1040x Printable Tax Forms

What is the 1040x Printable Tax Forms

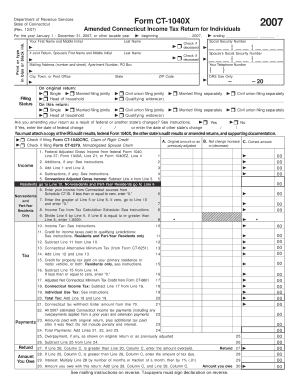

The 1040x printable tax forms are used by taxpayers in the United States to amend their previously filed federal income tax returns. This form allows individuals to correct errors, claim additional deductions, or adjust their filing status. The 1040x is essential for ensuring that your tax records are accurate and up to date, which can affect your overall tax liability and potential refunds.

How to use the 1040x Printable Tax Forms

Using the 1040x printable tax forms involves several steps. First, ensure that you have the correct version of the form for the tax year you are amending. Next, gather all relevant documents, including your original tax return and any supporting documentation for the changes you wish to make. Complete the form by clearly indicating the changes in the appropriate sections, providing explanations where necessary. Finally, review the form for accuracy before submitting it to the IRS.

Steps to complete the 1040x Printable Tax Forms

Completing the 1040x printable tax forms requires careful attention to detail. Follow these steps:

- Obtain the correct 1040x form for the specific tax year.

- Fill out your personal information at the top of the form.

- In Part I, indicate the changes you are making, including the original amounts and the corrected amounts.

- In Part II, provide a detailed explanation for each change.

- Sign and date the form to certify its accuracy.

Legal use of the 1040x Printable Tax Forms

The 1040x printable tax forms are legally binding documents when completed correctly. To ensure that the form is valid, it must comply with IRS regulations, including accurate reporting of tax information and proper signatures. Additionally, the form must be submitted within the designated time frame, typically within three years of the original filing date or within two years of paying any tax owed.

Filing Deadlines / Important Dates

Filing deadlines for the 1040x printable tax forms are crucial for compliance. Generally, the form must be filed within three years from the original return's due date or within two years from the date you paid the tax owed. It is important to keep track of these dates to avoid penalties and ensure that your amendments are processed in a timely manner.

Required Documents

When completing the 1040x printable tax forms, certain documents are necessary. These typically include:

- Your original tax return for the year you are amending.

- Any supporting documentation for the changes you are making, such as W-2s, 1099s, or receipts.

- Any prior correspondence with the IRS related to your original return.

Quick guide on how to complete 1040x printable tax forms

Easily Prepare 1040x Printable Tax Forms on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a fantastic environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage 1040x Printable Tax Forms on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

Effortlessly Modify and eSign 1040x Printable Tax Forms

- Find 1040x Printable Tax Forms and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important parts of your documents or redact sensitive data with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign 1040x Printable Tax Forms and ensure clear communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040x printable tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1040x form and why would I need it?

The 1040x form is an official document used to amend a previously filed tax return in the United States. If you realize there were mistakes or new information has come to light after submitting your original 1040 form, using the 1040x allows you to correct those errors. This ensures your tax records are accurate and can potentially lead to refunds.

-

How can airSlate SignNow help with filing a 1040x?

airSlate SignNow provides an easy-to-use eSignature solution that streamlines the process of completing and submitting your 1040x form. With the ability to sign documents electronically, you can ensure that amendments are filed quickly and securely. This minimizes the hassle and speeds up the entire amendment process.

-

Is there a cost associated with using airSlate SignNow for 1040x forms?

AirSlate SignNow offers competitive pricing plans that accommodate various business needs, including those dealing with 1040x forms. Whether it's a monthly or annual subscription, you'll find affordable options that enhance efficiency and simplify document management. Check our pricing page for specific details and choose a plan that fits your requirements.

-

What features does airSlate SignNow offer for handling a 1040x?

AirSlate SignNow offers a range of features that benefit users dealing with 1040x forms, such as user-friendly templates, secure eSigning, and automated workflows. These tools help streamline the process of amending tax returns, making it less cumbersome. The platform's intuitive interface also ensures that you can complete your 1040x efficiently.

-

Can I integrate airSlate SignNow with other tools for 1040x processing?

Yes, airSlate SignNow seamlessly integrates with various applications, making it easier to manage your 1040x paperwork alongside other essential tools. By connecting with accounting software or CRM platforms, you can centralize your document management processes, enhancing productivity and organization. Explore our integration options for a more comprehensive workflow.

-

What are the benefits of using airSlate SignNow for 1040x forms?

Using airSlate SignNow for your 1040x forms translates to improved efficiency, better compliance, and enhanced security. The electronic signing feature allows for prompt submissions and reduces the likelihood of errors. Additionally, you can track document statuses in real-time, ensuring that your amendments are processed quickly.

-

Is it secure to use airSlate SignNow for filing a 1040x?

Absolutely, airSlate SignNow prioritizes security for all documents, including 1040x forms. The platform utilizes advanced encryption methods to safeguard sensitive information. With compliance to industry standards, you can trust that your personal and financial data remains protected at all times.

Get more for 1040x Printable Tax Forms

Find out other 1040x Printable Tax Forms

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online