Dr 501 Tax Exemption Seminole County Form

What is the Dr 501 Tax Exemption Seminole County Form

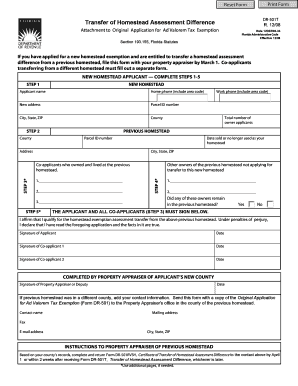

The Dr 501 Tax Exemption Seminole County Form is a document used by property owners in Seminole County, Florida, to apply for a tax exemption on their property. This exemption can significantly reduce the amount of property tax owed, making it an important form for eligible homeowners. The form is specifically designed for those who meet certain criteria, such as being a permanent resident or qualifying for specific exemptions based on age, disability, or income status.

How to use the Dr 501 Tax Exemption Seminole County Form

Using the Dr 501 Tax Exemption Seminole County Form involves several steps. First, you must determine your eligibility based on the criteria set forth by the Seminole County Property Appraiser’s Office. Once eligibility is confirmed, you can fill out the form with accurate information regarding your property and personal details. After completing the form, it should be submitted to the appropriate office for review. It is essential to ensure all required documentation is included to avoid delays in processing.

Steps to complete the Dr 501 Tax Exemption Seminole County Form

Completing the Dr 501 Tax Exemption Seminole County Form involves a systematic approach:

- Gather necessary documents, including proof of residency and any supporting evidence for your exemption claim.

- Carefully fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the completed form along with required documentation to the Seminole County Property Appraiser’s Office.

Eligibility Criteria

To qualify for the Dr 501 Tax Exemption Seminole County Form, applicants must meet specific eligibility criteria. Generally, this includes being a permanent resident of Seminole County and owning the property for which the exemption is sought. Additional criteria may involve age restrictions, disability status, or income thresholds. It is advisable to review the latest guidelines provided by the Seminole County Property Appraiser to ensure compliance.

Required Documents

When completing the Dr 501 Tax Exemption Seminole County Form, certain documents are required to support your application. These may include:

- Proof of residency, such as a driver’s license or utility bill.

- Documentation of income if applying for income-based exemptions.

- Medical records or disability documentation if claiming a disability exemption.

Form Submission Methods

The Dr 501 Tax Exemption Seminole County Form can be submitted through various methods, providing flexibility for applicants. These methods include:

- Online submission through the Seminole County Property Appraiser’s website.

- Mailing the completed form to the designated office address.

- In-person submission at the local property appraiser’s office.

Quick guide on how to complete dr 501 tax exemption seminole county form

Prepare Dr 501 Tax Exemption Seminole County Form seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly, without any holdups. Manage Dr 501 Tax Exemption Seminole County Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and eSign Dr 501 Tax Exemption Seminole County Form effortlessly

- Obtain Dr 501 Tax Exemption Seminole County Form and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal status as a conventional wet ink signature.

- Review the details and click on the Done button to save your alterations.

- Select your preferred method of sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Dr 501 Tax Exemption Seminole County Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 501 tax exemption seminole county form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Dr 501 Tax Exemption Seminole County Form?

The Dr 501 Tax Exemption Seminole County Form is a document used by property owners in Seminole County to apply for a tax exemption. This form helps in reducing the overall property tax for eligible individuals, such as seniors, veterans, and disabled persons, by signNowing their status.

-

How can I obtain the Dr 501 Tax Exemption Seminole County Form?

You can obtain the Dr 501 Tax Exemption Seminole County Form from the Seminole County property appraiser's website or office. Additionally, our platform offers an easy method to eSign and submit the form efficiently, ensuring you meet all necessary deadlines.

-

What are the benefits of using airSlate SignNow for the Dr 501 Tax Exemption Seminole County Form?

Using airSlate SignNow for the Dr 501 Tax Exemption Seminole County Form ensures a hassle-free, secure, and quick signing process. Our platform allows multiple signers, tracking capabilities, and ensures your documents are legally binding, making the process efficient and easy.

-

Is there a cost associated with the Dr 501 Tax Exemption Seminole County Form through airSlate SignNow?

While the Dr 501 Tax Exemption Seminole County Form itself does not have a fee, airSlate SignNow offers various subscription plans that are affordable and provide extensive features. We ensure that our pricing is competitive while maintaining a high level of service for all your document signing needs.

-

Can I integrate airSlate SignNow with other tools for managing the Dr 501 Tax Exemption Seminole County Form?

Absolutely! airSlate SignNow seamlessly integrates with popular applications such as Google Drive, Dropbox, and more to help manage the Dr 501 Tax Exemption Seminole County Form. This integration helps streamline document storage and retrieval, enhancing your document workflow.

-

What features does airSlate SignNow offer for the Dr 501 Tax Exemption Seminole County Form?

airSlate SignNow provides great features such as customizable templates, a user-friendly interface for signing the Dr 501 Tax Exemption Seminole County Form, and real-time notifications. These features ensure you are always updated on your document status and can easily manage your eSigning needs.

-

How secure is the process of signing the Dr 501 Tax Exemption Seminole County Form with airSlate SignNow?

Security is a top priority for us at airSlate SignNow. The process of signing the Dr 501 Tax Exemption Seminole County Form is protected with industry-standard encryption and compliance with regulations, ensuring that your personal and sensitive information remains confidential and secure.

Get more for Dr 501 Tax Exemption Seminole County Form

- What type of isotope was used to give energy to the flubber form

- Sst meeting template 428327489 form

- Dc 37 beneficiary form

- C e form no 35 synchronized decision of the comelec

- Arizona marriage absentee application form 42345219

- Vawa updatesvawa experts listserv application asista asistahelp form

- Notice re electronic writ form

- Form 10 notice of change of directors bc registry services bcregistryservices gov bc

Find out other Dr 501 Tax Exemption Seminole County Form

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online