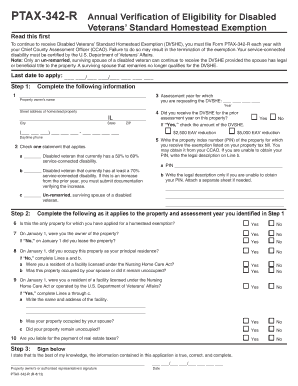

Ptax 342 R Form

What is the Ptax 342 R

The Ptax 342 R form is a property tax assessment application used in the United States. It is primarily utilized by property owners to appeal their property tax assessments. This form allows individuals to contest the valuation placed on their property by local tax authorities, ensuring that they are not overpaying on their taxes. The Ptax 342 R serves as a crucial tool for taxpayers seeking to ensure fair taxation based on accurate property valuations.

How to use the Ptax 342 R

Using the Ptax 342 R form involves several straightforward steps. First, gather the necessary information about your property, including its current assessed value and any supporting documentation that justifies your appeal. Next, complete the form by providing accurate details regarding your property and the reasons for your appeal. After filling out the form, submit it to the appropriate local tax authority by the specified deadline. It is important to keep copies of all submitted documents for your records.

Steps to complete the Ptax 342 R

Completing the Ptax 342 R form requires careful attention to detail. Follow these steps to ensure your application is accurate:

- Obtain the Ptax 342 R form from your local tax authority's website or office.

- Fill in your personal information, including your name, address, and contact details.

- Provide the property details, including the property address and the assessed value.

- Clearly state the reasons for your appeal, supported by any relevant evidence.

- Review the form for accuracy and completeness before submission.

- Submit the completed form by mail, in person, or online, depending on your local authority's submission methods.

Legal use of the Ptax 342 R

The Ptax 342 R form is legally recognized as a valid method for appealing property tax assessments in the United States. To ensure its legal standing, it must be completed accurately and submitted within the designated timeframe established by local tax authorities. Compliance with state regulations regarding property tax appeals is essential for the form to be considered valid. Additionally, maintaining documentation that supports your appeal will strengthen your case should it be reviewed by a tax board or court.

Filing Deadlines / Important Dates

Filing deadlines for the Ptax 342 R form vary by state and local jurisdiction. Typically, property owners must submit their appeals within a specific timeframe following the receipt of their property tax assessment notice. It is crucial to check with your local tax authority for the exact deadlines to avoid missing the opportunity to contest your assessment. Marking these important dates on your calendar can help ensure timely submission.

Who Issues the Form

The Ptax 342 R form is issued by local tax authorities, typically at the county or municipal level. These authorities are responsible for property tax assessments and managing appeals. It is advisable to contact your local tax office for specific information regarding the issuance of the form, as well as any additional requirements that may apply in your jurisdiction.

Quick guide on how to complete ptax 342 r

Complete Ptax 342 R effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing users to locate the appropriate form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Handle Ptax 342 R on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Ptax 342 R with ease

- Locate Ptax 342 R and click on Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign function, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or link invitation, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ptax 342 R while ensuring smooth communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 342 r

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Ptax 342 R and how does it function within airSlate SignNow?

Ptax 342 R is a document that facilitates the electronic signing process. Within the airSlate SignNow platform, it allows users to easily create, send, and store signed documents securely. By streamlining the signing process, Ptax 342 R enhances efficiency for businesses.

-

What are the key features of airSlate SignNow that support Ptax 342 R?

AirSlate SignNow offers various features that enhance the handling of Ptax 342 R, including reusable templates, real-time tracking, and customizable workflows. These features ensure that users can manage their eSigning processes effectively while maintaining compliance with legal standards. Additionally, users can collaborate seamlessly through shared links.

-

Is there a cost associated with using Ptax 342 R in airSlate SignNow?

Yes, there are pricing plans for using airSlate SignNow, which include features supporting Ptax 342 R. The plans are cost-effective and designed to cater to different business needs, ensuring that companies of all sizes can benefit from secure electronic signatures without breaking the bank.

-

How can Ptax 342 R improve my business operations?

Utilizing Ptax 342 R through airSlate SignNow can signNowly improve your business operations by reducing the time required for document signing. This streamlined process minimizes delays and improves overall productivity, as teams can focus on their core tasks instead of getting bogged down with paperwork.

-

What integrations does airSlate SignNow offer that support Ptax 342 R?

airSlate SignNow integrates seamlessly with a variety of applications, enhancing the usability of Ptax 342 R. Some popular integrations include Google Drive, Salesforce, and Zapier, allowing users to automate workflows and manage documents effortlessly across platforms.

-

Are there mobile options for managing Ptax 342 R in airSlate SignNow?

Yes, airSlate SignNow offers mobile applications that enable users to manage Ptax 342 R on the go. With these mobile options, users can send, sign, and track documents anytime, anywhere, making it convenient for those who frequently work away from their desks.

-

What security measures are in place for Ptax 342 R in airSlate SignNow?

AirSlate SignNow prioritizes security, implementing advanced encryption protocols for documents like Ptax 342 R. Features such as secure access controls, audit trails, and compliance with regulations like GDPR ensure that your sensitive information remains protected throughout the signing process.

Get more for Ptax 342 R

- New york funeral form

- Dla for children claim form use this form to claim disability living allowance for a child

- Declaration of due diligence and request to form

- Hivhcv test formpatient

- Wic clinickentucky wic program infant 1 year old form

- Police department white bear lake minnesota form

- Avera 8610 form

- Platoon leaders class ground form

Find out other Ptax 342 R

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy