W2 Form Hawaii

What is the W-2 Form Hawaii

The W-2 form in Hawaii is a crucial tax document that employers must provide to their employees. It reports an employee's annual wages and the amount of taxes withheld from their paycheck. This form is essential for employees when filing their federal and state tax returns. The W-2 form contains important information, including the employee's Social Security number, employer's identification number, and details about state and federal tax withholdings. Understanding this form is vital for ensuring accurate tax reporting and compliance with state and federal regulations.

How to Obtain the W-2 Form Hawaii

Employees in Hawaii can obtain their W-2 form from their employer, who is responsible for issuing it by January thirty-first of each year. Employers may provide the form in paper format or electronically, depending on their policies and the employee's preferences. If an employee does not receive their W-2 by mid-February, they should contact their employer's payroll department to request a copy. Additionally, employees can access their W-2 forms through online payroll systems if their employer uses such services.

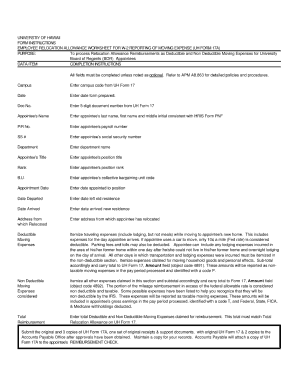

Steps to Complete the W-2 Form Hawaii

Completing the W-2 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your Social Security number, employer's identification number, and total wages earned during the year.

- Fill in the employee's information, ensuring that names and addresses are accurate.

- Report total wages, tips, and other compensation in the designated box.

- Indicate the amount of federal income tax withheld, Social Security wages, and Medicare wages.

- Complete state-specific sections, including Hawaii state tax withheld.

- Review all entries for accuracy before submitting the form.

Legal Use of the W-2 Form Hawaii

The W-2 form is legally binding and must be completed accurately to comply with federal and state tax laws. Employers are required to provide this form to employees, and failure to do so can result in penalties. Employees must use the information on the W-2 to file their income tax returns correctly. The form serves as proof of income and tax withholdings, which can be critical in case of audits or disputes with tax authorities.

Filing Deadlines / Important Dates

For the W-2 form in Hawaii, employers must issue the form to employees by January thirty-first each year. Employees should ensure they receive their W-2 in time to file their tax returns by the federal deadline, which is typically April fifteenth. If the deadline falls on a weekend or holiday, it may be extended. It is essential for both employers and employees to be aware of these dates to avoid penalties and ensure compliance with tax regulations.

Who Issues the Form

The W-2 form is issued by employers to their employees. Employers are responsible for accurately reporting wages and tax withholdings for each employee. This includes private companies, government agencies, and non-profit organizations. It is crucial for employers to maintain accurate payroll records to ensure that the information reported on the W-2 form is correct and complies with IRS and state requirements.

Quick guide on how to complete w2 form hawaii

Finalize W2 Form Hawaii seamlessly on any device

Digital document management has become increasingly popular among enterprises and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage W2 Form Hawaii on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest method to modify and electronically sign W2 Form Hawaii with ease

- Obtain W2 Form Hawaii and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides for that specific purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review all details and click the Done button to preserve your modifications.

- Select your preferred method of delivering your form, whether it be via email, SMS, invitation link, or downloading it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your preference. Modify and electronically sign W2 Form Hawaii and ensure top-notch communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w2 form hawaii

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W2 form in Hawaii?

A W2 form in Hawaii is a tax document provided by employers to their employees, summarizing the income earned and the taxes withheld for the year. It is essential for filing your state and federal taxes accurately. By using airSlate SignNow, you can easily manage and eSign your W2 forms, ensuring a hassle-free experience.

-

How can airSlate SignNow help with W2 forms in Hawaii?

airSlate SignNow simplifies the management of W2 forms in Hawaii by providing an intuitive platform for sending, signing, and storing documents securely. Our solution enables you to quickly eSign your W2 forms without the need for printing, scanning, or faxing. This saves time and enhances the efficiency of your document workflow.

-

Is airSlate SignNow cost-effective for managing W2 forms in Hawaii?

Yes, airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes, making it a cost-effective choice for managing W2 forms in Hawaii. With flexible subscription options, you can select the plan that best fits your needs and budget while enjoying all the powerful features our platform provides.

-

What features does airSlate SignNow offer for W2 forms in Hawaii?

airSlate SignNow offers a range of features for managing W2 forms in Hawaii, including customizable templates, secure electronic signatures, and real-time tracking of document status. Our platform also includes the ability to integrate with popular business applications, streamlining your entire document management process.

-

Can airSlate SignNow integrate with other platforms for W2 forms in Hawaii?

Absolutely! airSlate SignNow seamlessly integrates with numerous platforms, allowing for efficient management of W2 forms in Hawaii. Whether you use accounting software or HR management tools, our integrations ensure that your document workflows are synchronized with your existing systems.

-

What are the benefits of using airSlate SignNow for W2 forms in Hawaii?

Using airSlate SignNow for W2 forms in Hawaii offers numerous benefits, including improved efficiency, enhanced security, and reduced operational costs. Our easy-to-use platform allows employees and employers to eSign documents quickly, resulting in faster turnaround times and increased productivity.

-

Is my information secure when using airSlate SignNow for W2 forms in Hawaii?

Yes, airSlate SignNow takes data security seriously. When you manage W2 forms in Hawaii on our platform, your information is protected through advanced encryption and secure cloud storage. We adhere to stringent security measures to ensure that your sensitive information remains safe and private.

Get more for W2 Form Hawaii

- Primal blueprint fitness pdf form

- Transaction screen questionnaire form 206401912

- Consent photography plastic form

- Pest control pro application markel insurance company form

- Formulario para la historia de salud

- Trg regencerx prior authorization form pa 6

- 4187 example form

- Energy control procedure template form

Find out other W2 Form Hawaii

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter