Sentry 401k Withdrawal Form

What is the Sentry 401k Withdrawal Form

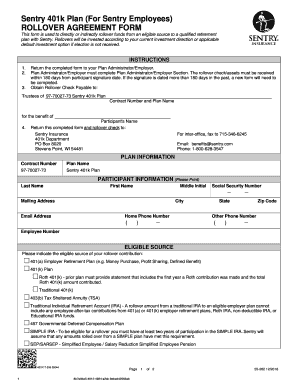

The Sentry 401k withdrawal form is a crucial document that allows participants in the Sentry retirement 401k plan to request the withdrawal of funds from their retirement accounts. This form is designed to ensure that all withdrawals are processed in compliance with federal regulations and the specific policies of the Sentry retirement plan. Understanding the purpose of this form is essential for anyone considering accessing their retirement savings.

How to Obtain the Sentry 401k Withdrawal Form

To obtain the Sentry 401k withdrawal form, participants can visit the official Sentry website or contact their plan administrator directly. The form is typically available in a downloadable format, allowing users to print it for completion. Additionally, some employers may provide the form through their human resources department, ensuring that employees have easy access to the necessary documentation.

Steps to Complete the Sentry 401k Withdrawal Form

Completing the Sentry 401k withdrawal form involves several key steps:

- Personal Information: Fill in your name, address, and contact details accurately.

- Withdrawal Amount: Specify the amount you wish to withdraw from your 401k account.

- Reason for Withdrawal: Indicate the reason for your withdrawal, as this may affect the tax implications.

- Signature: Sign and date the form to validate your request.

Ensure that all information is correct to avoid delays in processing your request.

Legal Use of the Sentry 401k Withdrawal Form

The Sentry 401k withdrawal form must be completed and submitted in accordance with legal guidelines to ensure its validity. This includes adhering to the Employee Retirement Income Security Act (ERISA) regulations and any specific requirements set forth by the Sentry retirement plan. Proper execution of the form is essential for the withdrawal to be legally recognized and processed without issues.

Required Documents for the Sentry 401k Withdrawal

When submitting the Sentry 401k withdrawal form, participants may need to provide supporting documentation. Commonly required documents include:

- A copy of a government-issued ID.

- Proof of the reason for withdrawal, such as medical bills or financial hardship documentation.

- Any additional forms or documentation specified by the plan administrator.

Having these documents ready can facilitate a smoother withdrawal process.

Form Submission Methods

The Sentry 401k withdrawal form can typically be submitted through various methods, including:

- Online Submission: Many plans allow for digital submission through a secure portal.

- Mail: Participants can send the completed form via postal service to the designated address provided by Sentry.

- In-Person: Some individuals may prefer to deliver the form directly to their plan administrator or human resources department.

Choosing the right submission method can help ensure timely processing of your withdrawal request.

Quick guide on how to complete sentry 401k withdrawal form

Manage Sentry 401k Withdrawal Form effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, edit, and eSign your documents quickly and efficiently. Handle Sentry 401k Withdrawal Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to edit and eSign Sentry 401k Withdrawal Form with ease

- Find Sentry 401k Withdrawal Form and click on Get Form to begin.

- Utilize the resources we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Edit and eSign Sentry 401k Withdrawal Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sentry 401k withdrawal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Sentry 401k withdrawal form?

The Sentry 401k withdrawal form is used by individuals to request funds from their 401k retirement accounts. This form ensures that your withdrawal request is processed in compliance with regulations and helps you make informed decisions regarding your retirement savings.

-

How can I access the Sentry 401k withdrawal form?

You can easily access the Sentry 401k withdrawal form through the airSlate SignNow platform. Simply log in, navigate to the relevant section, and download the form to begin your withdrawal process.

-

Are there any fees associated with processing the Sentry 401k withdrawal form?

The fees for processing the Sentry 401k withdrawal form may vary based on your plan and provider. It’s essential to check with your 401k plan administrator or review your plan’s documentation for any specific charges that may apply.

-

Can I fill out the Sentry 401k withdrawal form electronically?

Yes, the airSlate SignNow platform allows you to fill out the Sentry 401k withdrawal form electronically. This feature ensures a user-friendly experience, enabling you to complete and sign the document digitally, making the process quicker and more efficient.

-

What information do I need to complete the Sentry 401k withdrawal form?

To complete the Sentry 401k withdrawal form, you will typically need personal identification information, account details, and the amount you wish to withdraw. Having your plan identification number on hand can also streamline the process.

-

How long does it take to process the Sentry 401k withdrawal form?

The processing time for the Sentry 401k withdrawal form can range from a few days to several weeks, depending on your plan's policies and the completeness of your submission. It's advisable to submit your request well in advance to ensure timely access to your funds.

-

What are the tax implications of using the Sentry 401k withdrawal form?

Withdrawing funds using the Sentry 401k withdrawal form may have tax consequences. Generally, withdrawals are subject to income tax, and you might incur an early withdrawal penalty if you are under the age of 59½. Consulting a tax advisor is recommended to understand the implications.

Get more for Sentry 401k Withdrawal Form

Find out other Sentry 401k Withdrawal Form

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order