Hw 3 Form

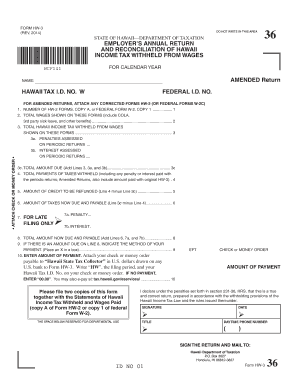

What is the Hw 3?

The Hw 3 is a specific form used primarily for tax purposes in the United States. It is essential for individuals and businesses to report certain types of income and deductions accurately. This form is particularly relevant for taxpayers who are self-employed or have specific income sources that require detailed reporting. Understanding the purpose of the Hw 3 is crucial for ensuring compliance with IRS regulations and avoiding potential penalties.

How to use the Hw 3

Using the Hw 3 involves several steps to ensure that all information is accurately reported. First, gather all necessary documentation, including income statements and receipts for deductions. Next, fill out the form with precise details, ensuring that all entries align with the supporting documents. After completing the form, review it for accuracy before submission. Utilizing digital tools can simplify this process, allowing for easy corrections and secure submission.

Steps to complete the Hw 3

Completing the Hw 3 requires careful attention to detail. Follow these steps:

- Gather all relevant documents, such as W-2s and 1099s.

- Fill in your personal information, including your Social Security number.

- Report all income accurately, ensuring that it matches your documentation.

- List any deductions you are eligible for, providing necessary details.

- Double-check all entries for accuracy before finalizing the form.

- Submit the form electronically or via mail, as per your preference.

Legal use of the Hw 3

The Hw 3 is legally binding when completed and submitted in accordance with IRS guidelines. To ensure its legal standing, it is vital to provide accurate information and to adhere to all filing requirements. Utilizing a reliable digital platform can enhance the legal validity of the form by ensuring compliance with eSignature laws and providing a secure method of submission.

Filing Deadlines / Important Dates

Filing deadlines for the Hw 3 are critical for maintaining compliance with tax regulations. Typically, the form must be submitted by April 15 of the following tax year. However, extensions may be available under certain circumstances. It is important to stay informed about any changes in deadlines or requirements to avoid penalties.

Examples of using the Hw 3

The Hw 3 can be utilized in various scenarios. For instance, self-employed individuals may use the form to report income from freelance work. Additionally, businesses may need to file the Hw 3 to account for specific deductions related to operational costs. Understanding these examples can help taxpayers recognize when and how to use the form effectively.

Quick guide on how to complete hw 3

Complete Hw 3 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Hw 3 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Hw 3 with ease

- Find Hw 3 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight necessary sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Hw 3 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hw 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable form hw 3?

A fillable form hw 3 is a digital form that can be completed and submitted online, making it perfect for various business applications. With airSlate SignNow, you can easily create and manage these forms, ensuring efficient data collection.

-

How does airSlate SignNow enhance the use of a fillable form hw 3?

airSlate SignNow provides a user-friendly interface to create and send fillable form hw 3 documents, streamlining the eSignature process. This enhances productivity, as it eliminates the hassle of physical paperwork and allows for quick electronic submissions.

-

Are there any costs associated with using a fillable form hw 3 on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including the use of fillable form hw 3. Each plan is designed to deliver value while keeping your costs manageable, allowing you to select the option that best fits your budget.

-

What features should I expect with a fillable form hw 3 from airSlate SignNow?

When using a fillable form hw 3 with airSlate SignNow, you can expect features like customizable templates, drag-and-drop form builders, and robust eSignature capabilities. These features ensure that your forms are both functional and user-friendly.

-

Can I integrate fillable form hw 3 with other applications?

Yes, airSlate SignNow supports integration with numerous third-party applications, allowing you to connect your fillable form hw 3 seamlessly with your existing workflows. This capability enhances efficiency and keeps your data synchronized across platforms.

-

Is it easy to track submissions for fillable form hw 3 on airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features for all fillable form hw 3 submissions, enabling you to monitor the status and progress of each document. You receive real-time updates and notifications for a better workflow management experience.

-

What industries can benefit from using fillable form hw 3?

Various industries, including education, healthcare, and real estate, can benefit from using fillable form hw 3 through airSlate SignNow. The flexibility and ease of use make it an ideal solution for any business looking to streamline their document processes.

Get more for Hw 3

- Cover application and change of details formcomple

- Make the following statutory declaration form

- Goal setting form for staff

- Consent form photovideo the university of notre dame australia

- Distribution commissioning test sheet lv kiosk hpc 4dl form

- Remission of debt la trobe form

- Bfairgroundsb u18 consent form

- Www textnow commessaging texting ampamp calling app phone servicetextnow form

Find out other Hw 3

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form