Home Tax Business Form

Understanding the Home Tax Business

The Home Tax Business refers to the processes and requirements involved in filing taxes for residential properties in the United States. This type of business often deals with various tax forms and declarations that homeowners must complete to comply with local and federal regulations. Understanding the nuances of the Home Tax Business is essential for ensuring accurate filings and avoiding penalties.

Steps to Complete the Home Tax Business

Completing the Home Tax Business involves several key steps:

- Gather necessary documents, including tax returns, property deeds, and any relevant financial statements.

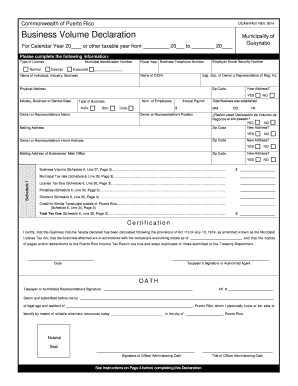

- Determine the applicable tax forms, such as the W-9 for reporting income or the volume of business declaration for local taxes.

- Fill out the forms accurately, ensuring all information is current and correct.

- Review all entries for accuracy before submission.

- Submit the completed forms through the designated method, whether online, by mail, or in person.

Legal Use of the Home Tax Business

Engaging in the Home Tax Business requires compliance with various legal standards. This includes adhering to local, state, and federal tax laws. Proper use of documents, such as the volume of business declaration, ensures that all tax obligations are met. Failure to comply with these regulations can result in penalties or legal repercussions.

Required Documents for the Home Tax Business

When managing the Home Tax Business, several documents are typically required:

- Property tax statements

- Previous tax returns

- W-9 forms for reporting income

- Volume of business declaration forms

- Any additional local forms required by the municipality

Filing Deadlines / Important Dates

Timely filing is crucial in the Home Tax Business. Important deadlines often include:

- April 15 for federal income tax returns

- Local property tax deadlines, which can vary by municipality

- Quarterly estimated tax payment dates for self-employed individuals

IRS Guidelines for the Home Tax Business

The IRS provides specific guidelines for homeowners and businesses involved in property taxation. These guidelines cover various aspects, including deductions, credits, and filing requirements. Familiarizing oneself with these regulations is essential for compliance and maximizing potential tax benefits.

Quick guide on how to complete home tax business

Effortlessly Prepare Home Tax Business on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without any delays. Manage Home Tax Business on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and eSign Home Tax Business with minimal effort

- Obtain Home Tax Business and click on Get Form to initiate the process.

- Use the tools we offer to fill in your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign Home Tax Business and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the home tax business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Puerto Rico business volume ocam pa01 catano?

airSlate SignNow is a cloud-based platform that empowers businesses, including those in Puerto Rico, to send and eSign documents effortlessly. For companies dealing with high business volume, such as ocam pa01 catano operations, it provides a streamlined process to manage contracts and approvals efficiently.

-

How can airSlate SignNow improve the efficiency of my Puerto Rico business volume ocam pa01 catano?

Using airSlate SignNow can signNowly enhance efficiency by automating the signing process and reducing paperwork. This allows businesses with high volumes, like ocam pa01 catano, to speed up transactions, reduce errors, and focus on core activities without the burden of document management.

-

What pricing plans does airSlate SignNow offer for handling Puerto Rico business volume ocam pa01 catano?

airSlate SignNow provides various pricing plans tailored to meet the needs of businesses of all sizes, including those with high business volume like ocam pa01 catano in Puerto Rico. Each plan is designed to ensure affordability while offering the essential features required for efficient document handling.

-

Are there any special features of airSlate SignNow for Puerto Rico business volume ocam pa01 catano?

Yes, airSlate SignNow offers features specifically beneficial for businesses with high volumes such as ocam pa01 catano in Puerto Rico. These include customizable templates, an intuitive interface, and powerful integration options that streamline workflow and enhance document management.

-

What benefits does using airSlate SignNow provide to Puerto Rico businesses focusing on ocam pa01 catano?

Utilizing airSlate SignNow allows Puerto Rico businesses, especially those focused on ocam pa01 catano, to maximize their productivity. The ability to eSign documents on the go and obtain approvals rapidly translates to faster operations and improved customer satisfaction.

-

Can airSlate SignNow integrate with other tools for Puerto Rico business volume ocam pa01 catano?

Absolutely! airSlate SignNow integrates with various tools that are essential for businesses dealing with high volumes, like ocam pa01 catano in Puerto Rico. This integration capability simplifies workflows and allows for seamless document exchanges between platforms, enhancing overall productivity.

-

Is airSlate SignNow secure for businesses managing Puerto Rico business volume ocam pa01 catano?

Yes, airSlate SignNow prioritizes security and compliance for businesses managing high volumes, such as ocam pa01 catano in Puerto Rico. With policies and encryption standards in place, your documents and signatures are protected, ensuring peace of mind while conducting business.

Get more for Home Tax Business

- Wp4 form

- Occupational therapy competency checklist form

- Mv2172 form

- Dd form 2903 1

- Signuture on 30 day notice form

- Business certificate procedure and application form

- Temporary food service application townchathammaus town chatham ma form

- Inspectional servicescity of worcester malynn inspectional services lynn massachusettslynn inspectional services lynn form

Find out other Home Tax Business

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe