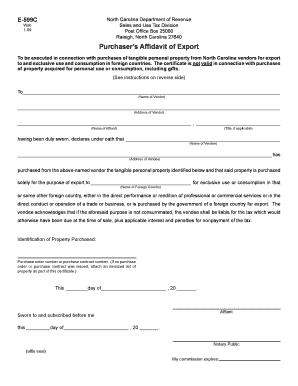

E 599c Form

What is the E 599c Form

The E 599c Form is a specific document used for reporting certain financial information to the Internal Revenue Service (IRS). It is primarily utilized by businesses and individuals who need to disclose specific transactions or financial activities. Understanding the purpose of this form is essential for compliance with U.S. tax regulations.

How to obtain the E 599c Form

To obtain the E 599c Form, individuals and businesses can visit the official IRS website or contact their local IRS office. The form is typically available for download in PDF format, allowing users to print and fill it out as needed. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to complete the E 599c Form

Completing the E 599c Form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents related to the transactions you need to report.

- Download and print the E 599c Form from the IRS website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide detailed information about the transactions or financial activities being reported.

- Review the completed form for accuracy and completeness.

- Sign and date the form where indicated.

Legal use of the E 599c Form

The E 599c Form is legally binding when completed and submitted in accordance with IRS guidelines. It is crucial to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or legal issues. Utilizing electronic signature solutions can enhance the legal validity of the form, ensuring compliance with applicable laws.

Required Documents

When filling out the E 599c Form, several documents may be required to support the information reported. These can include:

- Financial statements related to the reported transactions.

- Previous tax returns for reference.

- Any correspondence from the IRS regarding your tax status.

Having these documents on hand can facilitate a smoother completion process and help ensure accuracy.

Form Submission Methods

The E 599c Form can be submitted to the IRS through various methods. These include:

- Online submission through the IRS e-file system, if applicable.

- Mailing the completed form to the designated IRS address.

- In-person submission at your local IRS office.

Choosing the right submission method can depend on your specific circumstances and preferences.

Quick guide on how to complete e 599c form

Easily Prepare E 599c Form on Any Device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents swiftly without delays. Manage E 599c Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

How to Modify and eSign E 599c Form Effortlessly

- Find E 599c Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize critical parts of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign E 599c Form and guarantee excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e 599c form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the E 599c Form?

The E 599c Form is a document utilized for specific tax exemptions in various jurisdictions. Understanding its requirements and proper submission can make a signNow impact on your tax savings. Using airSlate SignNow, you can easily eSign and send the E 599c Form securely.

-

How can I complete the E 599c Form using airSlate SignNow?

airSlate SignNow offers intuitive tools that simplify the completion of the E 599c Form. You can fill out the necessary fields digitally, ensuring accuracy and compliance. Once completed, you can efficiently eSign the document directly within the platform.

-

Is airSlate SignNow user-friendly for filling out the E 599c Form?

Absolutely! airSlate SignNow is designed with user-friendliness in mind. Even those unfamiliar with eSigning processes can quickly learn to navigate the platform and fill out the E 599c Form effectively.

-

What are the benefits of using airSlate SignNow for the E 599c Form?

Using airSlate SignNow for the E 599c Form provides numerous benefits, including enhanced security and expedited processing. You can ensure that your documents are securely stored and accessible at any time, facilitating faster transactions without compromising safety.

-

Does airSlate SignNow integrate with other software for handling the E 599c Form?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing you to manage the E 599c Form more efficiently. Whether you're using CRM systems, cloud storage, or accounting software, these integrations streamline your workflow for optimal productivity.

-

What pricing plans does airSlate SignNow offer for eSigning the E 599c Form?

airSlate SignNow offers flexible pricing plans to accommodate different needs, making it a cost-effective solution for eSigning the E 599c Form. You can choose from various subscription options depending on your volume of usage and required features. Check our website for the latest pricing details.

-

How secure is the eSigning process for the E 599c Form with airSlate SignNow?

AirSlate SignNow prioritizes security and employs advanced encryption protocols during the eSigning process of the E 599c Form. This ensures that your sensitive information remains protected from unauthorized access while allowing you to manage documents effortlessly.

Get more for E 599c Form

- Microdermabrasion consent form 393453453

- Licking county plumbing permit form

- Ghostbuster shatters the myth about phantoms form

- Service request form pdf safeware inc

- For vehicles purchased in the following states alabama alaska california colorado connecticut form

- Spousal support letter template form

- Westlaw form builder work more productively with westlaw form builders automated forms assembly

- Www elderlaw us form

Find out other E 599c Form

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile