Sample Notification of Death Letter to Credit Reporting Agencies Form

What is the Sample Notification of Death Letter to Credit Reporting Agencies

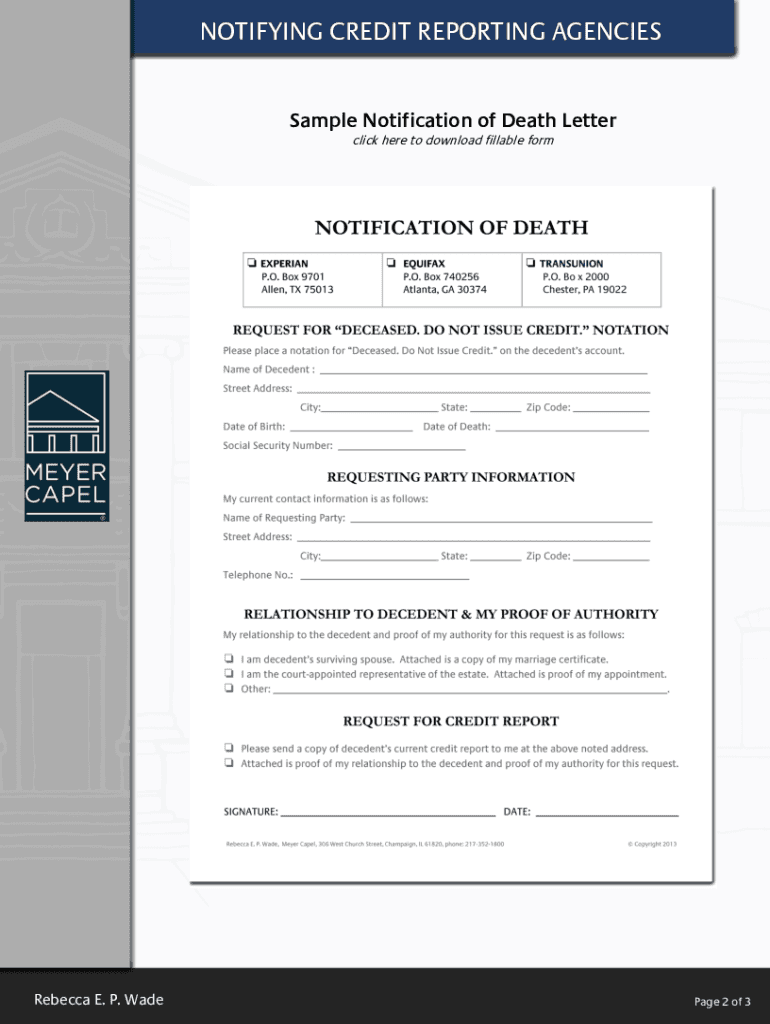

The Sample Notification of Death Letter is a formal document used to inform credit reporting agencies, such as TransUnion, Experian, and Equifax, about the death of an individual. This notification is essential for updating the deceased person's credit report and ensuring that their credit history is accurately reflected. By submitting this letter, you help prevent identity theft and ensure that no further credit activity is associated with the deceased individual.

Key Elements of the Sample Notification of Death Letter to Credit Reporting Agencies

A well-structured Notification of Death Letter should include several key elements to ensure its effectiveness:

- Full name of the deceased individual.

- Date of birth and date of death.

- Social Security number of the deceased, if applicable.

- Address of the deceased at the time of death.

- Your relationship to the deceased and your contact information.

- Request for the credit reporting agency to update their records accordingly.

Steps to Complete the Sample Notification of Death Letter to Credit Reporting Agencies

To effectively complete the Notification of Death Letter, follow these steps:

- Gather all necessary information about the deceased, including their full name, date of birth, and Social Security number.

- Draft the letter, ensuring that you include all key elements mentioned above.

- Sign the letter, indicating your relationship to the deceased.

- Make copies of the letter for your records.

- Send the letter to each credit reporting agency via certified mail to ensure delivery confirmation.

Form Submission Methods (Online / Mail / In-Person)

When submitting the Notification of Death Letter, you can choose from various methods:

- Mail: This is the most common method. Send the letter to the appropriate address for each credit reporting agency.

- Online: Some agencies may allow you to submit the notification through their online portals. Check each agency's website for specific instructions.

- In-Person: Visiting a local office of the credit reporting agency may be an option, but it is less common.

Legal Use of the Sample Notification of Death Letter to Credit Reporting Agencies

The Notification of Death Letter serves a legal purpose by formally notifying credit reporting agencies of an individual's death. This action is important for maintaining accurate credit records and protecting the deceased's identity. The letter should be treated as a legal document, and it is advisable to keep copies of all correspondence for future reference.

