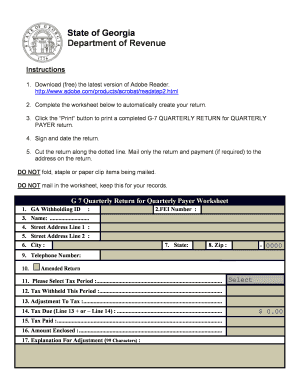

G 7 Form

What is the G 7 Form?

The G 7 Form, also known as the G 7 quarterly return, is a document used primarily for reporting and remitting certain taxes. This form is essential for businesses and organizations that need to report their financial activities to the appropriate tax authorities. It is designed to ensure compliance with federal and state tax regulations, providing a standardized method for reporting income, expenses, and other relevant financial information.

How to use the G 7 Form

Using the G 7 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form by entering the required information, ensuring that all figures are accurate and complete. After completing the form, review it for any errors before submission. Finally, submit the form through the designated method, whether online, by mail, or in person, depending on the requirements set by the tax authority.

Steps to complete the G 7 Form

Completing the G 7 Form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, including previous returns and supporting documentation.

- Fill in the form with accurate figures, ensuring all calculations are correct.

- Double-check all entries for completeness and accuracy.

- Sign and date the form, as required.

- Submit the form by the deadline specified by the tax authority.

Legal use of the G 7 Form

The G 7 Form is legally binding when filled out and submitted according to the guidelines provided by the relevant tax authority. It is crucial to adhere to all legal requirements to ensure that the form is accepted. This includes using accurate information and following the prescribed submission methods. Failure to comply with these regulations may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the G 7 Form vary depending on the specific tax period being reported. It is important to stay informed about these dates to avoid late submissions. Generally, quarterly returns must be filed within a specific timeframe after the end of each quarter. Mark your calendar with these important dates to ensure timely compliance.

Form Submission Methods

The G 7 Form can be submitted through various methods, depending on the preferences of the tax authority. Common submission methods include:

- Online submission through the tax authority's official website.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at local tax offices or designated locations.

Choosing the right submission method can help streamline the process and ensure that your form is received on time.

Quick guide on how to complete g 7 form 74174348

Complete G 7 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can locate the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage G 7 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign G 7 Form without hassle

- Find G 7 Form and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize crucial sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that use.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional hand-signed signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form: via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign G 7 Form and ensure excellent communication at any point of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the g 7 form 74174348

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the g 7 form 2018 and why is it important?

The g 7 form 2018 is a crucial document for organizations that need to report financial information and compliance. Its importance lies in its ability to ensure transparency and accountability in financial dealings, making it essential for proper governance and operations.

-

How can airSlate SignNow facilitate the completion of the g 7 form 2018?

airSlate SignNow simplifies the process of completing the g 7 form 2018 by providing an easy-to-use interface for document management. Users can quickly fill out the form, eSign, and send it securely, making the process faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for the g 7 form 2018?

Yes, there is a pricing structure associated with airSlate SignNow, though it remains cost-effective for businesses. Different plans are available that cater to varied needs, ensuring that you can handle the g 7 form 2018 without breaking the bank.

-

What features does airSlate SignNow offer for managing the g 7 form 2018?

airSlate SignNow offers features such as eSignature capabilities, document templates, workflow automation, and secure cloud storage, all tailored to streamline the management of the g 7 form 2018. These tools enhance user efficiency and form compliance.

-

Can I integrate airSlate SignNow with other software for the g 7 form 2018?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms such as Google Drive, Dropbox, and CRM systems. This integration allows for easy access and efficient management of the g 7 form 2018 across different applications.

-

What are the benefits of using airSlate SignNow for the g 7 form 2018?

Using airSlate SignNow for the g 7 form 2018 offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. Additionally, the easy eSigning process expedites document turnaround times, allowing businesses to focus on their core operations.

-

Is airSlate SignNow secure for handling the g 7 form 2018?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your data while handling the g 7 form 2018 is protected. The platform employs advanced encryption and authentication measures to safeguard your documents and sensitive information.

Get more for G 7 Form

Find out other G 7 Form

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple