What Does a Mortgagee Clause Look Like Form

What does a mortgagee clause look like?

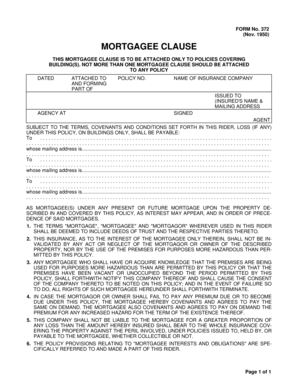

A mortgagee clause is a specific provision included in a mortgage contract that protects the lender's interests in the event of a loss or damage to the property. Typically, it outlines the rights of the mortgagee, or lender, to receive insurance proceeds directly in case of a claim. This clause ensures that the lender can recover their investment before any funds are disbursed to the borrower. The language in a mortgagee clause can vary, but it generally includes the name of the lender, the loan number, and a statement confirming the lender's rights to insurance payouts.

Key elements of a mortgagee clause

Understanding the key elements of a mortgagee clause is essential for both borrowers and lenders. The main components typically include:

- Lender's name: The full legal name of the mortgagee must be clearly stated.

- Loan number: This identifies the specific loan associated with the property.

- Insurance requirements: The clause may specify the type and amount of insurance coverage required.

- Payment instructions: Details on how insurance proceeds should be directed to the lender in case of a claim.

- Rights to policy cancellation: The lender may have the right to cancel the insurance policy if premiums are not paid.

How to use a mortgagee clause

Using a mortgagee clause effectively involves understanding its implications during the life of the mortgage. When obtaining property insurance, borrowers should ensure that the mortgagee clause is included in the policy. This protects the lender's interests and ensures compliance with the mortgage agreement. Additionally, if a claim arises, the borrower must notify the insurance company of the mortgagee clause to ensure that the lender receives any payouts directly, as stipulated in the clause.

Steps to complete a mortgagee clause example

Completing a mortgagee clause correctly is crucial for ensuring that all parties are protected. Here are the steps to follow:

- Review your mortgage agreement to identify the required details for the mortgagee clause.

- Contact your insurance provider to confirm they can include the mortgagee clause in your policy.

- Provide the insurance company with the lender's name, loan number, and any other necessary information.

- Request a copy of the insurance policy with the mortgagee clause included for your records.

- Keep the policy updated, especially if there are changes to the mortgage or lender.

Legal use of a mortgagee clause

The legal use of a mortgagee clause is governed by state laws and the terms of the mortgage agreement. It is essential for borrowers to understand their rights and obligations under the clause. In many cases, the mortgagee clause is a requirement for obtaining financing, as lenders want to ensure their investment is protected. Failure to comply with the terms of the mortgagee clause can lead to complications, such as the lender not receiving insurance payouts in the event of a loss.

Examples of using a mortgagee clause

Examples of how a mortgagee clause is utilized can provide clarity on its importance. For instance, if a homeowner experiences a fire that damages their property, the insurance company must be notified of the mortgagee clause. This ensures that any insurance payout goes directly to the lender to cover the outstanding mortgage balance. Another example is when a borrower refinances their mortgage; they must ensure that the new lender's name is updated in the mortgagee clause of their insurance policy.

Quick guide on how to complete what does a mortgagee clause look like

Effortlessly Prepare What Does A Mortgagee Clause Look Like on Any Device

Digital document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any holdups. Handle What Does A Mortgagee Clause Look Like on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign What Does A Mortgagee Clause Look Like with Ease

- Locate What Does A Mortgagee Clause Look Like and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, the hassle of searching for forms, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign What Does A Mortgagee Clause Look Like to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what does a mortgagee clause look like

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mortgage clause in a document?

A mortgage clause is a specific provision that outlines the obligations and rights of the parties involved in a mortgage agreement. It ensures that the lender can take appropriate action in case of default or bsignNow of the contract. Understanding the mortgage clause is crucial for both lenders and borrowers to navigate their responsibilities effectively.

-

How can airSlate SignNow help with mortgage clauses?

airSlate SignNow simplifies the process of sending and signing documents that include mortgage clauses. Our platform allows you to easily create, modify, and securely eSign mortgage documents, ensuring compliance and streamlined communication. This efficiency minimizes errors and keeps your transactions moving smoothly.

-

Are there any costs associated with using airSlate SignNow for mortgage documents?

Yes, airSlate SignNow offers flexible pricing plans designed to fit various business needs. You can choose a plan that best suits your volume of transactions involving mortgage clauses, making it a cost-effective option for managing documentation. You’ll gain access to all essential features, ensuring you can handle mortgage-related paperwork efficiently.

-

What features does airSlate SignNow offer for managing mortgage clauses?

airSlate SignNow provides features like customizable templates, robust eSignature capabilities, and secure document storage specifically for mortgage clauses. You can track the status of documents in real-time and ensure that all parties are notified promptly. This enhances the overall efficiency of managing mortgage-related documentation.

-

Is airSlate SignNow secure for handling mortgage clauses?

Absolutely! Security is a top priority at airSlate SignNow. We implement advanced encryption and compliance with industry standards to protect all documents containing mortgage clauses. You can confidently manage sensitive information, knowing that your data is safe from unauthorized access.

-

Can airSlate SignNow integrate with other tools for managing mortgage documents?

Yes, airSlate SignNow integrates seamlessly with various CRM, ERP, and document management systems. This allows you to incorporate mortgage clause management into your existing workflows without disruption. The integration enhances productivity and minimizes the time spent on administrative tasks.

-

What are the benefits of using airSlate SignNow for mortgage clauses?

Using airSlate SignNow for mortgage clauses offers numerous benefits including reduced processing time, improved accuracy, and enhanced compliance. The ease of eSigning allows for quicker transaction completion, which is vital in the fast-paced mortgage industry. Overall, it simplifies the document management process signNowly.

Get more for What Does A Mortgagee Clause Look Like

- Individual absence and lateness record individual form

- Registration concession application queensland government support transport qld gov form

- Quarterly report form doh 5012 new york state health ny

- Scouts honor pdf form

- Asthmaactionplan ehr doc form

- Medical records authorization form english 102022 pdf

- Statement of claim for members and dependents form

- Birth certificates tucson arizona az form

Find out other What Does A Mortgagee Clause Look Like

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free