Pdc Loan Form

What is the PDC Loan

The PDC loan, or Post-Dated Check loan, is a financial instrument often used to secure funds based on a check that is dated for a future date. This type of loan allows borrowers to access cash quickly while providing lenders with a guarantee of repayment on the specified date. The PDC loan is particularly useful for individuals or businesses that may need immediate funds but can repay the amount at a later time.

How to use the PDC Loan

Using a PDC loan involves several straightforward steps. First, the borrower must identify a lender who offers PDC loans. After selecting a lender, the borrower needs to fill out an application form, providing necessary personal and financial information. Once approved, the borrower issues a post-dated check to the lender for the loan amount plus any applicable fees or interest. It is crucial to ensure that sufficient funds are available in the account on the date the check is cashed to avoid overdraft fees.

Steps to complete the PDC Loan

Completing a PDC loan involves a series of steps to ensure a smooth process:

- Research Lenders: Look for reputable lenders that offer PDC loans.

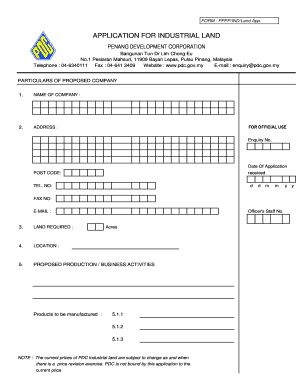

- Fill Out Application: Provide accurate personal and financial information.

- Review Terms: Understand the loan terms, including interest rates and repayment schedules.

- Issue Post-Dated Check: Write a check for the loan amount, dated for the repayment date.

- Ensure Funds Availability: Confirm that your account will have sufficient funds on the repayment date.

Legal use of the PDC Loan

The legal use of a PDC loan is governed by state laws and regulations. It is essential for borrowers to understand their rights and obligations under these laws. The loan agreement should clearly outline the terms, including repayment conditions and consequences of default. Compliance with relevant consumer protection laws is also crucial to ensure that the loan is executed legally and ethically.

Eligibility Criteria

Eligibility for a PDC loan typically includes several criteria that borrowers must meet. Common requirements may include:

- Age: Borrowers must be at least eighteen years old.

- Income: Proof of a stable income source may be required.

- Bank Account: A checking account is necessary for issuing a post-dated check.

- Credit History: Some lenders may review credit history, although it is not always a determining factor.

Required Documents

When applying for a PDC loan, borrowers usually need to provide specific documentation. This may include:

- Identification: A government-issued ID such as a driver's license or passport.

- Proof of Income: Recent pay stubs or bank statements to verify income.

- Bank Information: Details of the checking account from which the post-dated check will be drawn.

- Loan Application: Completed application form with personal and financial details.

Quick guide on how to complete pdc

Complete pdc effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the instruments you require to generate, modify, and electronically sign your documents rapidly without delays. Manage pdc full form on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign pdc loan with ease

- Find pdc form and then click Get Form to begin.

- Utilize the tools provided to submit your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries exactly the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your revisions.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you prefer. Edit and electronically sign pdc acknowledgement receipt and ensure optimal communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to pdc form

Create this form in 5 minutes!

How to create an eSignature for the pdc acknowledgement receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask pdc penang

-

What is the pdc full form in the context of airSlate SignNow?

The pdc full form is 'Payment Due date Confirmation.' In airSlate SignNow, this refers to a feature that helps businesses track and confirm payment due dates for signed documents, enhancing financial management and accountability.

-

How does airSlate SignNow streamline the document signing process?

AirSlate SignNow simplifies document signing by allowing users to eSign directly within the platform. With features like templates and automated reminders, businesses can ensure that all required signatures, including those associated with the pdc full form, are collected promptly and efficiently.

-

What are the pricing options available for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that cater to various business needs. Each plan provides different features, including those that facilitate handling documents involving the pdc full form, making it an economical choice for businesses of all sizes.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing productivity. This includes CRM systems and financial software that often require handling documents that reference the pdc full form.

-

What benefits does airSlate SignNow provide for businesses?

AirSlate SignNow offers multiple benefits, including improved efficiency in document workflows and faster turnaround times for eSigning. This helps companies manage critical documents, such as those related to the pdc full form, more effectively.

-

Is airSlate SignNow secure for document management?

Yes, security is a top priority for airSlate SignNow. The platform employs robust security protocols and encryption methods to ensure that all documents, including those with the pdc full form, are safely stored and transmitted.

-

How does airSlate SignNow enhance collaboration among teams?

AirSlate SignNow fosters collaboration by allowing multiple users to access and sign documents simultaneously. This is particularly useful for teams that manage agreements tied to the pdc full form, ensuring everyone is on the same page.

Get more for pdc full form

- Application form nc state university

- General assistance check listjob search form

- Evaluation memorandum form

- Release and waiver associated students of sdsu san diego as sdsu form

- Docusign envelope id 4c4f70fd 5a0e 45fd 82c5 fa9922bfd18d form

- Student login ashford university form

- Transportation grade form

- Orpa guidance for principal investigators and administrators when form

Find out other pdc loan

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form