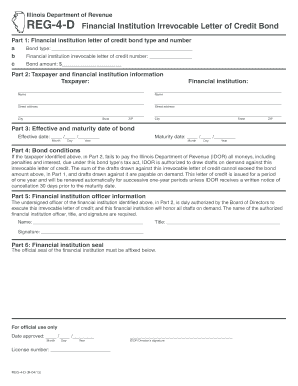

Illinois Department of Revenue Reg 4 D Form

What is the Illinois Department of Revenue Reg 4 D Form

The Illinois Department of Revenue Reg 4 D Form is a specific document used for various tax-related purposes within the state of Illinois. This form is primarily associated with the state's tax regulations, particularly concerning the taxation of certain types of income and transactions. It is essential for taxpayers to understand the purpose and implications of this form to ensure compliance with state tax laws.

How to use the Illinois Department of Revenue Reg 4 D Form

Utilizing the Illinois Department of Revenue Reg 4 D Form involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary information related to their income and any applicable deductions or credits. After obtaining the form, individuals should carefully fill it out, ensuring that all fields are completed accurately. Once completed, the form can be submitted either electronically or via traditional mail, depending on the specific instructions provided by the Illinois Department of Revenue.

Steps to complete the Illinois Department of Revenue Reg 4 D Form

Completing the Illinois Department of Revenue Reg 4 D Form requires attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the form from the Illinois Department of Revenue website.

- Read the instructions carefully to understand the requirements for filling out the form.

- Gather all necessary documentation, including income statements and prior tax returns.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the form according to the provided guidelines, either online or by mail.

Legal use of the Illinois Department of Revenue Reg 4 D Form

The Illinois Department of Revenue Reg 4 D Form is legally binding when completed and submitted according to state guidelines. It is crucial for taxpayers to adhere to the legal requirements associated with this form to avoid potential penalties. The form serves as a formal declaration of income and tax obligations, and improper use or submission can lead to legal repercussions.

Key elements of the Illinois Department of Revenue Reg 4 D Form

Understanding the key elements of the Illinois Department of Revenue Reg 4 D Form is vital for accurate completion. Important components include:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Income Reporting: Sections dedicated to reporting various types of income.

- Deductions and Credits: Areas to claim any applicable tax deductions or credits.

- Signature Section: A place for the taxpayer's signature, affirming the accuracy of the information provided.

Form Submission Methods

The Illinois Department of Revenue Reg 4 D Form can be submitted through multiple methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to submit the form electronically through the Illinois Department of Revenue's online portal.

- Mail: The form can also be printed and mailed to the appropriate address as specified in the instructions.

- In-Person: Some individuals may choose to deliver the form in person at designated state offices.

Quick guide on how to complete illinois department of revenue reg 4 d form

Complete Illinois Department Of Revenue Reg 4 D Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Manage Illinois Department Of Revenue Reg 4 D Form on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Illinois Department Of Revenue Reg 4 D Form effortlessly

- Obtain Illinois Department Of Revenue Reg 4 D Form and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow caters to all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Illinois Department Of Revenue Reg 4 D Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue reg 4 d form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a letter from Illinois Department of Revenue?

A letter from the Illinois Department of Revenue is an official communication that provides information regarding your tax obligations, assessments, or any necessary actions you must take. Receiving this letter indicates that you need to address specific tax matters promptly to avoid penalties.

-

How can airSlate SignNow help me manage letters from the Illinois Department of Revenue?

airSlate SignNow allows you to easily send and eSign responses or documents related to your letter from the Illinois Department of Revenue. This streamlines the process, ensuring that your responses are sent promptly and securely.

-

Is there a cost associated with using airSlate SignNow to manage my letter from the Illinois Department of Revenue?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. You can choose a plan that suits your requirements for handling documents, including those related to your letter from the Illinois Department of Revenue.

-

What features does airSlate SignNow provide that assist with letters from the Illinois Department of Revenue?

airSlate SignNow offers features such as document templates, automated workflows, and secure eSigning that enhance your experience when dealing with letters from the Illinois Department of Revenue. These tools help you stay organized and compliant with tax requirements.

-

Can I integrate airSlate SignNow with other software to handle my letter from the Illinois Department of Revenue?

Absolutely! airSlate SignNow integrates seamlessly with various CRM, accounting, and document management systems, making it easier to manage your letter from the Illinois Department of Revenue alongside your other important business processes.

-

What are the benefits of using airSlate SignNow for tax-related documentation like a letter from the Illinois Department of Revenue?

Using airSlate SignNow for tax-related documentation streamlines your processes, reduces turnaround times, and improves compliance. This is vital for managing letters from the Illinois Department of Revenue efficiently, ensuring you meet deadlines and obligations.

-

How secure is airSlate SignNow when dealing with sensitive documents like letters from the Illinois Department of Revenue?

Security is a top priority for airSlate SignNow. The platform utilizes bank-level encryption and complies with industry standards, ensuring that any letter from the Illinois Department of Revenue and your sensitive data remain protected during transmission and storage.

Get more for Illinois Department Of Revenue Reg 4 D Form

- Service book pdf form

- Sealed bid form agriculture leases commissioners of the land office

- Chilln form no 32aoriginalstate bank of pakistanc

- Welcome packet business information wisconsin gov

- Osu expend subcode state object code form

- Affidavit of test of casing in well form

- Guardian notice and proof of claim for disability benefits form

- Sealed bid form for surface lease lease no

Find out other Illinois Department Of Revenue Reg 4 D Form

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast