G 7 Form

What is the G 7 Form

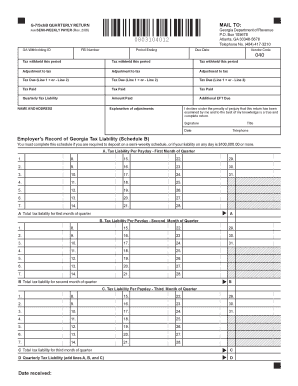

The G 7 form is a specific document used primarily for reporting purposes within certain regulatory frameworks. It is essential for individuals and businesses to understand its purpose and implications. This form typically involves financial information that must be accurately reported to comply with applicable laws. The G 7 form is often associated with tax regulations and may be required by various governmental entities in the United States.

How to use the G 7 Form

Using the G 7 form involves a series of straightforward steps to ensure compliance and accuracy. First, gather all necessary information, which may include personal identification details, financial records, and any relevant supporting documents. Next, carefully fill out the form, ensuring that all fields are completed accurately. After filling it out, review the form for any errors or omissions before submission. Depending on the requirements, you may need to submit the G 7 form electronically or via traditional mail.

Steps to complete the G 7 Form

Completing the G 7 form involves several key steps:

- Gather necessary documentation, including identification and financial records.

- Access the G 7 form through the appropriate governmental website or office.

- Fill in the form, ensuring all sections are completed accurately.

- Review the form for accuracy and completeness.

- Submit the form as per the guidelines provided, either online or by mail.

Legal use of the G 7 Form

The legal use of the G 7 form is critical for ensuring compliance with federal and state regulations. It is important to understand the legal implications of the information reported. The G 7 form must be filled out truthfully and submitted by the specified deadlines to avoid penalties. Additionally, keeping copies of submitted forms and related documentation is advisable for record-keeping and potential audits.

Key elements of the G 7 Form

Several key elements are integral to the G 7 form, including:

- Identification section for the individual or business submitting the form.

- Financial reporting sections that require detailed information about income, expenses, and other relevant financial data.

- Signature line for the individual or authorized representative to validate the information provided.

- Instructions for submission, including deadlines and acceptable methods.

Form Submission Methods

The G 7 form can typically be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission through a secure government portal.

- Mailing a physical copy to the designated address.

- In-person submission at a local government office, if applicable.

Quick guide on how to complete g 7 form

Complete G 7 Form effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to find the correct form and securely store it online. airSlate SignNow delivers all the necessary tools to create, alter, and eSign your documents swiftly without delays. Handle G 7 Form on any platform using airSlate SignNow Android or iOS applications and streamline any document-centric task today.

How to modify and eSign G 7 Form with ease

- Find G 7 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign G 7 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the g 7 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a G 7 form and how is it used?

The G 7 form is a key document used for various purposes, including tax and compliance requirements. Businesses utilize the G 7 form to report specific financial information, ensuring they stay compliant with legal obligations. Understanding the G 7 form is crucial for accurate documentation and eSigning processes.

-

How can airSlate SignNow help with G 7 form preparation?

airSlate SignNow streamlines the preparation of the G 7 form by allowing users to create, edit, and send documents effortlessly. With our user-friendly platform, you can easily fill out the G 7 form and ensure all necessary details are included. This not only saves time but also minimizes errors during the document preparation process.

-

Is there a cost associated with using airSlate SignNow for the G 7 form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including features specifically useful for managing the G 7 form. Our plans provide flexibility and scalability, ensuring that you get the best value while managing your document workflows. Additionally, we often offer promotions, so be sure to check for the latest pricing options.

-

What features does airSlate SignNow offer for managing the G 7 form?

airSlate SignNow includes features like templates, collaboration tools, and secure eSigning, which can all enhance your experience with the G 7 form. These features allow multiple users to review and approve the G 7 form quickly and securely. Plus, our cloud-based platform ensures that you can access your documents from anywhere at any time.

-

Can I integrate airSlate SignNow with other applications when working on the G 7 form?

Absolutely! airSlate SignNow offers integrations with various applications that can enhance your workflow when dealing with the G 7 form. Whether you use CRM systems, accounting software, or project management tools, our platform can easily connect with them, making it seamless to manage related documents.

-

How does airSlate SignNow ensure the security of my G 7 form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and compliance with industry standards to protect your G 7 form and other sensitive documents. With features like two-factor authentication and audit trails, you can have confidence in the safety of your documents throughout the signing process.

-

What are the benefits of using airSlate SignNow for the G 7 form?

Using airSlate SignNow for the G 7 form offers numerous benefits including increased efficiency, improved collaboration, and enhanced security. Our platform is designed to simplify the signing process, making it faster and more reliable. Business users can focus more on their core activities rather than getting bogged down by paperwork.

Get more for G 7 Form

- Your campaign name volunteer pledge form iaff iaff

- Form 945 1652412

- Vollara ez pay bristol va 24201 telephone 800 704 leiaryan form

- Dexa bone density screening patient questionnaire form

- Installment contract template form

- Installment loan contract template form

- Installment land contract template form

- Installment private car sale contract template form

Find out other G 7 Form

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast