Puerto Rico Tax Exemption Form 2006-2026

What is the Puerto Rico Tax Exemption Form

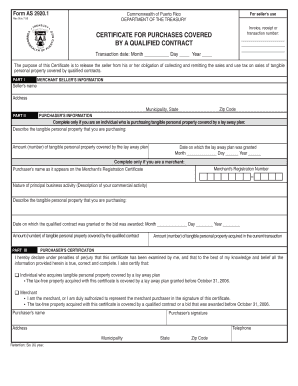

The Puerto Rico tax exemption form is a vital document that allows eligible individuals and businesses to claim exemptions from certain taxes imposed by the Puerto Rican government. This form is particularly important for those engaged in activities that qualify for tax relief, such as purchasing goods for resale or specific types of services. By completing this form, taxpayers can legally reduce their tax liabilities, ensuring compliance with local tax regulations while benefiting from available exemptions.

How to obtain the Puerto Rico Tax Exemption Form

Obtaining the Puerto Rico tax exemption form is a straightforward process. Taxpayers can access the form through the official Puerto Rico Department of Treasury website or by visiting local government offices. It is essential to ensure that you are using the most current version of the form to avoid any compliance issues. Additionally, some organizations may provide the form directly to their clients or members, so checking with relevant associations can also be beneficial.

Steps to complete the Puerto Rico Tax Exemption Form

Completing the Puerto Rico tax exemption form involves several key steps:

- Gather necessary information, including your tax identification number and details about the transaction.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to the specified guidelines, whether online, by mail, or in person.

Taking these steps carefully helps ensure that your application for tax exemption is processed smoothly and efficiently.

Key elements of the Puerto Rico Tax Exemption Form

Several key elements must be included when filling out the Puerto Rico tax exemption form:

- Taxpayer Information: This includes the name, address, and tax identification number of the individual or business applying for the exemption.

- Type of Exemption: Clearly specify the type of exemption being requested, such as resale or other specific exemptions.

- Details of the Transaction: Provide information about the goods or services involved in the transaction that qualifies for the exemption.

- Signature: The form must be signed by the taxpayer or an authorized representative to validate the request.

Eligibility Criteria

To qualify for the Puerto Rico tax exemption, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Being a registered business or individual taxpayer in Puerto Rico.

- Engaging in activities that are explicitly recognized as eligible for tax exemption under Puerto Rican law.

- Providing accurate and truthful information on the exemption form.

Meeting these criteria is essential for the approval of the tax exemption request.

Form Submission Methods

The Puerto Rico tax exemption form can be submitted through various methods, allowing for flexibility based on the taxpayer's preference:

- Online: Many taxpayers prefer to submit the form electronically through the official government portal, which often provides instant confirmation.

- By Mail: The completed form can be printed and mailed to the appropriate tax authority.

- In-Person: Taxpayers may also choose to deliver the form directly to local government offices for processing.

Choosing the right submission method can help ensure timely processing of the exemption request.

Quick guide on how to complete puerto rico tax exemption form

Easily Prepare Puerto Rico Tax Exemption Form on Any Device

Managing documents online has become a favored choice for businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, edit, and electronically sign your documents quickly without delays. Handle Puerto Rico Tax Exemption Form on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-driven procedure today.

How to Edit and eSign Puerto Rico Tax Exemption Form Effortlessly

- Obtain Puerto Rico Tax Exemption Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive data with tools specifically offered by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional pen-and-ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method of sharing the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or having to reprint new document copies due to mistakes. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Puerto Rico Tax Exemption Form and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the puerto rico tax exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Puerto Rico tax exemption form?

The Puerto Rico tax exemption form is a document that allows eligible individuals and businesses to claim tax benefits provided by the government of Puerto Rico. By using the forman appropriate manner, businesses can streamline their tax obligations, ensuring compliance while maximizing benefits. Understanding this form is crucial for anyone looking to take advantage of tax exemptions in Puerto Rico.

-

How can airSlate SignNow help with the Puerto Rico tax exemption form?

airSlate SignNow offers a simple and efficient way to electronically sign and send the Puerto Rico tax exemption form. Our platform ensures that your documents are securely signed and stored, facilitating quick and easy access. Utilizing SignNow can save time and reduce errors when handling tax documentation.

-

What features does airSlate SignNow offer for managing the Puerto Rico tax exemption form?

Our platform includes features like customizable templates, real-time tracking, and automated reminders to help manage your Puerto Rico tax exemption form efficiently. These tools enhance efficiencies and ensure deadlines are met without the hassle of manual tracking. Additionally, the ease of use simplifies the overall process for users at any tech level.

-

Are there any costs associated with using airSlate SignNow for the Puerto Rico tax exemption form?

Yes, while airSlate SignNow offers various pricing plans, many users find the cost to be very reasonable, especially considering the time saved in managing forms like the Puerto Rico tax exemption form. The platform provides a cost-effective solution for eSigning and document management, allowing businesses to invest more resources into growth and less on administrative tasks.

-

Can I integrate airSlate SignNow with other applications for the Puerto Rico tax exemption form?

Absolutely! airSlate SignNow offers a range of integrations with popular applications and platforms, which can enhance your workflow when managing the Puerto Rico tax exemption form. With seamless connections to tools like Google Drive, Dropbox, and CRM systems, you can streamline document creation and management effortlessly.

-

What benefits does using airSlate SignNow offer for the Puerto Rico tax exemption form?

Using airSlate SignNow for the Puerto Rico tax exemption form provides several benefits, including quicker processing times, reduced paperwork, and enhanced security. The digital approach minimizes errors and allows for better tracking of submitted forms. Furthermore, it enables businesses to maintain compliance with tax regulations without increasing their workload.

-

Is the Puerto Rico tax exemption form easy to fill out using airSlate SignNow?

Yes, the Puerto Rico tax exemption form is designed to be user-friendly when using airSlate SignNow. The intuitive interface allows you to fill out and customize the form quickly, even if you're not tech-savvy. This ease of use is essential for ensuring accurate submissions without unnecessary delays.

Get more for Puerto Rico Tax Exemption Form

- Axis mutual fund third party declaration form

- Pv47 estate tax return payment voucher minnesota department revenue state mn form

- Form 593 real estate withholding statement form 593 real estate withholding statement

- Spousal renunciation of rights affidavit omwbe omwbe wa form

- Bexar county constable pct form

- Soil formation worksheet pdf

- Land transfer contract template form

- Landlord contract template form

Find out other Puerto Rico Tax Exemption Form

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy