Nonretirement Account Investment Form Vanguard

What is the Nonretirement Account Investment Form Vanguard

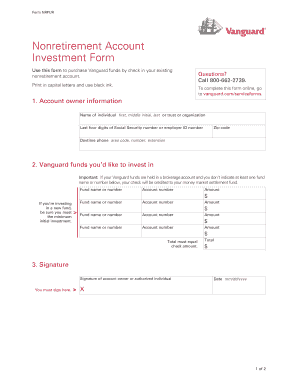

The Nonretirement Account Investment Form Vanguard is a crucial document used for establishing and managing investment accounts that do not fall under retirement plans. This form allows individuals to open accounts for various investment purposes, such as purchasing mutual funds or other investment products offered by Vanguard. It is essential for investors looking to grow their wealth outside of tax-advantaged retirement accounts.

How to use the Nonretirement Account Investment Form Vanguard

Using the Nonretirement Account Investment Form Vanguard involves several straightforward steps. First, gather all necessary personal information, including your Social Security number and contact details. Next, choose the specific investment products you wish to purchase. Once you have completed the form, review it for accuracy before submitting it electronically or via mail. This ensures that your investment account is set up correctly and efficiently.

Steps to complete the Nonretirement Account Investment Form Vanguard

Completing the Nonretirement Account Investment Form Vanguard requires careful attention to detail. Follow these steps for a successful submission:

- Provide your personal information, including full name, address, and Social Security number.

- Select the type of account you wish to open, such as an individual or joint account.

- Indicate your investment choices, specifying the funds or products you want to invest in.

- Review the terms and conditions associated with your investments.

- Sign and date the form to validate your application.

Legal use of the Nonretirement Account Investment Form Vanguard

The Nonretirement Account Investment Form Vanguard is legally binding once it is properly filled out and signed. To ensure its validity, it must comply with relevant regulations governing investment accounts. This includes adherence to federal and state laws regarding financial disclosures and investor protections. Utilizing a secure and compliant platform for electronic signatures further enhances the legal standing of the form.

Required Documents

When completing the Nonretirement Account Investment Form Vanguard, certain documents are necessary to verify your identity and financial information. These may include:

- Government-issued identification, such as a driver's license or passport.

- Proof of address, like a utility bill or bank statement.

- Tax identification number, typically your Social Security number.

Form Submission Methods

The Nonretirement Account Investment Form Vanguard can be submitted through various methods to accommodate user preferences. Options include:

- Online submission via Vanguard's secure portal, which allows for quick processing.

- Mailing a printed version of the form to Vanguard's designated address.

- In-person submission at a Vanguard branch, if available in your area.

Quick guide on how to complete nonretirement account investment form vanguard

Complete Nonretirement Account Investment Form Vanguard effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to acquire the correct format and securely store it online. airSlate SignNow equips you with all the essential tools to generate, edit, and electronically sign your documents swiftly and without hindrance. Handle Nonretirement Account Investment Form Vanguard on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to edit and electronically sign Nonretirement Account Investment Form Vanguard with ease

- Obtain Nonretirement Account Investment Form Vanguard and click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize key sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your document, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Nonretirement Account Investment Form Vanguard and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nonretirement account investment form vanguard

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Vanguard 401k account number and why is it important?

A Vanguard 401k account number is a unique identifier assigned to your retirement account, essential for managing your investments and ensuring secure transactions. This number allows you to access your account online, track your contributions, and make changes to your investments. It is crucial for maintaining accurate records and accessing customer support.

-

How can I find my Vanguard 401k account number?

You can easily find your Vanguard 401k account number by checking your account statements, online account portal, or contacting Vanguard customer service. If you are using the airSlate SignNow platform, you can also securely send your documentation to retrieve your account information efficiently. Accessing this number is important for managing your retirement investments.

-

Can I change my Vanguard 401k account number?

Typically, your Vanguard 401k account number cannot be changed as it is unique to your account. However, if you believe there has been an error, you should contact Vanguard customer service for assistance. Maintaining the integrity of your Vanguard 401k account number is vital for secure management of your retirement funds.

-

What features does airSlate SignNow offer for managing documents related to my Vanguard 401k account?

airSlate SignNow provides a cost-effective solution for seamlessly managing documents related to your Vanguard 401k account. You can eSign, share, and store documents securely, all while ensuring compliance with financial regulations. This makes it easier for you to handle paperwork associated with your retirement planning.

-

Are there any fees associated with accessing my Vanguard 401k account?

While accessing your Vanguard 401k account number is typically free, there may be fees associated with certain transactions, such as account maintenance or fund transfers. It is recommended to review the terms and conditions of your specific plan to understand any potential charges. Using airSlate SignNow can help reduce costs related to document management.

-

How does airSlate SignNow integrate with financial tools for my Vanguard 401k?

airSlate SignNow integrates with various financial tools, allowing you to manage your Vanguard 401k documentation alongside other financial accounts. This integration streamlines workflows and enhances document sharing capabilities, making it easier to keep track of your retirement savings. The efficiency offered by airSlate SignNow can improve your overall financial management.

-

What are the benefits of eSigning documents for my Vanguard 401k with airSlate SignNow?

Using airSlate SignNow for eSigning documents tied to your Vanguard 401k offers multiple benefits, including increased efficiency and enhanced security. You can quickly sign necessary documents from anywhere, ensuring timely processing of your retirement investments. Additionally, electronic signatures are legally binding and provide a clear audit trail for all transactions.

Get more for Nonretirement Account Investment Form Vanguard

Find out other Nonretirement Account Investment Form Vanguard

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word