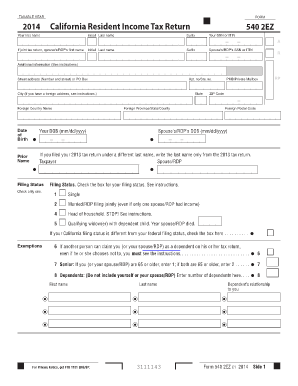

California Tax Return Form

What is the California Tax Return

The California tax return is a document that residents and certain non-residents use to report their income to the California Franchise Tax Board (FTB). It outlines income earned, deductions claimed, and taxes owed or refunds due. The primary form used for this purpose is the 540 form for residents, while non-residents typically use the 540NR form. Understanding the California tax return is essential for compliance with state tax laws and ensuring accurate reporting of financial information.

Steps to Complete the California Tax Return

Completing the California tax return involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and eligibility for certain credits.

- Calculate your total income by adding all sources of income.

- Claim deductions and credits that you qualify for, which can reduce your taxable income.

- Complete the appropriate tax form, ensuring all information is accurate and complete.

- Review your return for errors and ensure all required signatures are included.

- Submit your tax return electronically or by mail before the filing deadline.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the California tax return to avoid penalties. Typically, the deadline for filing is April 15 of each year, aligning with federal tax deadlines. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension, which allows for additional time to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To successfully complete the California tax return, specific documents are required. These include:

- W-2 forms from employers showing annual wages and taxes withheld.

- 1099 forms for other income sources, such as freelance work or interest income.

- Records of any deductions, such as mortgage interest statements or medical expenses.

- Identification information, including Social Security numbers for all dependents.

Legal Use of the California Tax Return

The California tax return serves as a legally binding document that must be filed accurately and truthfully. Misrepresentation or failure to file can lead to penalties, including fines and interest on unpaid taxes. The information provided on the return is used by the California Franchise Tax Board to assess tax liability and ensure compliance with state tax laws. It is essential to maintain records and documentation to support the information reported on the return.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting their California tax return. The most common methods include:

- Online: E-filing is the fastest and most efficient way to submit your return. Many taxpayers choose this method for its convenience.

- Mail: Taxpayers can print their completed forms and mail them to the appropriate address provided by the California Franchise Tax Board.

- In-Person: Some taxpayers may prefer to file in person at designated tax offices or during tax assistance events.

Quick guide on how to complete california tax return

Complete California Tax Return effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without any delays. Manage California Tax Return on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to alter and eSign California Tax Return with ease

- Locate California Tax Return and click Get Form to begin.

- Utilize the tools we provide to submit your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about missing or lost documents, lengthy form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Alter and eSign California Tax Return and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California state income tax?

California state income tax is a tax imposed on the income of California residents by the state's Franchise Tax Board. It has a progressive tax rate ranging from 1% to 13.3%, depending on the income level. Understanding how this tax works is crucial for accurate financial planning and compliance.

-

How can airSlate SignNow help with California state income tax documentation?

airSlate SignNow provides an efficient way to sign and send important tax documents related to California state income tax electronically. Using our platform, you can quickly get signatures on tax forms, reducing the time spent on paperwork. This simplifies the overall process, ensuring you meet filing deadlines without hassle.

-

What features does airSlate SignNow offer for California state income tax preparers?

With airSlate SignNow, tax preparers can leverage features like document templates, real-time tracking of signed documents, and mobile compatibility. These tools enhance productivity, allowing tax professionals to focus more on their clients’ needs related to California state income tax rather than administrative tasks. Our solution is designed to streamline workflows effectively.

-

Is airSlate SignNow cost-effective for handling California state income tax forms?

Yes, airSlate SignNow offers affordable pricing plans that cater to various business sizes and needs, making it a cost-effective choice for managing California state income tax forms. Our solutions help reduce costs associated with paper and ink while enhancing productivity. Investing in our eSigning services can lead to signNow savings over time.

-

What integrations does airSlate SignNow support for tax-related services?

airSlate SignNow seamlessly integrates with numerous platforms such as Google Drive, Salesforce, and accounting software that assist with California state income tax preparation. These integrations allow for easy access and sharing of tax documents without switching platforms. This interoperability helps provide a streamlined experience for users managing tax-related documents.

-

What are the benefits of using airSlate SignNow for California state income tax submissions?

Using airSlate SignNow for California state income tax submissions ensures documents are signed quickly and securely. Our platform reduces the turnaround time for signatures, thus speeding up the submission process. Additionally, our secure storage features protect sensitive information related to tax filings.

-

Can individuals use airSlate SignNow for personal California state income tax filings?

Absolutely! Individuals can use airSlate SignNow to facilitate the signing of their personal California state income tax documents with ease. Our user-friendly interface allows anyone, regardless of technical ability, to prepare and send important tax forms electronically, streamlining the filing process.

Get more for California Tax Return

- Gypsy moth customer declaration kit 1 800 pack rat form

- Table of contents imperial county form

- Assignment submission form

- Traffic controller report form final worksafe victoria

- Application for special occasion liquor license gov ns form

- Christian funeral pre planning worksheet form

- Doc code pgea form

- Renew business license form

Find out other California Tax Return

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later