Required Documents

In addition to the Notification of Death Letter, you may need to provide certain documents to the credit reporting agencies:

- Death certificate: A certified copy may be required to verify the death.

- Proof of identity: Your identification may be necessary to establish your relationship to the deceased.

Quick guide on how to complete how do i notify credit reporting agencies of a loved oneamp39s death

Effortlessly prepare Sample Notification Of Death Letter To Credit Reporting Agencies on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate forms and securely save them online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delay. Manage Sample Notification Of Death Letter To Credit Reporting Agencies on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-related process today.

The easiest way to alter and electronically sign Sample Notification Of Death Letter To Credit Reporting Agencies without hassle

- Locate Sample Notification Of Death Letter To Credit Reporting Agencies and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Sample Notification Of Death Letter To Credit Reporting Agencies while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How must a credit card company notify me before reporting to the credit reporting agencies?

Your bank is responsible for issuing your statement at a certain date and delivering that statement to you. They make you aware of your monthly statement date generally when you receive your card and again in your online account data. They send the statement to you per your instructions — electronically or via mail.It is your responsibility to notice any non-arrival of your statement. It is your responsibility to track who and what you owe. Knowing you made a purchase and were never asked for payment is extreme negligence on your part. Never receiving a statement and not investigating is extreme negligence on your part. You deserve the derogatory data on your credit reports.Your bank is not required to notify you prior to reporting to the credit bureaus each month. Your account Terms and Conditions already notify you that they will report their experience with you periodically to the credit bureaus. If you failed to read that, it's further extreme negligence on your part.

-

How do I report a bad tenant to the credit agencies?

It is impractical to do that any more.Best bet, it to write the ex-tenant a letter (if you have not already), detailing what they owe you, and say you will go to court if not paid within 10 days or so (I am assuming this is already late).If not paid, bring the lease, your invoice to him and all the letters to court, and sue him (would probably cost $50 if you do it yourself and take a month or 2). You get the judgement on them, and then you can 1) wait until he comes to you to get the judgement removed if he ever wants a mortgage or loan 2) you will have a MORE VALUABLE claim that you can sell to a debt agency or 3) you can continue in the courts and try to garnish his wages.This is a bit of work obviously... but how much do you want the money, and I assume that your lease states a late payment interest fee which has been accruing since his last rent was due.

-

How do I know if my credit card reports to all three credit reporting agencies?

There’s not really a lot you can do about it if they don’t.What are you going to do, close the account? That’s a bad idea.Almost all the credit card issuers for MasterCard and Visa do, along with other major issuers. Do you want to know why?First, understand that while lenders generally report to all 3 CRAs, for most loans, they will only pull a report from 1 CRA. Pulling a report costs money, reporting accounts to a CRA does not cost money.Now suppose you know that particular lender only reports to 2 of the CRAs, and you’re short this month. As the borrower, I will prioritize my payments to those lenders that report to all 3. I’ll do that, because if I want to borrow more money, I just need to find a lender that pulls the report from the CRA that the one lender doesn’t report to. As a lender, I don’t like the idea of being your lowest priority, that’s why I report to all 3.

-

How do I get over one-sided love?

Thanks for the A2A. If you love her truly, then it is really difficult to get over her and get over that love. There is no easy way to unlove a person and it is not that easy. Accept that your feelings for her are true, deep and real and acknowledge and feel that emotion. Feel that love and also feel that pain completely. Then wish her well and try to stay away for you want her to be happy, if you truly love her. Don't fake your feelings. Cry if you want to, get angry if you want to, but process all those emotions fully. Time may lessen the pain. Have this in mind that you will never be completely over her, but you will have to start to learn to live with it. I can completely empathize with you and I know that pain as I have been going through the same for two long years. It is tough but I want her to be happy even without me. Love is about wanting the other to be happy, not about possession. My two cents.STAY AWAY AND MOVE ON BEFORE YOU ARE MISUNDERSTOOD.If it is meant to be, it will be someday. But don't hope.True love alone is not enough sometimes. If it is meant to be, it will be someday. But don’t be in touch with her if she asked you to stay away. It will hurt you more to realize that she doesn’t care about you/loves you as much as you do about her.If you love her truly, then it is really difficult to get over her and get over that love. There is no easy way to unlove a person and it is not a cake walk. Accept that your feelings for her are true, deep and real and acknowledge and feel that emotion. Feel that love and also feel that pain completely.Then wish her well and try to stay away for you want her to be happy, if you truly love her. Don't fake your feelings. Cry if you want to, get angry if you want to, but process all those emotions fully. Time may lessen the pain. Have this in mind that you will never be completely over her, but you will have to start to learn to live with it.I can completely empathize with you and I know that pain as I have been going through the same for more than three long years. It is tough. But in my case, I want her to be happy even if it doesn’t involve being with me. Love is about wanting the other to be happy, not about possession. My two cents.You never heal completely from breaking up with your true love especially if you still love them and they were the one who initiated the breakup and left. You will only learn to live with that pain with time.The heart always wants what it wants. The problem is to silence the mind. Accept that unrequited love is really painful. Move on for now and if it is true and meant to be, it will definitely be someday.Unrequited love is really painful. Especially if your feelings are genuine and you love her to the truest of your senses. It kills you everyday to realize that she doesn't love you back yet. And worse is getting ignored. But the thing about love is, it is always unconditional. You love her because you want to, not because you want her to love you back. That's what love is all about. Just be true to your feelings and try to stay away from her in order to avoid the pain.Unrequited love is one of the most painful things we can ever experience. It's not even like getting over a dead person. Getting over someone you love truly is an extremely difficult task. Someday your heart will learn to live with it. It may not completely move on, but it will try to heal and live with it.MOVE ON AND STAY AWAY BEFORE YOU ARE MISUNDERSTOOD. IT HURTS MORE.Care is sometimes misunderstood as pestering.Love is sometimes misunderstood as pestering.Not moving on is sometimes misunderstood as weakness.Not letting go is sometimes misunderstood as stubbornness.Take care and learn to live with that pain. It will get better with time.

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How do you find out if a company is open to using a staffing agency to fill positions?

Get an introduction to the target company through a referral if possible. A lot of the companies that retain us even talk explicitly about "no agency referrals" on their website. There are times that going in through HR or their staffing org can be to your benefit but more often that not it helps to have a referral with a "VP" in their title to get you that introduction. You might still be a long way from getting a fee agreement signed (retained or contingent) but you'll be a lot close than being one of the hundreds of agency recruiters leaving voicemails for the VP HR or Staffing Manager.

Create this form in 5 minutes!

How to create an eSignature for the how do i notify credit reporting agencies of a loved oneamp39s death

How to make an electronic signature for the How Do I Notify Credit Reporting Agencies Of A Loved Oneamp39s Death in the online mode

How to make an electronic signature for your How Do I Notify Credit Reporting Agencies Of A Loved Oneamp39s Death in Google Chrome

How to generate an eSignature for signing the How Do I Notify Credit Reporting Agencies Of A Loved Oneamp39s Death in Gmail

How to make an eSignature for the How Do I Notify Credit Reporting Agencies Of A Loved Oneamp39s Death right from your smartphone

How to make an electronic signature for the How Do I Notify Credit Reporting Agencies Of A Loved Oneamp39s Death on iOS devices

How to make an electronic signature for the How Do I Notify Credit Reporting Agencies Of A Loved Oneamp39s Death on Android devices

People also ask

-

What does a deceased indicator on credit report signify?

A deceased indicator on credit report is a flag that confirms the individual's passing, which can affect their credit history and scores. Lenders use this indicator to understand the status of debts associated with the deceased. It's an important feature to recognize, as it impacts credit decisions and estate management.

-

How can I check if there's a deceased indicator on my credit report?

To check for a deceased indicator on your credit report, request a copy from major credit bureaus like Equifax, Experian, and TransUnion. Review the report for any status updates, including this indicator. Monitoring regularly can help ensure your credit information is accurate and up to date.

-

Does a deceased indicator on credit report affect credit scores?

Yes, a deceased indicator on credit report can signNowly affect credit scores, as it indicates that the individual is no longer living. This status ensures that creditors do not extend credit to a person who cannot repay it. Understanding this impact is crucial in managing the credit legacy of the deceased.

-

How does airSlate SignNow help with document signing related to deceased estates?

airSlate SignNow simplifies the process of handling documents for deceased estates by enabling secure electronic signatures. This streamlines tasks like filing claims or transferring assets by allowing authorized individuals to sign documents efficiently. It's an essential tool for managing the legalities surrounding a deceased indicator on credit report situations.

-

Are there costs associated with using airSlate SignNow for document management?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The costs depend on the features chosen, but they provide a cost-effective solution overall. The affordability ensures effective management of documents, especially for sensitive subjects like deceased indicators on credit reports.

-

What features does airSlate SignNow provide to enhance document signing?

airSlate SignNow features include customizable templates, in-person signing, and real-time tracking of document statuses. These tools ensure efficiency and clarity when dealing with important documents, particularly those related to handling accounts with a deceased indicator on credit report. These features cater to the needs of diverse users.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow offers integrations with various software applications and platforms, facilitating seamless workflow management. Whether you use CRM systems or project management tools, these integrations enhance productivity while addressing needs, including handling a deceased indicator on credit report efficiently.

Get more for Sample Notification Of Death Letter To Credit Reporting Agencies

Find out other Sample Notification Of Death Letter To Credit Reporting Agencies

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe