Ia 1065 Form

What is the Ia 1065 Form

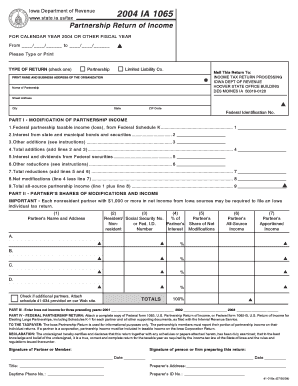

The Ia 1065 Form is a tax document used by partnerships in the United States to report income, deductions, gains, and losses from the partnership's operations. This form is essential for partnerships to inform the Internal Revenue Service (IRS) about their financial activities for the tax year. It is important to note that the Ia 1065 Form itself does not result in a tax liability; instead, it provides the IRS with information needed to assess the individual partners' tax obligations based on their share of the partnership's income.

How to use the Ia 1065 Form

Using the Ia 1065 Form involves several steps to ensure accurate reporting of partnership income. First, gather all necessary financial records, including income statements, expense reports, and any other relevant documentation. Next, complete the form by providing details about the partnership, including its name, address, and Employer Identification Number (EIN). Each partner's share of income, deductions, and credits must also be reported accurately. After filling out the form, it should be reviewed for accuracy before submission.

Steps to complete the Ia 1065 Form

Completing the Ia 1065 Form requires careful attention to detail. Here are the key steps:

- Gather all financial records for the partnership.

- Provide the partnership's basic information, including name, address, and EIN.

- List all income sources and total income earned by the partnership.

- Detail any deductions the partnership is eligible for, such as business expenses.

- Calculate each partner's share of income and deductions based on their ownership percentage.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the designated deadline.

Legal use of the Ia 1065 Form

The Ia 1065 Form is legally binding when completed and submitted according to IRS regulations. Partnerships must ensure compliance with all relevant tax laws to avoid penalties. The form must be signed by a partner or an authorized representative, confirming that the information provided is accurate and truthful. Failure to file the Ia 1065 Form or providing false information can lead to legal repercussions, including fines and audits.

Filing Deadlines / Important Dates

Partnerships must adhere to specific deadlines for filing the Ia 1065 Form to avoid penalties. The standard deadline for submitting the form is March 15 of the year following the tax year being reported. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Partnerships can request a six-month extension to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Who Issues the Form

The Ia 1065 Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides detailed instructions and guidelines on how to complete the form, ensuring that partnerships can accurately report their financial activities. It is crucial for partnerships to refer to the IRS website or official publications for the most current information regarding the Ia 1065 Form.

Quick guide on how to complete ia 1065 form

Prepare Ia 1065 Form effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as a perfect sustainable alternative to conventional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without obstacles. Manage Ia 1065 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric activity today.

How to modify and eSign Ia 1065 Form effortlessly

- Obtain Ia 1065 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact confidential details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from your selected device. Edit and eSign Ia 1065 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ia 1065 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ia 1065 Form?

The Ia 1065 Form is a tax document used for reporting income, deductions, and credits for partnerships in Iowa. It is essential for ensuring compliance with state tax regulations. Understanding the Ia 1065 Form is crucial for accurate filing and to avoid penalties.

-

How can airSlate SignNow help with the Ia 1065 Form?

airSlate SignNow offers an efficient solution for signing and sending the Ia 1065 Form electronically. With our platform, you can easily eSign documents, ensuring that your form gets completed more swiftly and securely. This streamlines your tax filing process, making it hassle-free.

-

Is airSlate SignNow affordable for small businesses needing the Ia 1065 Form?

Yes, airSlate SignNow provides a cost-effective solution for small businesses managing the Ia 1065 Form. Our pricing plans are designed to fit various budgets while offering powerful features to simplify document handling. Investing in airSlate SignNow can result in signNow savings in time and resources.

-

What features does airSlate SignNow offer for managing the Ia 1065 Form?

airSlate SignNow includes features like customizable templates, real-time tracking, and secure storage for the Ia 1065 Form. These tools enhance the document management experience, making it easier to collaborate with partners and ensure timely submissions. Overall, these features contribute to a more efficient workflow.

-

Can I integrate airSlate SignNow with my existing tax software for the Ia 1065 Form?

Absolutely! airSlate SignNow integrates seamlessly with various tax and accounting software, making it easier to manage the Ia 1065 Form alongside your existing tools. This integration helps streamline your workflow, ensuring that your forms are correctly filled and submitted on time.

-

What are the benefits of using airSlate SignNow for the Ia 1065 Form?

Using airSlate SignNow for the Ia 1065 Form offers numerous benefits, including enhanced efficiency, secure eSigning, and compliance assurance. The platform’s user-friendly interface allows for quick document management, making it easier to focus on more important business tasks. You'll save time and reduce the risks associated with traditional paperwork.

-

Is it easy to use airSlate SignNow for signing the Ia 1065 Form?

Yes, airSlate SignNow is designed to be user-friendly, making it simple to sign the Ia 1065 Form. You do not need any technical expertise to navigate the platform. Our intuitive interface guides you through the signing process, ensuring a smooth experience from start to finish.

Get more for Ia 1065 Form

- Wi mv2541 form

- High school enrollment form 101402152

- Faa form 8420 8 70461452

- Personal inventory of assets and important documents desjardins form

- Bv11 cev beach volleyball international scoresheet rps2 out of 3 sets name of competition edition site court beach player no cev form

- Affidavit of landlord 384234584 form

- Acknowledgement contract template form

- First right of refusal horse contract template form

Find out other Ia 1065 Form

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form