Vat Registration Form

What is the VAT Registration Form

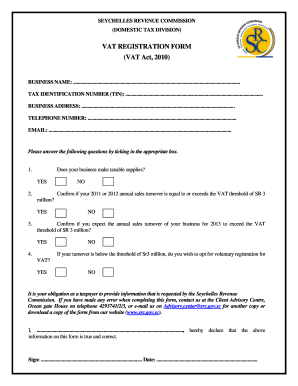

The VAT registration form is a crucial document for businesses that need to register for Value Added Tax (VAT) in the United States. This form collects essential information about the business, including its name, address, and type of business entity. The primary purpose of the form is to establish the business's obligation to collect VAT from customers and remit it to the government. Completing this form accurately is vital for compliance with tax regulations and to avoid potential penalties.

Steps to Complete the VAT Registration Form

Completing the VAT registration form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business, including your Employer Identification Number (EIN) and business structure. Next, fill out the form with accurate details, ensuring that all fields are completed as required. After completing the form, review it for any errors or omissions. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on your state’s requirements.

Legal Use of the VAT Registration Form

The VAT registration form serves a legal purpose, establishing a business's obligation to collect and remit VAT. It is essential that the form is filled out truthfully and accurately, as any discrepancies can lead to legal complications. Compliance with the regulations surrounding this form is critical, as it helps maintain the integrity of the tax system. Businesses must ensure that they are aware of and adhere to the legal requirements associated with VAT registration to avoid penalties.

Required Documents for VAT Registration

To successfully complete the VAT registration process, several documents may be required. These typically include proof of business identity, such as a business license or registration certificate, and financial documents that demonstrate the business's operations. Additionally, you may need to provide identification for the business owner or responsible party, such as a driver's license or passport. Having these documents ready can streamline the registration process and help ensure a successful application.

Form Submission Methods

The VAT registration form can be submitted through various methods, depending on the specific requirements of your state. Common submission methods include online registration through the state’s tax authority website, mailing a physical copy of the form, or delivering it in person at a local tax office. Each method has its own set of guidelines, so it is important to follow the instructions provided by your state to ensure timely processing of your registration.

IRS Guidelines for VAT Registration

The Internal Revenue Service (IRS) provides guidelines that govern the VAT registration process. These guidelines outline the eligibility criteria for businesses seeking to register for VAT, including revenue thresholds and types of taxable goods or services. It is essential for businesses to familiarize themselves with these guidelines to ensure compliance and avoid potential issues during the registration process. Adhering to IRS guidelines helps maintain proper tax practices and supports the overall integrity of the tax system.

Quick guide on how to complete vat registration form

Facilitate Vat Registration Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any holdups. Manage Vat Registration Form on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

The simplest method to modify and electronically sign Vat Registration Form with ease

- Locate Vat Registration Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive details with tools specially designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and electronically sign Vat Registration Form, ensuring top-notch communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat registration form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VAT registration number and why do I need one?

A VAT registration number is a unique identifier assigned to businesses that are registered for Value Added Tax (VAT). It is essential for compliance with tax regulations and allows businesses to collect VAT on sales, submit VAT returns, and reclaim VAT on eligible purchases. Without a VAT registration number, your business may face penalties and difficulties in conducting transactions.

-

How can airSlate SignNow help me manage my VAT registration number documentation?

airSlate SignNow provides a streamlined platform to manage all your VAT registration number documentation efficiently. With electronic signatures and automated document workflows, you can easily gather and store necessary VAT-related documents safely. This ensures that your VAT registration processes are both secure and compliant.

-

Is it easy to integrate airSlate SignNow with my accounting software for VAT purposes?

Yes, integrating airSlate SignNow with your accounting software is straightforward and enhances your VAT management. Our platform seamlessly connects with various accounting solutions, ensuring that your VAT registration number and related documents are automatically organized. This integration saves time and reduces the likelihood of errors in your VAT filings.

-

What are the benefits of using airSlate SignNow for handling VAT registration?

Using airSlate SignNow for your VAT registration simplifies the process by providing a user-friendly interface for document management. The ability to eSign documents securely and store them in the cloud ensures easy access and compliance with tax regulations. Moreover, the cost-effectiveness of our solution makes managing your VAT registration number budget-friendly.

-

How does airSlate SignNow improve the accuracy of my VAT registration number submissions?

airSlate SignNow enhances the accuracy of your VAT registration number submissions by automating workflows and providing built-in validation checks. These features minimize human error when preparing and signing key VAT documents. You can be confident that your submissions are accurate, which is crucial for avoiding fines and ensuring compliance.

-

What is the pricing structure for airSlate SignNow, especially for VAT-related features?

The pricing structure for airSlate SignNow is flexible and designed to fit various business needs, including VAT-related features. We offer different plans that provide access to essential tools for managing your VAT registration number efficiently. Evaluate our pricing options to find the best fit for your company's requirements and budget.

-

Can I track document statuses related to my VAT registration number in airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of all documents related to your VAT registration number in real-time. This feature provides transparency throughout the signing process, ensuring that you know exactly where your documents are at any given moment. Keeping tabs on your VAT paperwork has never been easier.

Get more for Vat Registration Form

Find out other Vat Registration Form

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter