Blank Form 990 N

What is the Blank Form 990 N

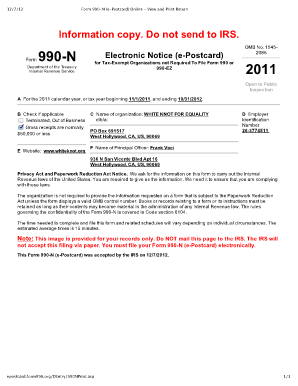

The Blank Form 990 N, also known as the 990 postcard, is a simplified tax return form designed for small tax-exempt organizations in the United States. This form is filed with the Internal Revenue Service (IRS) and is used to report basic financial information about the organization. It is specifically intended for organizations that have gross receipts of $50,000 or less. By using this form, organizations can maintain their tax-exempt status without the need for a more complex filing process.

How to use the Blank Form 990 N

Using the Blank Form 990 N involves a straightforward process. Organizations must first ensure they meet the eligibility criteria, which includes having gross receipts below the specified threshold. Once eligibility is confirmed, organizations can fill out the form by providing essential information such as their name, address, and the tax year for which they are reporting. After completing the form, it must be submitted electronically through the IRS website, ensuring compliance with submission guidelines.

Steps to complete the Blank Form 990 N

Completing the Blank Form 990 N requires careful attention to detail. Here are the steps to follow:

- Verify eligibility: Confirm that your organization has gross receipts of $50,000 or less.

- Gather necessary information: Collect your organization’s name, address, and tax identification number.

- Access the form: Obtain the Blank Form 990 N from the IRS website.

- Complete the form: Fill in the required fields accurately, ensuring all information is correct.

- Submit electronically: File the completed form through the IRS e-file system.

Legal use of the Blank Form 990 N

The Blank Form 990 N serves a critical legal function for tax-exempt organizations. By filing this form, organizations fulfill their obligation to report financial activities to the IRS, which helps maintain transparency and accountability. Failure to file the form can result in penalties, including the loss of tax-exempt status. Therefore, it is essential for organizations to understand the legal implications of their filing responsibilities.

Filing Deadlines / Important Dates

Filing deadlines for the Blank Form 990 N are crucial for compliance. Organizations must submit the form by the 15th day of the fifth month after the end of their fiscal year. For example, if an organization’s fiscal year ends on December 31, the form is due by May 15 of the following year. It is important to keep track of these deadlines to avoid penalties and ensure continued tax-exempt status.

Form Submission Methods (Online / Mail / In-Person)

The Blank Form 990 N is primarily submitted electronically, which is the preferred method by the IRS. Organizations can file the form using the IRS e-file system, ensuring a faster processing time and immediate confirmation of submission. While electronic filing is encouraged, organizations may also choose to submit the form by mail. However, in-person submissions are not accepted for this specific form. It is essential to follow the IRS guidelines for submission to avoid any issues.

Quick guide on how to complete blank form 990 n

Handle Blank Form 990 N effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents quickly without any delays. Manage Blank Form 990 N on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Blank Form 990 N with ease

- Find Blank Form 990 N and click on Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Blank Form 990 N and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank form 990 n

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 990 n?

airSlate SignNow is a powerful e-signature solution that enables businesses to send and sign documents electronically. The platform is designed for ease of use and efficiency, making it an ideal choice for organizations looking to streamline their document workflows. By utilizing 990 n features, users can achieve greater productivity and reduce turnaround times.

-

How does pricing work for airSlate SignNow with respect to 990 n?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including features related to 990 n functionalities. Depending on your team size and usage frequency, you can choose from monthly or annual plans. Each plan includes essential tools to enhance your document signing experience.

-

What are the key features of airSlate SignNow that support 990 n functionality?

Key features of airSlate SignNow include customizable templates, real-time tracking, and automatic reminders, all of which enhance the 990 n process. These features ensure that your documents are signed quickly and securely. Additionally, the platform supports multiple file formats for flexibility in document management.

-

Can airSlate SignNow integrate with other software while supporting 990 n requirements?

Yes, airSlate SignNow offers seamless integrations with various software applications, meeting the needs of the 990 n processes. This includes CRM systems, project management tools, and cloud storage solutions. Such integrations ensure that your e-signature workflows fit perfectly within your existing tech stack.

-

What benefits does airSlate SignNow provide for businesses using 990 n?

airSlate SignNow enhances the efficiency of document management, particularly in the context of 990 n. Businesses can reduce paperwork, speed up sign-off times, and increase overall productivity. The platform's user-friendly interface allows employees to adapt quickly, fostering a more agile work environment.

-

Is airSlate SignNow secure for handling documents related to 990 n?

Absolutely, airSlate SignNow prioritizes the security of your documents, especially those involved in 990 n. The platform uses advanced encryption protocols and complies with industry standards to protect sensitive information. You can confidently send and receive documents knowing they are secure.

-

What types of businesses can benefit from airSlate SignNow's 990 n features?

Any business that requires document signatures can benefit from airSlate SignNow's 990 n features. Whether you're in real estate, finance, or healthcare, the platform is designed to meet various industry needs. Its versatility makes it an essential tool for businesses of all sizes.

Get more for Blank Form 990 N

- Pre licensing education student registration form

- Gasolinespecial fuel tax refund permit application dr 7189 colorado form

- Formulaire b2

- Form 656 booklet offer in compromise

- How do i find a good irs tax attorney form

- Cnes v1legionnaires disease risk assessment form

- Offer in compromise e form rs login

- Energy performance level display card 469772911

Find out other Blank Form 990 N

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer