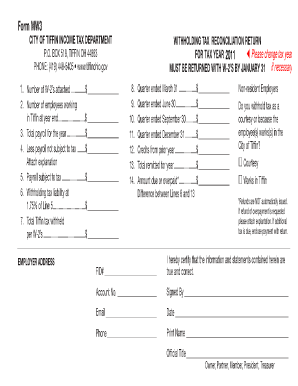

City of Tiffin Income Tax Form

What is the City of Tiffin Income Tax

The City of Tiffin income tax is a local tax imposed on residents and businesses operating within Tiffin, Ohio. This tax is used to fund various municipal services, including public safety, infrastructure, and community development. The tax rate is typically a percentage of earned income, and it applies to both individuals and entities conducting business in the city. Understanding the specifics of this tax is essential for compliance and effective financial planning.

Steps to Complete the City of Tiffin Income Tax

Completing the City of Tiffin income tax forms involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, determine your total taxable income by adding all sources of income. After calculating your taxable income, apply the appropriate tax rate to determine your tax liability. Finally, fill out the relevant tax forms accurately, ensuring all information is correct before submission.

Required Documents

When filing the City of Tiffin income tax, specific documents are essential to support your submission. These typically include:

- W-2 forms from employers

- 1099 forms for additional income sources

- Records of any deductions or credits you plan to claim

- Previous year’s tax return for reference

Having these documents ready will streamline the filing process and help avoid potential delays or issues with your tax return.

Form Submission Methods

Residents and businesses can submit their City of Tiffin income tax forms through various methods. The options typically include:

- Online submission via the city’s official tax portal

- Mailing the completed forms to the designated tax office

- In-person submission at the local tax office

Choosing the most convenient method for your situation can facilitate a smoother filing experience.

Penalties for Non-Compliance

Failure to comply with the City of Tiffin income tax regulations can result in penalties. These may include:

- Late filing fees for submissions past the deadline

- Interest on unpaid taxes

- Potential legal action for persistent non-compliance

Understanding these penalties emphasizes the importance of timely and accurate tax filing.

Eligibility Criteria

Eligibility for the City of Tiffin income tax applies to all residents and businesses earning income within the city limits. Specific criteria may include:

- Residency status in Tiffin

- Income level exceeding the minimum taxable threshold

- Business registration for entities operating within the city

Meeting these criteria is crucial for ensuring compliance with local tax laws.

Quick guide on how to complete city of tiffin income tax 100088689

Complete City Of Tiffin Income Tax effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily access the appropriate forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage City Of Tiffin Income Tax on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign City Of Tiffin Income Tax effortlessly

- Locate City Of Tiffin Income Tax and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of your documents or conceal sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign City Of Tiffin Income Tax and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of tiffin income tax 100088689

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Tiffin income tax rate?

The city of Tiffin income tax rate is currently set at 1.5%. This tax applies to all earned income within city limits, helping to fund local services and infrastructure. It's essential to stay informed about these rates as they can change.

-

How does the city of Tiffin income tax impact businesses?

Businesses operating in Tiffin are subject to the city of Tiffin income tax, which can affect overall operational costs. Employers must withhold tax from employee wages and file periodic returns. Proper management of these obligations can help businesses avoid penalties.

-

What are the benefits of using airSlate SignNow for city of Tiffin income tax documents?

Using airSlate SignNow simplifies the process of signing and managing city of Tiffin income tax documents electronically. It provides a secure and efficient way to handle paperwork, allowing businesses to focus on growth without the hassle of manual document signing.

-

How can I integrate airSlate SignNow with my existing systems for city of Tiffin income tax handling?

airSlate SignNow offers seamless integrations with various software systems to facilitate city of Tiffin income tax management. This ability allows you to streamline your workflows and document processes, ensuring greater efficiency and compliance with tax regulations.

-

What features does airSlate SignNow provide for managing city of Tiffin income tax documents?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage for all city of Tiffin income tax documents. These tools make it easier for users to track and manage tax-related paperwork effectively.

-

Is there customer support available for queries related to city of Tiffin income tax?

Yes, airSlate SignNow provides dedicated customer support to help users with any questions about managing city of Tiffin income tax documents. Whether it’s assistance with software features or compliance matters, our team is available to provide guidance.

-

How does airSlate SignNow ensure the security of city of Tiffin income tax documents?

Security is a top priority at airSlate SignNow. All city of Tiffin income tax documents are encrypted and stored securely in compliance with industry standards, ensuring that sensitive information remains protected against unauthorized access.

Get more for City Of Tiffin Income Tax

Find out other City Of Tiffin Income Tax

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple