Where Can I Download Fbar Form

What is the FBAR Form?

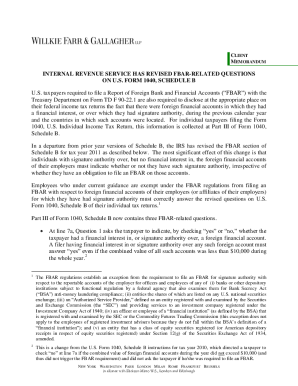

The FBAR form, officially known as FinCEN Form 114, is a critical document that U.S. citizens, residents, and entities must file if they have financial accounts outside the United States that exceed a total value of $10,000 at any time during the calendar year. This form is used to report foreign bank and financial accounts to the Financial Crimes Enforcement Network (FinCEN). The purpose of the FBAR is to prevent money laundering and tax evasion by ensuring that U.S. taxpayers disclose their foreign financial interests.

How to Obtain the FBAR Form

To download the FBAR form, you can visit the official FinCEN website or access the form directly through various government resources. The FBAR is available in PDF format, allowing users to easily download and print it for completion. Ensure you have the latest version of the form to comply with current regulations. You can also find instructions on how to fill out the form alongside the downloadable PDF.

Steps to Complete the FBAR Form

Completing the FBAR form involves several key steps:

- Gather information: Collect details about your foreign bank accounts, including account numbers, bank names, and addresses.

- Determine account values: Calculate the maximum value of each account during the reporting period.

- Fill out the form: Enter the required information accurately in the downloaded FBAR form PDF.

- Review: Double-check your entries for accuracy to avoid errors that could lead to penalties.

- Submit: File the completed form electronically through the BSA E-Filing System.

Legal Use of the FBAR Form

The FBAR form is legally required under the Bank Secrecy Act. Failing to file the FBAR or providing false information can lead to severe penalties, including civil fines and potential criminal charges. Understanding the legal implications of the FBAR is essential for compliance and to avoid legal repercussions. It is advisable to consult with a tax professional if you have any uncertainties regarding your filing obligations.

Filing Deadlines for the FBAR

The deadline for filing the FBAR is April 15 of the year following the calendar year being reported. However, an automatic extension is available, extending the deadline to October 15. It is crucial to adhere to these deadlines to avoid penalties. If you miss the deadline, you may face significant fines, so timely submission is essential.

Penalties for Non-Compliance with FBAR Requirements

Non-compliance with FBAR filing requirements can result in severe consequences. Civil penalties can reach up to $10,000 for non-willful violations, while willful violations can incur penalties of up to $100,000 or 50% of the account balance, whichever is greater. Understanding these penalties emphasizes the importance of filing the FBAR accurately and on time to avoid financial repercussions.

Quick guide on how to complete where can i download fbar form

Complete Where Can I Download Fbar Form effortlessly on any gadget

Digital document administration has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without holdups. Manage Where Can I Download Fbar Form on any gadget with airSlate SignNow Android or iOS applications and ease any document-related process today.

The simplest method to alter and eSign Where Can I Download Fbar Form with ease

- Locate Where Can I Download Fbar Form and click on Get Form to initiate the process.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure confidential details using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your needs in document management within a few clicks from any device you prefer. Modify and eSign Where Can I Download Fbar Form and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the where can i download fbar form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FBAR form and why do I need to download it?

The FBAR form, or Report of Foreign Bank and Financial Accounts, is required for U.S. taxpayers with foreign accounts exceeding $10,000. You need to download the FBAR form to report your foreign financial accounts to the U.S. government and avoid potential penalties for noncompliance.

-

How can I easily download the FBAR form using airSlate SignNow?

To download the FBAR form using airSlate SignNow, simply navigate to our secure document library, locate the FBAR form, and click on the download option. Our platform ensures a seamless and user-friendly experience for all your form handling needs.

-

Is there a cost associated with downloading the FBAR form through airSlate SignNow?

The ability to download the FBAR form is part of our service offerings, which come with various pricing plans. Explore our plans to find an option that best fits your needs and enjoy the benefits of a cost-effective solution for document signing and management.

-

What features does airSlate SignNow offer for the FBAR form?

airSlate SignNow provides a range of features for the FBAR form including e-signature capabilities, customizable templates, and secure storage. These features ensure that you can efficiently manage your form while maintaining compliance with regulations.

-

How does downloading the FBAR form benefit my business?

By downloading the FBAR form through airSlate SignNow, your business can enhance compliance, streamline the reporting process, and reduce the risk of penalties. Our platform simplifies document management, making it easier to handle critical financial forms.

-

Can I integrate airSlate SignNow with other applications for easier access to the FBAR form?

Yes, airSlate SignNow allows for seamless integrations with various applications, enhancing accessibility to the FBAR form. This means you can manage and download the form directly from your preferred tools, improving workflow efficiency.

-

Are there resources available to help me understand the FBAR form better?

Absolutely! airSlate SignNow offers a wealth of resources, including guides and FAQs, to help you understand how to properly download and fill out the FBAR form. These resources are designed to simplify the process and ensure you meet all filing requirements.

Get more for Where Can I Download Fbar Form

- Oregon state hospital visitor application form

- Fillable va tax form 763 s

- Bldg permitsgreen sheet briny breezes fl brinybreezes form

- Form 794 397348225

- Taxes form

- Town of acton hard drive destruction release form

- Public record request2010 2 township of parsippany form

- Manag director contract template form

Find out other Where Can I Download Fbar Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors