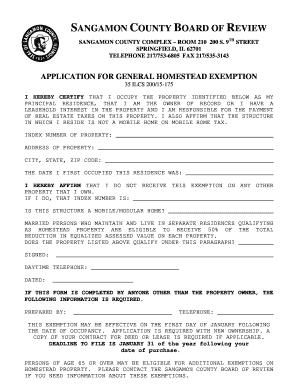

Sangamon County Property Tax Exemptions Form

What is the Sangamon County Property Tax Exemptions

The Sangamon County property tax exemptions are designed to reduce the property tax burden for eligible homeowners. These exemptions can vary based on specific criteria, including the homeowner's age, income, and disability status. The most common exemption is the general homestead exemption, which provides a reduction in the assessed value of the property, thereby lowering the overall tax owed. Additionally, there are specific exemptions available for senior citizens and disabled individuals, which offer further financial relief.

Eligibility Criteria

To qualify for the Sangamon County homestead exemption, applicants must meet certain eligibility requirements. Generally, the property must be the primary residence of the homeowner, and the applicant must have owned the property for at least one year prior to applying. For senior citizen exemptions, applicants typically must be at least sixty-five years old. Income limits may also apply, particularly for additional exemptions aimed at low-income seniors or disabled individuals. It is essential to review the specific criteria outlined by the county to ensure eligibility.

Steps to Complete the Sangamon County Property Tax Exemptions

Completing the application for the Sangamon County property tax exemptions involves several key steps. First, gather all necessary documentation, including proof of residency and any relevant income information. Next, fill out the exemption application form, ensuring that all sections are completed accurately. Once the form is filled out, submit it to the appropriate county office either online, by mail, or in person. It is advisable to keep a copy of the submitted application for personal records. Deadlines for submission should be noted to avoid missing out on potential savings.

Required Documents

When applying for the Sangamon County homestead exemption, specific documents are required to support your application. These may include:

- Proof of ownership, such as a deed or tax bill.

- Identification, like a driver's license or state ID.

- Income verification documents, if applicable.

- Any documentation supporting claims for senior or disability exemptions.

Having these documents ready can streamline the application process and help ensure that your request is processed without delays.

Form Submission Methods

Applicants for the Sangamon County property tax exemptions can submit their forms through various methods. The most convenient option is to complete the application online, which allows for a quicker processing time. Alternatively, forms can be printed, filled out, and mailed to the appropriate county office. In-person submissions are also accepted, providing an opportunity to ask questions or clarify any uncertainties directly with county staff. Each method has its own timelines and requirements, so it is important to choose the one that best fits your needs.

Legal Use of the Sangamon County Property Tax Exemptions

The legal framework surrounding the Sangamon County property tax exemptions ensures that the application process and the exemptions themselves comply with state and federal laws. Homeowners must adhere to the guidelines set forth by the county to maintain eligibility. Misrepresentation of information or failure to comply with the requirements can result in penalties, including the loss of the exemption. It is crucial for applicants to understand their rights and responsibilities to ensure that they are using the exemptions legally.

Quick guide on how to complete sangamon county property tax exemptions

Complete Sangamon County Property Tax Exemptions effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Sangamon County Property Tax Exemptions on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Sangamon County Property Tax Exemptions smoothly

- Locate Sangamon County Property Tax Exemptions and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your alterations.

- Choose how you wish to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Sangamon County Property Tax Exemptions and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sangamon county property tax exemptions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sangamon County homestead exemption?

The Sangamon County homestead exemption is a tax reduction program designed to lower the property tax burden for eligible homeowners. This exemption provides signNow savings by reducing the assessed value of your primary residence. To benefit from this exemption, property owners must apply through the Sangamon County Assessor's office.

-

Who is eligible for the Sangamon County homestead exemption?

Eligibility for the Sangamon County homestead exemption typically includes homeowners who occupy their property as their primary residence. Additionally, certain requirements, such as ownership and income limits, may apply. It's essential to check with the Sangamon County Assessor's office for specific criteria.

-

How much can I save with the Sangamon County homestead exemption?

The exact savings from the Sangamon County homestead exemption can vary based on property value and local tax rates. Homeowners can expect signNow reductions, potentially saving hundreds or even thousands of dollars annually on their property taxes. Calculating these savings can help homeowners plan their finances better.

-

How do I apply for the Sangamon County homestead exemption?

To apply for the Sangamon County homestead exemption, you can download the application form from the Sangamon County website or visit the Assessor's office in person. The application must be submitted by a specific deadline, typically in early March for the current tax year. Make sure to gather all necessary documentation to support your application.

-

Can I renew my Sangamon County homestead exemption each year?

Yes, the Sangamon County homestead exemption generally renews automatically as long as you meet the eligibility criteria. However, it’s important to keep your property information updated with the Assessor's office, especially if there are changes in ownership or occupancy. Regular checks ensure that you continue receiving your tax benefits.

-

What documents do I need to provide for the Sangamon County homestead exemption application?

When applying for the Sangamon County homestead exemption, you'll typically need to provide proof of residency, such as a driver's license or utility bill, along with the completed application form. Additional documentation, like property tax bills, may also be required. Ensure all documents are accurate to avoid processing delays.

-

Is the Sangamon County homestead exemption available for renters?

No, the Sangamon County homestead exemption is only available to homeowners who occupy their property as their primary residence. Renters do not qualify for this tax reduction benefit as it is designed to assist homeowners in reducing their property tax burden. However, renters may explore other state or local programs available for financial assistance.

Get more for Sangamon County Property Tax Exemptions

Find out other Sangamon County Property Tax Exemptions

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template