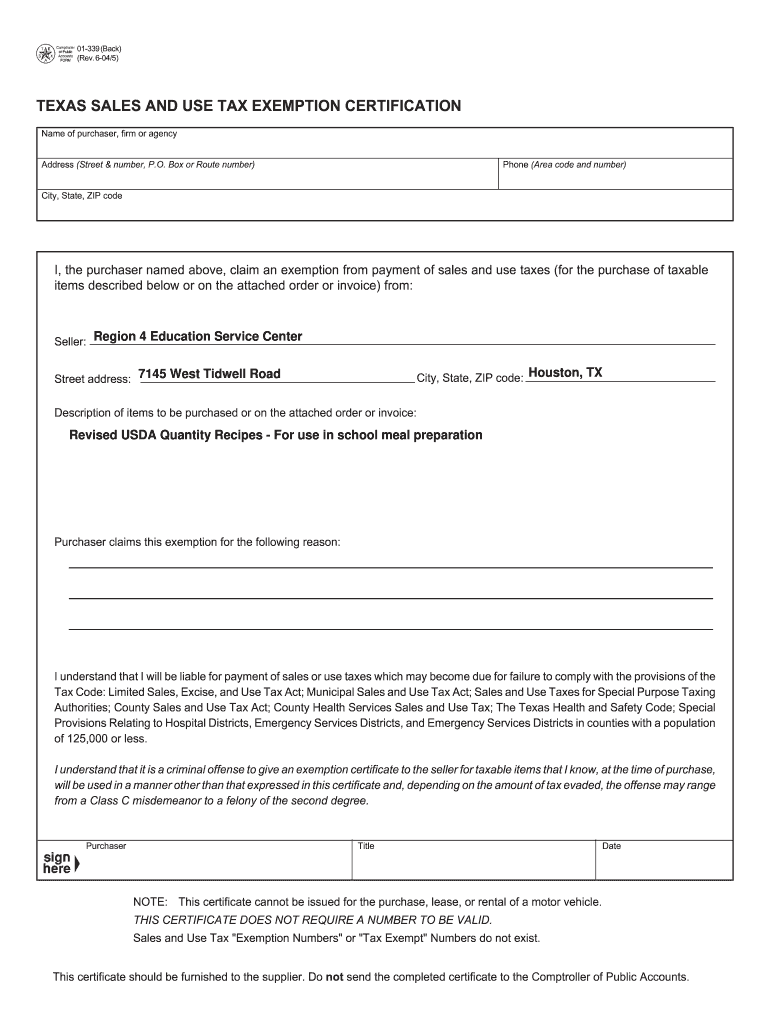

Usda Tax Exempt Form

What is the USDA Tax Exempt Form

The USDA tax exempt form is a document used by organizations to claim exemption from federal income tax. This form is essential for qualifying entities, such as nonprofit organizations, to operate without paying federal taxes on income related to their exempt purposes. The form typically requires detailed information about the organization, including its mission, activities, and financial status. Understanding the purpose and requirements of this form is crucial for any organization seeking tax-exempt status under USDA guidelines.

How to Use the USDA Tax Exempt Form

Using the USDA tax exempt form involves several steps to ensure compliance with federal regulations. First, organizations must accurately complete the form by providing all necessary information. This includes the organization’s legal name, address, and details about its tax-exempt activities. Once completed, the form must be submitted to the appropriate IRS office. It is important to keep a copy of the submitted form for record-keeping purposes. Proper use of this form can help organizations avoid unnecessary tax liabilities.

Steps to Complete the USDA Tax Exempt Form

Completing the USDA tax exempt form requires careful attention to detail. Here are the key steps involved:

- Gather necessary documentation, including proof of the organization’s mission and activities.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the appropriate IRS office, either online or via mail.

- Retain a copy of the submitted form and any correspondence for future reference.

Legal Use of the USDA Tax Exempt Form

The legal use of the USDA tax exempt form is governed by federal tax laws. Organizations must ensure that they meet the eligibility criteria for tax exemption, which typically includes being organized and operated exclusively for exempt purposes. Misuse of the form or failure to comply with IRS regulations can lead to penalties, including the loss of tax-exempt status. It is essential for organizations to understand their obligations and maintain compliance to benefit from the tax exemption.

Eligibility Criteria for the USDA Tax Exempt Form

To qualify for the USDA tax exempt form, organizations must meet specific eligibility criteria set by the IRS. Generally, these criteria include:

- Being organized as a nonprofit entity under state law.

- Operating exclusively for charitable, educational, or other exempt purposes.

- Not engaging in substantial lobbying or political activities.

- Ensuring that no part of the organization's net earnings benefits any private shareholder or individual.

Understanding these criteria is vital for organizations seeking to maintain their tax-exempt status.

Who Issues the USDA Tax Exempt Form

The USDA tax exempt form is issued by the Internal Revenue Service (IRS). The IRS is responsible for overseeing tax-exempt organizations and ensuring compliance with federal tax laws. Organizations must submit their completed forms to the IRS for review and approval. The IRS evaluates the applications based on established criteria and guidelines, determining whether the organization qualifies for tax-exempt status.

Quick guide on how to complete usda tax exempt form

Easily Prepare Usda Tax Exempt Form on Any Device

Managing documents online has become widely embraced by both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you require to generate, alter, and electronically sign your documents quickly and without interruptions. Handle Usda Tax Exempt Form on any gadget using the airSlate SignNow applications for Android or iOS and simplify any document-focused task today.

Effortlessly Edit and eSign Usda Tax Exempt Form

- Find Usda Tax Exempt Form and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically designed for that task by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional handwritten signature.

- Verify the information and click the Done button to retain your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Usda Tax Exempt Form to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the usda tax exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does a tax exempt number look like for businesses?

A tax exempt number typically appears as a series of digits issued by the state or federal government. This number is used to prove that an organization is exempt from paying sales tax under certain circumstances. If you're asking, 'what does a tax exempt number look like,' generally it includes the relevant tax exemption status and is shown on official documents like exemption certificates.

-

How can I use airSlate SignNow to manage tax exempt documents?

With airSlate SignNow, you can easily create, send, and eSign tax exempt documents. The platform allows you to upload tax exemption certificates and manage signatures seamlessly. This makes it simple to handle questions like 'what does a tax exempt number look like' by keeping all pertinent documents organized and easily accessible.

-

What features does airSlate SignNow offer related to tax exempt forms?

airSlate SignNow provides robust features for managing tax exempt forms, including custom templates and automated workflows. These tools help ensure that your paperwork is compliant and easy to track. If you're wondering 'what does a tax exempt number look like,' having the right features allows you to quickly generate and store this information as needed.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution tailored for small and medium-sized businesses. Its pricing plans are flexible, catering to various budget sizes while offering full features, including those needed for managing tax exempt documents. This helps businesses streamline their processes, including understanding 'what does a tax exempt number look like.'

-

Can airSlate SignNow integrate with other accounting software for tax purposes?

Absolutely, airSlate SignNow integrates with popular accounting software, allowing for efficient management of tax-related documents, including those confirming tax exempt status. These integrations can streamline your processes, especially when handling questions about 'what does a tax exempt number look like' in your workflows. It facilitates seamless data transfer, ensuring accuracy in your records.

-

What benefits can I expect from using airSlate SignNow for tax exempt processing?

Using airSlate SignNow for tax exempt processing offers numerous benefits such as increased efficiency and better organization of your documents. The platform simplifies the capture of essential information, like 'what does a tax exempt number look like,' making it easier to ensure compliance. Additionally, the eSigning capability speeds up approval times signNowly.

-

How do I ensure my tax exempt number is valid when using airSlate SignNow?

To ensure your tax exempt number is valid when using airSlate SignNow, verify that it is correctly formatted and issued by the appropriate governing body. You can include validation steps in your workflow to confirm this information before processing transactions. Understanding 'what does a tax exempt number look like' will help you maintain compliance and avoid potential tax issues.

Get more for Usda Tax Exempt Form

- Great depression bell ringer form

- Nr6 fillable form

- Benevolence request application form

- Open doors application the ymca of delaware ymcade form

- Virginia petition rights form

- Virginia subpoena duces tecum attorney fill online form

- In the fairfax county general district court form

- Inquiryclaim form trs trs virginia

Find out other Usda Tax Exempt Form

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself