Alabama Form 20s

What is the Alabama Form 20s

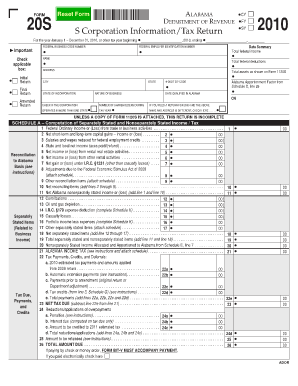

The Alabama Form 20s is a tax form used for reporting the income of certain business entities in the state of Alabama. It is primarily utilized by corporations and limited liability companies (LLCs) to report their income, deductions, and credits to the Alabama Department of Revenue. This form plays a crucial role in ensuring that businesses comply with state tax regulations and helps in the accurate assessment of tax liabilities.

How to use the Alabama Form 20s

To effectively use the Alabama Form 20s, businesses must first gather all necessary financial information, including income statements and expense reports. The form requires detailed entries regarding gross income, allowable deductions, and any applicable tax credits. Once the form is completed, it should be submitted to the Alabama Department of Revenue by the designated deadline to avoid penalties.

Steps to complete the Alabama Form 20s

Completing the Alabama Form 20s involves several key steps:

- Gather all financial documents, including profit and loss statements.

- Fill out the form with accurate income and expense figures.

- Calculate any tax credits or deductions applicable to your business.

- Review the form for accuracy before submission.

- Submit the completed form to the Alabama Department of Revenue by the due date.

Legal use of the Alabama Form 20s

The Alabama Form 20s is legally binding when completed and submitted in accordance with state regulations. It is essential for businesses to ensure that all information provided is truthful and accurate, as any discrepancies may lead to audits or penalties. Compliance with the guidelines set forth by the Alabama Department of Revenue is crucial for maintaining good standing as a business entity.

Filing Deadlines / Important Dates

Filing deadlines for the Alabama Form 20s typically align with the end of the business's fiscal year. Businesses must submit the form by the fifteenth day of the fourth month following the close of their fiscal year. It is important to keep track of these dates to ensure timely filing and to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Alabama Form 20s can be submitted through various methods. Businesses have the option to file online via the Alabama Department of Revenue's website, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate address or submitted in person at designated state offices. Each method has its own requirements and processing times, so businesses should choose the one that best fits their needs.

Key elements of the Alabama Form 20s

Key elements of the Alabama Form 20s include sections for reporting gross income, deductions, credits, and the calculation of tax owed. The form also requires information about the business entity, such as its name, address, and federal identification number. Accurate completion of these sections is vital for ensuring compliance and avoiding potential issues with the Alabama Department of Revenue.

Quick guide on how to complete alabama form 20s

Complete Alabama Form 20s effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Alabama Form 20s on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Alabama Form 20s without hassle

- Locate Alabama Form 20s and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Alabama Form 20s and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alabama form 20s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 20s and how can airSlate SignNow help with it?

A form 20s is a specific document format often used for various official purposes. airSlate SignNow streamlines the process of creating, sending, and eSigning form 20s, making it easy for businesses to manage their documentation needs efficiently.

-

Is airSlate SignNow a cost-effective solution for managing form 20s?

Yes, airSlate SignNow offers a cost-effective solution for managing form 20s. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you receive maximum value without sacrificing essential features for document management.

-

What features does airSlate SignNow offer for form 20s?

airSlate SignNow provides a range of features specifically for managing form 20s, including customizable templates, secure eSigning, and real-time workflow tracking. These features enhance the overall efficiency of document handling and minimize errors in submission.

-

How does airSlate SignNow improve the eSigning process for form 20s?

airSlate SignNow simplifies the eSigning process for form 20s with intuitive tools that enable users to sign documents electronically from any device. This speeds up the approval process and ensures that documents are handled securely and conveniently.

-

Can I integrate airSlate SignNow with other applications for form 20s management?

Absolutely! airSlate SignNow offers integrations with numerous applications and services, allowing you to streamline your workflow for form 20s. This means you can connect with CRMs, cloud storage solutions, and more to enhance your document management experience.

-

What benefits does airSlate SignNow provide for businesses using form 20s?

Businesses using airSlate SignNow for form 20s benefit from increased efficiency, reduced turnaround times, and improved accuracy in document handling. These benefits ultimately lead to a more organized and productive environment for business operations.

-

Is there a mobile app for managing form 20s with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that enables users to manage their form 20s on the go. This allows for flexibility and accessibility, ensuring that you can send and eSign important documents anytime, anywhere.

Get more for Alabama Form 20s

Find out other Alabama Form 20s

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer