North Carolina Estimated Tax Voucher Form

What is the North Carolina Estimated Tax Voucher

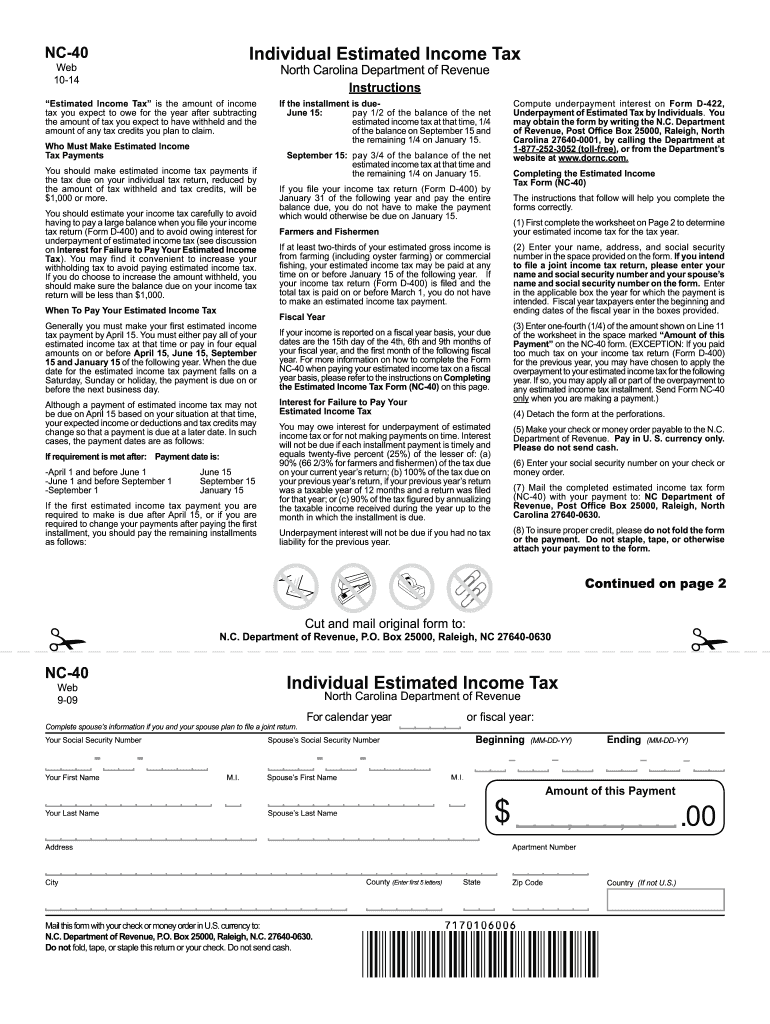

The North Carolina Estimated Tax Voucher, commonly known as Form NC-40, is a document used by individuals and businesses to report and pay estimated income taxes to the state of North Carolina. This form is essential for taxpayers who expect to owe tax of $1,000 or more when filing their annual tax return. The voucher allows taxpayers to make quarterly payments throughout the year, ensuring they meet their tax obligations and avoid penalties.

How to use the North Carolina Estimated Tax Voucher

To use the North Carolina Estimated Tax Voucher effectively, taxpayers must first calculate their expected tax liability for the year. This involves estimating income, deductions, and credits. Once the estimated tax amount is determined, taxpayers can fill out Form NC-40, specifying the payment amounts for each quarter. The form can be submitted either electronically or by mail, depending on the taxpayer's preference.

Steps to complete the North Carolina Estimated Tax Voucher

Completing the North Carolina Estimated Tax Voucher involves several key steps:

- Determine your expected annual income and tax liability.

- Calculate the estimated tax due for each quarter.

- Fill out Form NC-40 with your personal information and payment amounts.

- Review the form for accuracy and completeness.

- Submit the form by the due date, either online or by mail.

Legal use of the North Carolina Estimated Tax Voucher

The North Carolina Estimated Tax Voucher is legally binding when completed and submitted according to state regulations. Taxpayers must ensure that they comply with all requirements, including accurate calculations and timely submissions. Failure to adhere to these guidelines may result in penalties or interest on unpaid taxes. Utilizing a reliable eSignature tool can enhance the legal validity of the submitted form.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the North Carolina Estimated Tax Voucher. Typically, payments are due quarterly, with specific deadlines for each quarter. For example, the first payment is usually due by April 15, the second by June 15, the third by September 15, and the fourth by January 15 of the following year. Staying informed about these dates is crucial to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the North Carolina Estimated Tax Voucher. The form can be filed online through the North Carolina Department of Revenue's website, providing a convenient and efficient method. Alternatively, taxpayers may choose to mail the completed form to the designated address or submit it in person at local tax offices. Each method has its own processing times and requirements.

Penalties for Non-Compliance

Non-compliance with the North Carolina Estimated Tax Voucher can lead to significant penalties. If taxpayers fail to make the required payments or submit the form on time, they may incur interest on the unpaid amounts and face additional penalties. It is essential to understand these consequences and take proactive steps to ensure timely compliance with state tax obligations.

Quick guide on how to complete nc estimated tax payments form

Execute North Carolina Estimated Tax Voucher seamlessly on any device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without any hold-ups. Manage North Carolina Estimated Tax Voucher on any device using airSlate SignNow's Android or iOS applications and optimize any document-driven task today.

The easiest way to edit and eSign North Carolina Estimated Tax Voucher with minimal effort

- Find North Carolina Estimated Tax Voucher and click Get Form to initiate the process.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to secure your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow simplifies your document management needs in just a few clicks from any device you prefer. Edit and eSign North Carolina Estimated Tax Voucher while ensuring outstanding communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

Create this form in 5 minutes!

How to create an eSignature for the nc estimated tax payments form

How to generate an electronic signature for your Nc Estimated Tax Payments Form in the online mode

How to create an electronic signature for the Nc Estimated Tax Payments Form in Chrome

How to make an eSignature for signing the Nc Estimated Tax Payments Form in Gmail

How to generate an eSignature for the Nc Estimated Tax Payments Form from your mobile device

How to make an electronic signature for the Nc Estimated Tax Payments Form on iOS

How to create an electronic signature for the Nc Estimated Tax Payments Form on Android devices

People also ask

-

What are North Carolina estimated tax payments?

North Carolina estimated tax payments are pre-payments made towards your state income tax obligation, which are typically required for individuals and businesses that expect to owe more than a certain amount in tax. By making these payments, you can avoid penalties and interest associated with underpayment when tax returns are filed.

-

How can airSlate SignNow help with North Carolina estimated tax payments?

airSlate SignNow provides an efficient platform for eSigning and sending documents related to your North Carolina estimated tax payments. With easy-to-use features, you can quickly complete and submit necessary forms without the hassle of traditional paperwork.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features that allow users to create, sign, and send documents securely, which include customizable templates, cloud storage integration, and tracking capabilities. This simplifies the process of managing your North Carolina estimated tax payment documents, ensuring they're organized and easily accessible.

-

Is airSlate SignNow cost-effective for small businesses handling North Carolina estimated tax payments?

Yes, airSlate SignNow offers a cost-effective solution for businesses of all sizes. With affordable pricing plans, small businesses can manage their North Carolina estimated tax payments efficiently without incurring signNow expenses on document handling and signing.

-

What integrations does airSlate SignNow support for tax-related processes?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Microsoft Office. These integrations enable users to streamline their workflows related to North Carolina estimated tax payments and manage documents directly from their preferred platforms.

-

Are there security features in airSlate SignNow for tax documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your sensitive tax documents. This includes encryption, two-factor authentication, and secure access controls, ensuring that your North Carolina estimated tax payment data remains confidential and secure.

-

Can airSlate SignNow assist with reminders for North Carolina estimated tax payments?

Yes, airSlate SignNow can send automated reminders for payment deadlines related to your North Carolina estimated tax payments. This feature helps ensure that you never miss an important date, promoting compliance and reducing the risk of penalties.

Get more for North Carolina Estimated Tax Voucher

- Cisco college residency questionare form

- Area and circumference of a circle word problems worksheet pdf form

- Maybank2u biz application form 448402600

- Cape coral water bill form

- Domestic partnership california 5463533 form

- City of new orleans form 8070

- Application data sheet form

- Last name before 1st marriage form

Find out other North Carolina Estimated Tax Voucher

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online