Dtf24 Form

What is the Dtf24 Form

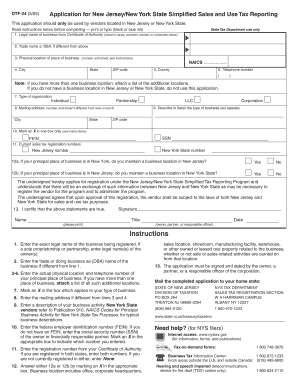

The Dtf24 Form is a specific tax form used in the United States, primarily for the purpose of reporting certain tax-related information to the state tax authorities. This form is essential for individuals and businesses to ensure compliance with state tax laws. It typically involves details regarding income, deductions, and credits that affect tax liability. Understanding the purpose and requirements of the Dtf24 Form is crucial for accurate tax reporting and to avoid potential penalties.

How to use the Dtf24 Form

Using the Dtf24 Form involves several key steps that ensure accurate and compliant submission. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, carefully fill out the form, ensuring all information is correct and complete. After completing the form, review it for any errors or omissions. Finally, submit the Dtf24 Form to the appropriate state tax authority by the specified deadline, either electronically or by mail.

Steps to complete the Dtf24 Form

Completing the Dtf24 Form requires a systematic approach to ensure accuracy. Follow these steps:

- Gather required documentation, including income records and deduction proofs.

- Fill out personal information, such as name, address, and taxpayer identification number.

- Report income sources and amounts accurately.

- Detail any deductions or credits you are claiming.

- Review the completed form for accuracy.

- Submit the form by the deadline, ensuring you follow the preferred submission method.

Legal use of the Dtf24 Form

The legal use of the Dtf24 Form is governed by state tax regulations, which dictate how the form must be completed and submitted. It is essential to ensure that all information provided is truthful and accurate, as discrepancies can lead to legal repercussions. Compliance with the relevant tax laws not only protects against penalties but also ensures that taxpayers receive any eligible refunds or credits.

Filing Deadlines / Important Dates

Filing deadlines for the Dtf24 Form vary by state and can significantly impact tax compliance. Typically, the form must be submitted by the state’s tax deadline, which aligns with the federal tax filing date. It is important to be aware of any extensions or specific state requirements that may affect the due date. Keeping track of these dates helps avoid late fees and potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The Dtf24 Form can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state tax authority's website, which may offer a streamlined process.

- Mailing the completed form to the designated address provided by the state tax authority.

- In-person submission at local tax offices, which may be necessary for certain situations or complex cases.

Who Issues the Form

The Dtf24 Form is issued by the state tax authority, which is responsible for overseeing tax compliance and collection within that state. Each state may have its own version of the form, tailored to its specific tax laws and requirements. It is important for taxpayers to ensure they are using the correct version of the form as issued by their respective state tax authority.

Quick guide on how to complete dtf24 form

Manage Dtf24 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right form and safely store it online. airSlate SignNow equips you with all the features you need to create, modify, and eSign your documents swiftly and without complications. Handle Dtf24 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Dtf24 Form with ease

- Find Dtf24 Form and click Get Form to begin.

- Make use of our tools to complete your document.

- Emphasize necessary sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device of your choosing. Modify and eSign Dtf24 Form and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf24 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Dtf24 Form?

The Dtf24 Form is a crucial document for tax purposes, specifically used in New York State for claiming a credit for the city and state withholding taxes paid. With airSlate SignNow, you can easily eSign and manage your Dtf24 Form, ensuring a smooth filing process.

-

How can airSlate SignNow help me with my Dtf24 Form?

airSlate SignNow provides a user-friendly platform to electronically sign and share your Dtf24 Form. Our solution enhances efficiency by enabling you to collect signatures securely and store your documents in one accessible location.

-

What are the pricing options for using airSlate SignNow for the Dtf24 Form?

airSlate SignNow offers flexible pricing plans that cater to different needs, making it cost-effective for businesses handling the Dtf24 Form. You can choose from monthly or annual subscriptions, ensuring you have access to essential features without breaking the budget.

-

Is airSlate SignNow secure for signing my Dtf24 Form?

Yes, airSlate SignNow prioritizes security, using advanced encryption technology to protect your Dtf24 Form and other sensitive documents. Our platform complies with industry standards to ensure that your data remains confidential and safe from unauthorized access.

-

Can I integrate airSlate SignNow with other tools for my Dtf24 Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and Microsoft Office. This makes it easier to manage and streamline your processes for the Dtf24 Form alongside other tools you already use.

-

What features does airSlate SignNow offer for the Dtf24 Form?

airSlate SignNow includes features such as document templates, automated workflows, and real-time tracking for your Dtf24 Form. These capabilities enhance productivity and ensure you never miss important deadlines during your filing process.

-

How does airSlate SignNow enhance the signing experience for the Dtf24 Form?

With airSlate SignNow, signing your Dtf24 Form is quick and hassle-free. Our platform enables users to sign documents electronically from any device, reducing turnaround time and improving overall efficiency.

Get more for Dtf24 Form

- Hr trn 003 form

- Chapter 17 test form a the age of exploration answer key

- Robert walters timesheet form

- Roswell nm business license form

- Personal graduation plan detailed planning form and credit

- Form dtr rev 04 doc

- Chapter 97 workers compensation act article 1 form

- Website sale contract template form

Find out other Dtf24 Form

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer