760 Ilcs 5 8 5 Form

What is the 760 ILCS 5 8 5?

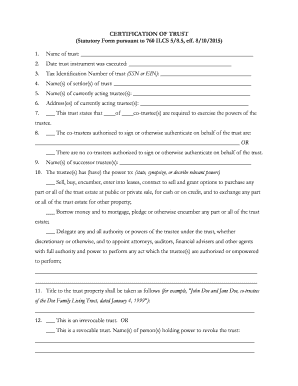

The 760 ILCS 5 8 5 is a legal form used in the state of Illinois, primarily concerning the administration of trusts and estates. This form outlines specific requirements and procedures that must be followed to ensure compliance with state laws regarding the management and distribution of trust assets. Understanding this form is essential for trustees, beneficiaries, and legal professionals involved in estate planning and trust administration.

How to use the 760 ILCS 5 8 5

Using the 760 ILCS 5 8 5 involves several steps that ensure the document is filled out correctly and legally binding. First, individuals must gather all necessary information related to the trust or estate, including details about the assets, beneficiaries, and any relevant legal documents. Once the information is compiled, the form can be completed, ensuring that all sections are filled out accurately. It is advisable to consult with a legal professional to confirm that the form meets all legal requirements before submission.

Key elements of the 760 ILCS 5 8 5

The key elements of the 760 ILCS 5 8 5 include the identification of the trust, the names and addresses of the trustees and beneficiaries, and a clear description of the assets involved. Additionally, the form requires specific declarations regarding the management of the trust and any conditions that may affect the distribution of assets. Understanding these elements is crucial for ensuring that the form is completed correctly and that the intentions of the trust creator are honored.

Steps to complete the 760 ILCS 5 8 5

Completing the 760 ILCS 5 8 5 involves a systematic approach:

- Gather all relevant documents related to the trust or estate.

- Identify all parties involved, including trustees and beneficiaries.

- Fill out the form accurately, ensuring all required information is provided.

- Review the completed form for any errors or omissions.

- Consult with a legal professional if necessary to ensure compliance.

- Submit the form according to the specified submission methods.

Legal use of the 760 ILCS 5 8 5

The legal use of the 760 ILCS 5 8 5 is governed by Illinois state law, which outlines the requirements for valid trust administration. This form must be executed in accordance with the Illinois Trust Code to be considered legally binding. Proper execution includes obtaining the necessary signatures and, in some cases, notarization. Failure to adhere to these legal requirements can result in challenges to the validity of the trust and potential disputes among beneficiaries.

Who Issues the Form

The 760 ILCS 5 8 5 is not issued by a specific agency but is a statutory form derived from Illinois law. It is typically utilized by individuals, attorneys, and financial professionals involved in trust and estate management. While the form itself does not have an issuing authority, it must comply with the regulations set forth by the Illinois General Assembly to ensure its legal standing.

Quick guide on how to complete 760 ilcs 5 8 5

Complete 760 Ilcs 5 8 5 seamlessly on any device

Digital document management has become favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can obtain the correct version and securely save it online. airSlate SignNow equips you with all the resources necessary to craft, modify, and electronically sign your documents promptly without delays. Manage 760 Ilcs 5 8 5 on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign 760 Ilcs 5 8 5 effortlessly

- Locate 760 Ilcs 5 8 5 and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or redact confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you prefer. Modify and eSign 760 Ilcs 5 8 5 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 760 ilcs 5 8 5

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the relevance of 760 ilcs 5 8 5 in electronic signatures?

760 ilcs 5 8 5 pertains to the legality of electronic signatures, ensuring they hold the same weight as traditional signatures. With airSlate SignNow, you can confidently eSign documents, knowing they comply with the stipulations set forth in 760 ilcs 5 8 5.

-

How does airSlate SignNow ensure compliance with 760 ilcs 5 8 5?

airSlate SignNow adheres to the requirements outlined in 760 ilcs 5 8 5 by implementing robust security measures and providing audit trails for every signed document. This guarantees that all signatures are verified and legally binding.

-

What are the pricing options for airSlate SignNow services?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Each plan is designed to provide access to features that ensure compliance with legal standards such as 760 ilcs 5 8 5, while remaining cost-effective.

-

What features does airSlate SignNow provide to users?

airSlate SignNow includes features such as document templates, real-time tracking, and customizable workflows. These features support compliance with legal requirements like 760 ilcs 5 8 5, allowing for seamless document management and signing.

-

How can airSlate SignNow improve business operations?

By using airSlate SignNow, businesses can streamline their document signing process, leading to increased efficiency and reduced turnaround times. This improvement is especially important in light of regulations like 760 ilcs 5 8 5, which govern the use of electronic signatures.

-

Are integrations available to enhance functionality with airSlate SignNow?

Yes, airSlate SignNow offers integrations with popular tools and platforms, enhancing document management and signing processes. Integrating these tools ensures compliance with 760 ilcs 5 8 5, making it easier for businesses to maintain legal standards.

-

What benefits does airSlate SignNow provide for small businesses?

Small businesses using airSlate SignNow gain access to a cost-effective solution that simplifies eSigning while maintaining compliance with regulations like 760 ilcs 5 8 5. This allows them to focus on growth while assuring clients of their legal compliance.

Get more for 760 Ilcs 5 8 5

- Office of the attorney general state of mississippi 2017 form

- Come now the plaintiff form

- The differences between criminal court and civil court form

- Chapter 3 injunction california code of civil procedure form

- Court of chancery of the state of delaware may form

- Smith v statefindlaw form

- What does next friend or anf mean in legal documents form

- Circuit court rankin county mississippi form

Find out other 760 Ilcs 5 8 5

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed