U P Revenue Code Notes PDF Form

What is the U P Revenue Code Notes Pdf

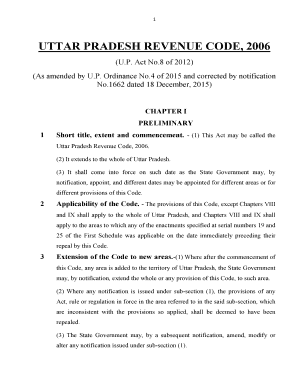

The U P Revenue Code Notes PDF is an essential document used in the United States for tax-related purposes. It outlines specific regulations and guidelines relevant to revenue codes established in 2006. This document serves as a reference for taxpayers, accountants, and legal professionals, providing clarity on tax obligations and compliance requirements. Understanding the content and implications of this PDF is crucial for accurate tax reporting and adherence to federal and state laws.

How to use the U P Revenue Code Notes Pdf

Using the U P Revenue Code Notes PDF effectively involves several steps. First, download the document from a reliable source. Once obtained, review the sections relevant to your tax situation. The notes provide insights into various revenue codes, including definitions, applications, and examples. It is advisable to cross-reference these notes with the IRS guidelines to ensure compliance. For individuals or businesses, integrating this information into your tax preparation process can help avoid errors and ensure that all obligations are met.

Steps to complete the U P Revenue Code Notes Pdf

Completing the U P Revenue Code Notes PDF requires careful attention to detail. Begin by gathering all necessary financial documents, including income statements and previous tax returns. Follow these steps:

- Read through the notes to understand applicable revenue codes.

- Fill out the relevant sections of the form accurately, ensuring all information is current.

- Review the completed document for any discrepancies or missing information.

- Sign and date the form as required.

- Submit the PDF according to the specified filing methods, whether online, by mail, or in person.

Legal use of the U P Revenue Code Notes Pdf

The U P Revenue Code Notes PDF holds legal significance when it comes to tax compliance. When properly filled out and submitted, it serves as a formal declaration of a taxpayer's income and obligations. The legal framework surrounding this document ensures that it is recognized by the IRS and state tax authorities. Therefore, it is essential to adhere to the guidelines provided in the notes to avoid penalties and legal issues. Utilizing a trusted digital platform for completion can enhance the legitimacy and security of the submission.

Key elements of the U P Revenue Code Notes Pdf

Several key elements define the U P Revenue Code Notes PDF. These include:

- Revenue Code Definitions: Clear explanations of various revenue codes applicable to taxpayers.

- Compliance Guidelines: Instructions on how to meet federal and state tax requirements.

- Examples: Practical scenarios illustrating the application of revenue codes.

- Filing Instructions: Detailed steps on how to submit the document correctly.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the U P Revenue Code Notes PDF. These guidelines include deadlines for filing, acceptable methods of submission, and documentation requirements. Staying informed about these guidelines is vital for ensuring compliance and avoiding any potential issues with tax authorities. Regularly checking the IRS website for updates can help taxpayers remain aware of any changes that may affect their filing process.

Quick guide on how to complete u p revenue code notes pdf

Complete U P Revenue Code Notes Pdf effortlessly on any gadget

Digital document management has gained traction among corporations and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly and without issues. Manage U P Revenue Code Notes Pdf on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign U P Revenue Code Notes Pdf with ease

- Locate U P Revenue Code Notes Pdf and then click Get Form to begin.

- Utilize the tools we provide to submit your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Disregard the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Edit and electronically sign U P Revenue Code Notes Pdf and guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the u p revenue code notes pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are up revenue code 2006 notes?

Up revenue code 2006 notes refer to specific billing codes used in the healthcare industry to ensure accurate reimbursement for services rendered. Understanding these codes is essential for managing financial operations and maximizing revenue streams. They help streamline the billing process and reduce claim denials.

-

How can airSlate SignNow help with up revenue code 2006 notes?

airSlate SignNow enhances the efficiency of managing up revenue code 2006 notes by allowing businesses to send and eSign necessary documents swiftly. This helps eliminate paperwork backlog and ensures timely submissions for reimbursement. Utilizing our platform can signNowly improve your revenue cycle management.

-

Is airSlate SignNow cost-effective for managing up revenue code 2006 notes?

Yes, airSlate SignNow provides a cost-effective solution designed to streamline document management, including up revenue code 2006 notes. Our pricing plans are tailored to suit various business sizes and needs, allowing you to optimize your operational costs while efficiently handling important documents.

-

What features does airSlate SignNow offer for handling up revenue code 2006 notes?

AirSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are crucial for managing up revenue code 2006 notes. These features not only enhance user experience but also ensure compliance with industry regulations, helping your business stay organized and effective.

-

Can I integrate airSlate SignNow with my existing systems for up revenue code 2006 notes management?

Absolutely, airSlate SignNow easily integrates with a wide range of existing software systems. This integration simplifies the process of managing up revenue code 2006 notes by allowing seamless data exchange and keeping your operations synchronized. You can connect with CRM, billing, and other essential tools effortlessly.

-

What are the benefits of eSigning documents related to up revenue code 2006 notes?

eSigning documents related to up revenue code 2006 notes signNowly speeds up the process of obtaining approvals and finalizing contracts. This not only accelerates revenue collection but also reduces the time involved in manual processes. Enhanced security features also protect sensitive data throughout the workflow.

-

Is there customer support available for issues related to up revenue code 2006 notes?

Yes, airSlate SignNow offers dedicated customer support to assist with any issues regarding up revenue code 2006 notes. Our support team is available through various channels to ensure that you receive the help you need promptly. We're committed to helping you maximize your experience with our platform.

Get more for U P Revenue Code Notes Pdf

- New transfer on death deed in californiaa peoples choice form

- Tax law docsharetips form

- A family guide to conservatorship and involuntary treatment form

- Trust two trustees to three individuals form

- Individual to six individuals form

- California mineral deed formsdeedscom

- Control number ca 036 78 form

- Joint family trust to two trusts form

Find out other U P Revenue Code Notes Pdf

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free