specific deadlines for your business type to ensure timely submission. Missing a deadline can result in late fees and interest on unpaid taxes, making it essential to stay informed about these important dates.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the City of Tempe Sales Tax Return Form. The form can be submitted online through the city’s official website, allowing for quick processing. Alternatively, businesses may choose to mail the completed form to the appropriate city department. In-person submissions are also accepted at designated city offices. Each method has its own advantages, and businesses should select the one that best fits their needs for convenience and efficiency.

Quick guide on how to complete city of tempe tpt return form

Your assistance manual on how to prepare your City Of Tempe Sales Tax Return Form

If you’re curious about how to complete and submit your City Of Tempe Sales Tax Return Form, here are some brief instructions on how to simplify tax filing.

To begin, you simply need to create your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is a user-friendly and robust document solution that enables you to modify, draft, and finalize your income tax forms with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and return to update details as necessary. Streamline your tax management with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your City Of Tempe Sales Tax Return Form in just a few minutes:

- Create your account and start working on PDFs almost instantly.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your City Of Tempe Sales Tax Return Form in our editor.

- Complete the required fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if necessary).

- Review your document and correct any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Leverage this manual to file your taxes electronically with airSlate SignNow. Remember that paper submissions can lead to return errors and slow down reimbursements. Before e-filing your taxes, make sure to check the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

FAQs

-

What is the official website to fill out the GST return form?

https://www.gst.gov.in/

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

Create this form in 5 minutes!

How to create an eSignature for the city of tempe tpt return form

How to generate an eSignature for your City Of Tempe Tpt Return Form online

How to generate an eSignature for your City Of Tempe Tpt Return Form in Chrome

How to create an electronic signature for putting it on the City Of Tempe Tpt Return Form in Gmail

How to make an eSignature for the City Of Tempe Tpt Return Form straight from your smart phone

How to make an electronic signature for the City Of Tempe Tpt Return Form on iOS devices

How to generate an eSignature for the City Of Tempe Tpt Return Form on Android

People also ask

-

What are the benefits of using airSlate SignNow for a limited company?

Using airSlate SignNow for your limited company can streamline your document signing process, improving efficiency and reducing turnaround time. The platform provides a user-friendly interface that makes it easy for employees to send and eSign documents securely. Additionally, it allows for better tracking and management of signed documents, ensuring compliance and reducing the risk of lost paperwork.

-

Is airSlate SignNow affordable for a limited company?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for limited companies of various sizes. The pricing structure is designed to fit different budgets while providing robust features that enhance productivity. This ensures that even small limited companies can take advantage of advanced eSignature solutions without overspending.

-

What features does airSlate SignNow offer for limited companies?

airSlate SignNow includes a variety of features specifically beneficial for limited companies, such as document templates, customization options, and advanced security protocols. The platform supports team collaboration, allowing multiple users to interact with documents efficiently. Furthermore, its mobile compatibility ensures that you can signed documents on the go, ensuring constant productivity.

-

How does airSlate SignNow ensure the security of documents for a limited company?

Security is paramount for airSlate SignNow, and the platform employs advanced encryption and secure cloud storage to protect your documents. For a limited company, this means that sensitive information is safeguarded against unauthorized access. Additionally, the platform complies with various legal regulations to ensure that your eSignatures are legally binding.

-

Can airSlate SignNow integrate with other tools used by a limited company?

Absolutely, airSlate SignNow offers seamless integrations with popular tools and software that many limited companies already use, such as Google Workspace, Microsoft Office, and various CRM systems. This ensures that you can streamline your workflow and maintain efficiency without disrupting your existing processes. Such integrations enable easier document management and reinforce collaboration across your team.

-

How long does it take to set up airSlate SignNow for a limited company?

Setting up airSlate SignNow for your limited company is a quick and straightforward process, often taking just minutes. After signing up, you can easily customize your account settings, upload necessary documents, and start sending them for a signature. The intuitive interface allows users to get accustomed to the platform quickly, minimizing downtime.

-

What types of documents can a limited company send using airSlate SignNow?

A limited company can send a wide array of documents using airSlate SignNow, including contracts, agreements, tax forms, and employee onboarding documents. The flexibility of the platform allows you to create and upload custom document templates that are suitable for your specific business needs. This versatility helps in expediting the signing process for any type of document.

Get more for City Of Tempe Sales Tax Return Form

Find out other City Of Tempe Sales Tax Return Form

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online