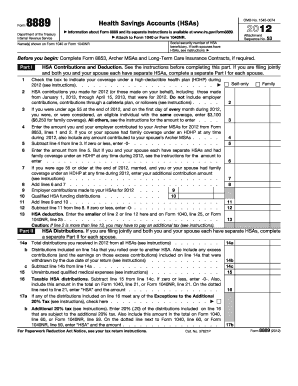

F8889 Form

What is the F8889

The F8889 form is a specific document used in various legal and administrative contexts. It serves as a means for individuals or entities to provide necessary information for compliance with regulations or to facilitate specific transactions. Understanding the purpose and requirements of the F8889 is essential for ensuring its proper use and submission.

How to use the F8889

Using the F8889 form involves several key steps. First, gather all necessary information required to complete the form accurately. This may include personal identification details, financial information, or other relevant data. Next, fill out the form carefully, ensuring that all sections are completed as required. After filling out the form, review it for accuracy and completeness before submission.

Steps to complete the F8889

Completing the F8889 form involves a systematic approach:

- Obtain the latest version of the F8889 form from a reliable source.

- Read the instructions carefully to understand what information is required.

- Fill in your personal details, ensuring accuracy in all entries.

- Provide any additional information as specified in the form.

- Review the completed form for any errors or omissions.

- Sign and date the form as required.

- Submit the form according to the specified method.

Legal use of the F8889

The legal use of the F8889 form is governed by specific regulations that outline its validity and requirements. To ensure that the form is legally binding, it is essential to follow all instructions and comply with applicable laws. This includes using a secure method for submission and ensuring that all signatures are valid. Adhering to these legal standards helps protect the interests of all parties involved.

Filing Deadlines / Important Dates

Filing deadlines for the F8889 form can vary based on the context in which it is used. It is crucial to be aware of any specific dates that apply to your situation to avoid penalties or complications. Keeping a calendar of important dates related to the F8889 ensures timely submission and compliance with all requirements.

Form Submission Methods

The F8889 form can typically be submitted through various methods, including:

- Online submission through designated platforms.

- Mailing the completed form to the appropriate address.

- In-person submission at designated locations.

Choosing the right submission method depends on personal preference and any specific requirements associated with the form.

Quick guide on how to complete f8889 278830

Access F8889 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It presents an ideal eco-conscious substitute for conventional printed and signed documents, as it enables you to find the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, alter, and electronically sign your documents rapidly and without holdups. Handle F8889 on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign F8889 with ease

- Find F8889 and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Select important sections of your documents or conceal confidential information using the tools that airSlate SignNow specifically provides for this function.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal authority as a standard wet ink signature.

- Review all the details and click on the Done button to confirm your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the concern of lost or misplaced files, tedious document searches, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs with just a few clicks from any device. Modify and electronically sign F8889 and guarantee seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f8889 278830

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is f8889 and how does it work with airSlate SignNow?

F8889 is a unique identifier for specific features and functionalities within the airSlate SignNow platform. By leveraging f8889, users can easily send and eSign documents efficiently. The solution provides a user-friendly interface that streamlines the signing process, saving time and resources for businesses.

-

What are the pricing options for airSlate SignNow related to f8889?

AirSlate SignNow offers various pricing plans that cater to different business needs, including those leveraging f8889. Each plan includes essential features like document management and eSigning capabilities. It's essential to check the official website for detailed pricing tiers to find the best fit for your organization.

-

What features does f8889 offer in airSlate SignNow?

F8889 highlights key features of airSlate SignNow, such as document templates, team collaboration, and advanced security measures. These features ensure that users can efficiently manage their signing processes while maintaining confidentiality and compliance. Utilizing f8889 optimally enhances the productivity of document workflows.

-

How can f8889 benefit my business?

Integrating f8889 into your workflow through airSlate SignNow can signNowly benefit your business by reducing the time needed for document approvals. It streamlines internal processes and improves customer satisfaction by enabling quick eSignatures. Overall, f8889 supports a more efficient way of working with vital documents.

-

Are there any integrations available for f8889 in airSlate SignNow?

Yes, airSlate SignNow with f8889 supports various integrations with popular business applications, enhancing your efficiency. This includes CRM systems, project management tools, and cloud storage solutions. These integrations allow for seamless document management and improve overall workflow processes.

-

Is airSlate SignNow with f8889 secure for sensitive documents?

Absolutely, airSlate SignNow ensures that documents signed and managed through f8889 are protected with robust security measures. This includes encryption and secure access protocols that comply with industry standards. By using f8889, you can confidently handle sensitive information without compromising security.

-

Can I customize documents using f8889 in airSlate SignNow?

Yes, airSlate SignNow allows for extensive customization of documents utilizing f8889 features. Users can create templates, add branding, and modify signature fields to suit their unique requirements. This flexibility ensures that all documents reflect your business's identity and meet your specific needs.

Get more for F8889

- Missouri warranty deed from two individuals to husband and wife form

- F 1120a form

- Location packet for retailers form

- The speech spatial and qualities of hearing scale ssq ihr mrc ac form

- Confidential informant contract pdf 102014671

- School of health sciences immunization cpr and p form

- Academic probation action plan part i to be completed by form

- Golden id tuition reduction form pdf towson university towson

Find out other F8889

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement