Form Kw7a Kansas

What is the Form KW-7A Kansas

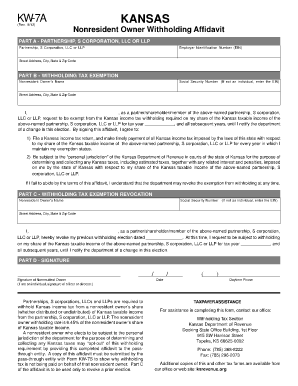

The Kansas Form KW-7A is a specific document used in the state of Kansas, primarily related to tax and financial reporting. This form is essential for individuals and businesses who need to report certain types of income, deductions, or credits to the Kansas Department of Revenue. Understanding the purpose and requirements of the KW-7A is crucial for compliance with state tax laws.

How to Use the Form KW-7A Kansas

Using the Kansas Form KW-7A involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and any relevant tax records. Next, carefully fill out the form, providing all required information. It is important to follow the instructions provided with the form to avoid errors that could lead to delays or penalties. Once completed, the form can be submitted according to the specified guidelines.

Steps to Complete the Form KW-7A Kansas

Completing the Kansas Form KW-7A requires attention to detail. Here are the essential steps:

- Review the form instructions thoroughly to understand the requirements.

- Gather all necessary documents, including income and deduction records.

- Fill out the form accurately, ensuring all information is correct.

- Double-check for any errors or omissions before submission.

- Submit the form by the deadline, either online, by mail, or in person, as specified.

Legal Use of the Form KW-7A Kansas

The legal use of the Kansas Form KW-7A is governed by state tax laws. It is essential to ensure that the form is filled out accurately and submitted on time to avoid legal repercussions. Failure to comply with the requirements may result in penalties, including fines or additional taxes owed. Understanding the legal implications of using this form is crucial for maintaining compliance with Kansas tax regulations.

Key Elements of the Form KW-7A Kansas

Several key elements must be included when completing the Kansas Form KW-7A. These elements typically include:

- Taxpayer identification information, such as name and Social Security number.

- Details of income sources and amounts.

- Applicable deductions and credits being claimed.

- Signature and date to validate the submission.

Form Submission Methods

The Kansas Form KW-7A can be submitted through various methods, depending on the preferences of the filer. Options typically include:

- Online submission through the Kansas Department of Revenue website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated state offices.

Filing Deadlines / Important Dates

Filing deadlines for the Kansas Form KW-7A are critical to ensure compliance. Generally, forms must be submitted by the tax deadline, which is typically April 15 for individual filers. However, it is advisable to check for any specific changes or extensions that may apply in a given tax year. Staying informed about these dates helps avoid penalties and ensures timely processing of the form.

Quick guide on how to complete form kw7a kansas

Complete Form Kw7a Kansas effortlessly on any device

Digital document management has gained popularity among enterprises and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without any holdups. Manage Form Kw7a Kansas on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to edit and electronically sign Form Kw7a Kansas without hassle

- Locate Form Kw7a Kansas and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that aim.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors requiring the printing of new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Kw7a Kansas and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form kw7a kansas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kansas Form KW 7A?

The Kansas Form KW 7A is a document used primarily in real estate transactions in Kansas. It serves as an important tool for both buyers and sellers in the process. Utilizing airSlate SignNow can streamline the completion and signing of the Kansas Form KW 7A.

-

How can airSlate SignNow help with the Kansas Form KW 7A?

With airSlate SignNow, you can easily send, sign, and manage the Kansas Form KW 7A digitally. This platform provides a user-friendly interface that enhances efficiency in document handling. It ensures that all parties involved can complete the form securely and quickly.

-

Is airSlate SignNow affordable for businesses handling the Kansas Form KW 7A?

Yes, airSlate SignNow offers cost-effective pricing plans that are suitable for businesses of all sizes dealing with the Kansas Form KW 7A. By minimizing the cost associated with paper-based processes, users can save money while ensuring compliance and efficiency in document management.

-

What features does airSlate SignNow offer for the Kansas Form KW 7A?

airSlate SignNow provides features such as eSignature capabilities, document templates, and real-time tracking for the Kansas Form KW 7A. These features facilitate seamless communication between all parties, ensuring that the document is processed promptly and without errors.

-

Can I integrate airSlate SignNow with other software for the Kansas Form KW 7A?

Absolutely! airSlate SignNow offers integrations with various applications which can further enhance the usefulness of the Kansas Form KW 7A. You can connect it with CRMs, accounting software, and more, making your workflow more efficient.

-

Is it secure to use airSlate SignNow for the Kansas Form KW 7A?

Yes, security is a top priority at airSlate SignNow. When using the platform for the Kansas Form KW 7A, your documents are encrypted, ensuring that sensitive information remains confidential. Compliance with industry standards further enhances the security measures in place.

-

What are the benefits of using airSlate SignNow for the Kansas Form KW 7A?

Using airSlate SignNow for the Kansas Form KW 7A includes benefits such as reduced processing time and improved accuracy. This leads to quicker transactions and a better experience for all parties involved. Additionally, it helps maintain organization and ensures that all documents are easily accessible.

Get more for Form Kw7a Kansas

Find out other Form Kw7a Kansas

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application