Ct Cert 120 Form

What is the Ct Cert 120 Form

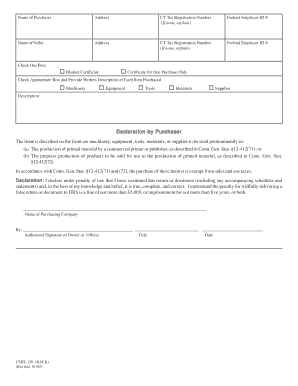

The Ct Cert 120 Form is a certification form used in the state of Connecticut, primarily for tax-related purposes. This form serves as a declaration of certain tax statuses or exemptions, allowing individuals and businesses to communicate their tax obligations effectively. It is essential for ensuring compliance with state tax regulations and is often required when filing various tax documents or applying for specific tax benefits.

How to use the Ct Cert 120 Form

Using the Ct Cert 120 Form involves several steps to ensure accurate and complete submission. Begin by downloading the form from the appropriate state website or obtaining a physical copy from a local tax office. Carefully read the instructions provided with the form to understand the specific information required. Fill out the form with accurate details regarding your tax situation, ensuring all necessary signatures are included. Once completed, submit the form according to the guidelines specified, whether online, by mail, or in person.

Steps to complete the Ct Cert 120 Form

Completing the Ct Cert 120 Form requires attention to detail. Follow these steps for successful submission:

- Download the Ct Cert 120 Form from the official state resources.

- Read the accompanying instructions thoroughly to understand the requirements.

- Fill in your personal or business information accurately, including tax identification numbers.

- Indicate the specific tax status or exemption you are claiming.

- Review the form for completeness and accuracy before signing.

- Submit the form as directed, ensuring it reaches the appropriate tax authority.

Legal use of the Ct Cert 120 Form

The Ct Cert 120 Form holds legal significance in the context of tax compliance in Connecticut. When completed accurately and submitted properly, it can serve as a legal declaration of your tax status. This form is essential for individuals and businesses to avoid penalties associated with incorrect tax filings. Understanding the legal implications of the information provided on this form is crucial for maintaining compliance with state tax laws.

Key elements of the Ct Cert 120 Form

Several key elements must be included in the Ct Cert 120 Form for it to be valid:

- Taxpayer Information: This includes the name, address, and tax identification number of the individual or business.

- Claimed Exemptions: Specific exemptions or statuses must be clearly indicated on the form.

- Signature: A signature is required to validate the information provided, confirming its accuracy.

- Date of Submission: The date when the form is completed and submitted is essential for record-keeping.

Form Submission Methods

The Ct Cert 120 Form can be submitted through various methods, depending on the preferences of the filer and the requirements of the tax authority. Common submission methods include:

- Online Submission: Many tax authorities offer online portals for electronic submission, which can expedite processing.

- Mail: The form can be printed and mailed to the designated tax office, ensuring it is sent with adequate postage.

- In-Person Submission: Filers may also choose to deliver the form directly to a local tax office for immediate processing.

Quick guide on how to complete ct cert 120 form

Effortlessly Prepare Ct Cert 120 Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides all the resources needed to create, modify, and electronically sign your documents quickly without delays. Handle Ct Cert 120 Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Modify and Electronically Sign Ct Cert 120 Form with Ease

- Locate Ct Cert 120 Form and select Get Form to begin.

- Utilize the available tools to fill out your form.

- Highlight important sections of the documents or redact sensitive data using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigating, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Modify and electronically sign Ct Cert 120 Form and ensure outstanding communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct cert 120 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ct Cert 120 Form?

The Ct Cert 120 Form is a document used for signNowing certain business operations and agreements in Connecticut. This form is crucial for businesses to ensure legal compliance and streamline their processes. Using airSlate SignNow, you can create, send, and eSign the Ct Cert 120 Form quickly and securely.

-

How can I electronically sign the Ct Cert 120 Form?

You can electronically sign the Ct Cert 120 Form using airSlate SignNow's intuitive platform. Simply upload your document, add the necessary fields for signatures, and invite signers via email. This eliminates the need for printing and scanning, making the process faster.

-

Is there a cost associated with using airSlate SignNow for the Ct Cert 120 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that provides you with the features necessary to manage documents like the Ct Cert 120 Form effectively. Evaluate our pricing page to find the best option for your business.

-

What features does airSlate SignNow offer for handling the Ct Cert 120 Form?

airSlate SignNow provides features such as template creation, automated reminders, and secure document storage for handling the Ct Cert 120 Form. You can track the signing process in real-time, ensuring all parties stay informed. These features streamline the workflow and enhance efficiency.

-

Can I integrate airSlate SignNow with other applications for the Ct Cert 120 Form?

Absolutely! airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Salesforce, and more. These integrations allow you to manage the Ct Cert 120 Form alongside other key business operations, enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for the Ct Cert 120 Form?

Using airSlate SignNow for the Ct Cert 120 Form offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform's user-friendly interface allows businesses to manage documents efficiently, ensuring compliance with state requirements. Additionally, the electronic signing process reduces paper waste.

-

Is the Ct Cert 120 Form legally binding when signed electronically?

Yes, the Ct Cert 120 Form is legally binding when signed electronically through airSlate SignNow, provided that the process adheres to state laws regarding electronic signatures. airSlate SignNow complies with regulations to ensure the validity of electronic documents. This means you can trust the integrity of your signed forms.

Get more for Ct Cert 120 Form

- Form l paac professional evaluation tmb state tx

- Intro to health care final exam questions flashcardsquizlet form

- Physical therapy referral form template 284773395

- Form 4121 home and community based servicestexas

- New patient packet andrew gottesman md form

- Form 2031 g designation of authorized individuals

- Medicine associates p a form

- Texas medicaidenrollment application facilities v form

Find out other Ct Cert 120 Form

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement