Form 4606

What is the Form 4606

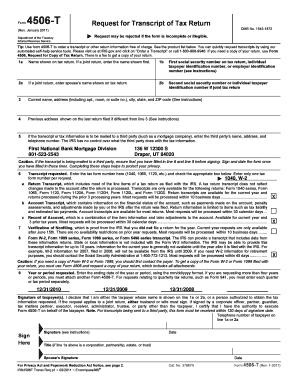

The Form 4606 is a document used primarily for tax purposes in the United States. It is often associated with specific reporting requirements that taxpayers must fulfill. This form serves as a means for individuals or businesses to report certain financial information to the IRS, ensuring compliance with federal tax regulations. Understanding the purpose of Form 4606 is essential for accurate tax filing and maintaining legal compliance.

How to use the Form 4606

Using Form 4606 involves several steps to ensure that the information provided is accurate and complete. First, gather all necessary financial documents and records that pertain to the information required on the form. Next, carefully fill out the form, ensuring that all sections are completed according to the guidelines provided by the IRS. After completing the form, review it for any errors or omissions before submission. It is crucial to retain a copy of the completed form for your records.

Steps to complete the Form 4606

Completing Form 4606 requires attention to detail. Follow these steps:

- Obtain the latest version of Form 4606 from the IRS website or authorized sources.

- Read the instructions carefully to understand the requirements for each section.

- Fill in your personal or business information accurately, including your name, address, and taxpayer identification number.

- Provide the necessary financial data as required by the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 4606

The legal use of Form 4606 is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted within the designated timeframes. Failure to comply with these requirements can result in penalties or legal repercussions. It is essential to ensure that the information provided is truthful and complete, as any discrepancies may lead to audits or further investigation by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for Form 4606 are critical to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, specific circumstances may alter these deadlines, such as extensions granted by the IRS. It is advisable to stay informed about any changes to filing dates to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

Form 4606 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file the form online using the IRS e-file system, which offers a convenient and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate IRS address, as specified in the instructions. In-person submission is also an option at designated IRS offices for those who prefer direct interaction.

Quick guide on how to complete form 4606

Complete Form 4606 effortlessly on any device

Digital document management has gained traction with companies and individuals alike. It serves as an exceptional environmentally friendly alternative to traditional printed and signed materials, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 4606 on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to adjust and eSign Form 4606 with ease

- Locate Form 4606 and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent parts of your documents or obscure sensitive information using tools that airSlate SignNow provides for that specific purpose.

- Create your eSignature with the Sign feature, which only takes a moment and holds the same legal significance as a traditional ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you prefer. Modify and eSign Form 4606 to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4606

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4606 and how can airSlate SignNow help with it?

Form 4606 is a specific document used for various regulatory purposes. airSlate SignNow provides an easy-to-use platform for you to send, sign, and manage form 4606 efficiently. With our solution, you can streamline the signing process and ensure compliance with all necessary regulations.

-

Is there a cost associated with using airSlate SignNow for form 4606?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solutions ensure that you can manage your form 4606 and other documents without breaking the bank. Explore our pricing options to find the right fit for your organization.

-

Can I customize form 4606 templates using airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and customize templates for form 4606 to fit your specific requirements. You can easily add fields, instructions, and branding elements to ensure that your document meets your unique standards.

-

How does airSlate SignNow ensure the security of my form 4606 documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption methods and comply with industry standards to protect your form 4606 and other sensitive documents. You can sign with confidence knowing that your information is secure.

-

What integrations does airSlate SignNow offer for form 4606?

airSlate SignNow seamlessly integrates with a variety of applications to enhance your document management workflow. Whether you’re using CRMs, cloud storage services, or other business tools, integrating your form 4606 capabilities is straightforward and efficient.

-

Can I track the status of form 4606 once it’s sent for signing?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your form 4606 throughout the signing process. You will receive notifications and updates, ensuring you are always informed about your document’s progress.

-

Is airSlate SignNow compliant with legal standards for form 4606?

Yes, airSlate SignNow complies with all legal standards necessary for document signing, including form 4606. Our platform ensures that your signed documents are legally binding and acknowledged, giving you peace of mind in your business dealings.

Get more for Form 4606

- Form 540 resident income tax return

- Small claims form 3 11 appearance and answer of d

- New york state disability claim new york state disability claim form

- Microsoft word bmv 4443 10 20 form

- Sf 424 family grants gov form

- Imm 5690 e document checklist permanent residence provincial nominee class and quebec skilled workers imm5690e pdf form

- Assignment of ownwership and attestation of identity for the transfer of ownership of an e titled motor vehicle off road vehi form

- Drivers under 45 must fill in the medical question form

Find out other Form 4606

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document