Gift Aid Form

What is the Gift Aid Form

The Gift Aid form is a declaration that allows charities and community organizations in the United States to reclaim tax on donations made by individuals. This form enables donors to increase the value of their contributions at no extra cost to themselves. By completing the Gift Aid form, donors permit the organization to claim back a percentage of the donation from the IRS, enhancing the overall impact of their generosity.

Steps to Complete the Gift Aid Form

Completing the Gift Aid form involves several straightforward steps:

- Gather necessary information, including your name, address, and taxpayer identification number.

- Indicate the amount of your donation and the date it was made.

- Confirm that you are a taxpayer and that you want the charity to reclaim tax on your donation.

- Sign and date the form to validate your declaration.

Ensure that all information is accurate to avoid complications in the tax reclaim process.

Legal Use of the Gift Aid Form

The Gift Aid form is legally binding when completed correctly. It must comply with IRS regulations to ensure that the charity can reclaim the appropriate tax amount. This includes providing accurate donor information and confirming the donor's taxpayer status. Non-compliance can result in penalties for both the donor and the organization.

How to Obtain the Gift Aid Form

To obtain the Gift Aid form, donors can typically request it directly from the charity or organization they wish to support. Many charities provide the form on their websites for easy access. Additionally, some organizations may offer digital versions that can be filled out and submitted electronically, streamlining the process for donors.

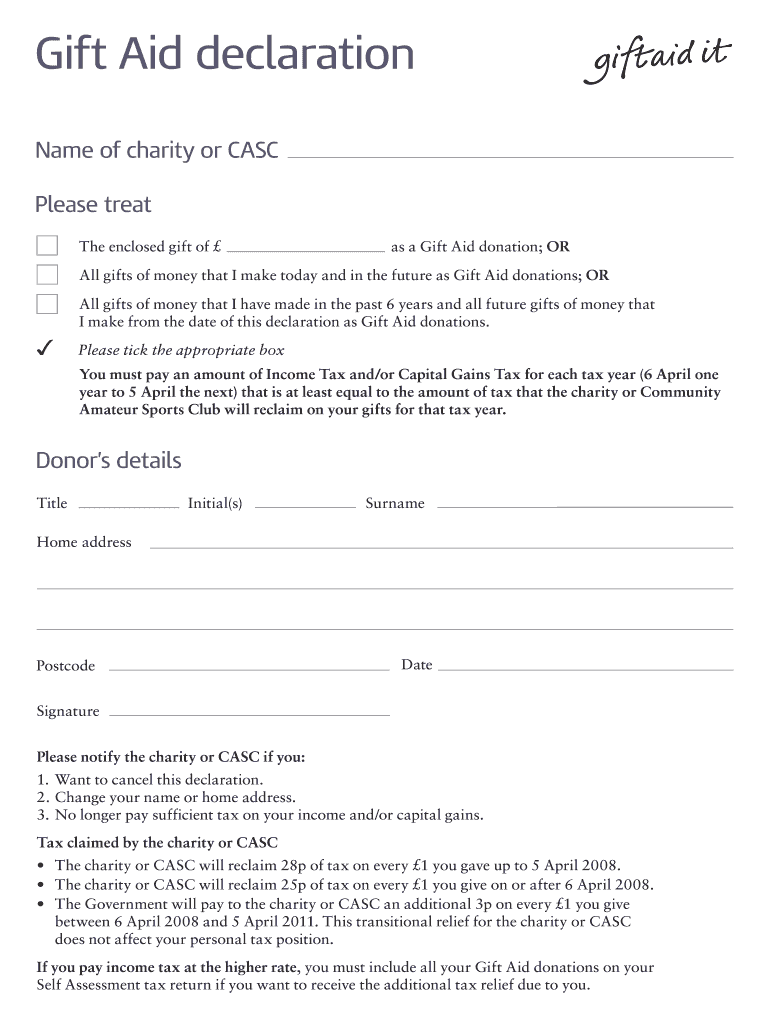

Key Elements of the Gift Aid Form

The Gift Aid form includes several key elements that must be completed for it to be valid:

- Donor Information: Full name and address of the donor.

- Donation Details: Amount donated and date of the donation.

- Taxpayer Confirmation: A statement confirming the donor's taxpayer status.

- Signature: The donor's signature and date are required to validate the form.

Examples of Using the Gift Aid Form

Donors can use the Gift Aid form in various scenarios, such as:

- Making a one-time donation to a charity.

- Setting up a recurring donation plan.

- Contributing to fundraising events organized by charitable organizations.

In each case, completing the form allows the charity to maximize the benefits of the donor's contributions.

Quick guide on how to complete gift aid form

Complete Gift Aid Form seamlessly on any gadget

Managing documents online has become favored by companies and individuals alike. It offers a superb eco-friendly substitute to traditional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Gift Aid Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The simplest way to modify and eSign Gift Aid Form effortlessly

- Locate Gift Aid Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to preserve your edits.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Gift Aid Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gift aid form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a UK Gift Aid declaration form?

The UK Gift Aid declaration form is a document that allows charities to reclaim tax on donations made by UK taxpayers. By filling out this form, donors enable their contributions to go further, as it boosts the value of their gifts without any extra cost to them.

-

How do I fill out a UK Gift Aid declaration form using airSlate SignNow?

Filling out a UK Gift Aid declaration form with airSlate SignNow is quick and easy. Simply access the form, provide the required information, and sign electronically. The user-friendly interface ensures a seamless experience for both donors and charities.

-

Is there a cost associated with using the UK Gift Aid declaration form on airSlate SignNow?

AirSlate SignNow offers competitive pricing for its eSignature services, including the use of the UK Gift Aid declaration form. Depending on your subscription plan, you may benefit from enhanced features at a cost-effective rate, maximizing your organization's budget for managing donations.

-

What features does the airSlate SignNow platform offer for managing UK Gift Aid declaration forms?

AirSlate SignNow provides a variety of features for managing UK Gift Aid declaration forms, such as automated workflows, templates, and secure storage. These tools streamline the donation process and ensure that your charity can efficiently handle Gift Aid claims.

-

Can airSlate SignNow integrate with other applications to manage UK Gift Aid declaration forms?

Yes, airSlate SignNow offers integrations with various applications, allowing charities to connect their systems seamlessly. This means that you can easily track donations and Gift Aid declarations in the software you already use, enhancing your operational efficiency.

-

What are the benefits of using airSlate SignNow for UK Gift Aid declaration forms?

Using airSlate SignNow for UK Gift Aid declaration forms allows for an efficient and compliant process. Not only can you easily collect signatures, but you also gain access to analytics and reporting tools that help you understand donor contributions better, ultimately increasing your charitable impact.

-

How secure is the information on the UK Gift Aid declaration forms submitted via airSlate SignNow?

AirSlate SignNow prioritizes security and implements industry-standard protocols to protect all information submitted through UK Gift Aid declaration forms. Your data is encrypted, and the platform is designed to keep sensitive donor information safe and confidential.

Get more for Gift Aid Form

- A student is asking me for an access code for ceng cengage form

- Performance evaluation non exempt employees

- 16 2 pronouns practice 1 answer key form

- Form 1095 b american benefits council

- Millbrae school district form

- Using information from demographic analysis in post enumeration survey estimation census

- Urban haitians documentedundocumented form

- As simple as one two three form

Find out other Gift Aid Form

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure