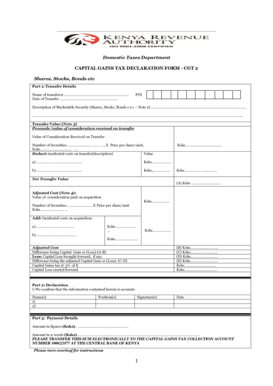

Kra Cgt Return Form

What is the Kra Cgt Return Form

The kra cgt return form is a crucial document used for reporting capital gains tax in the United States. This form is typically required for individuals and entities that have realized capital gains from the sale of assets, such as stocks, real estate, or other investments. Proper completion of this form ensures compliance with federal tax regulations and helps taxpayers accurately report their financial activities to the Internal Revenue Service (IRS).

How to use the Kra Cgt Return Form

Using the kra cgt return form involves several key steps. First, gather all necessary financial documents, including records of asset purchases and sales, to determine your capital gains or losses. Next, fill out the form with accurate information regarding these transactions. Ensure that you include any relevant deductions or exemptions. Finally, review the completed form for accuracy before submission to avoid potential penalties or audits.

Steps to complete the Kra Cgt Return Form

Completing the kra cgt return form requires a systematic approach. Follow these steps:

- Collect documentation of all transactions related to capital assets.

- Calculate total capital gains and losses for the reporting period.

- Fill in the form with accurate personal and financial information.

- Double-check all entries for accuracy and completeness.

- Submit the form electronically or by mail, following the IRS guidelines.

Legal use of the Kra Cgt Return Form

The legal use of the kra cgt return form is essential for ensuring compliance with tax laws. The form must be filled out accurately and submitted by the specified deadlines to avoid legal repercussions. Additionally, it is important to retain copies of the submitted form and supporting documentation in case of future audits or inquiries from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the kra cgt return form are critical for taxpayers to observe. Generally, the form must be submitted by April 15 of the following tax year. However, if you are unable to meet this deadline, you may file for an extension. It is advisable to stay informed about any changes in deadlines that may occur due to legislative updates or IRS announcements.

Required Documents

To complete the kra cgt return form, several documents are required. These typically include:

- Records of asset purchases and sales.

- Statements from brokerage accounts or financial institutions.

- Documentation of any capital losses carried over from previous years.

- Receipts for any related expenses that may be deductible.

Quick guide on how to complete kra cgt return form

Complete Kra Cgt Return Form effortlessly on any gadget

Web-based document management has become favored among corporations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to generate, modify, and eSign your documents quickly without interruptions. Handle Kra Cgt Return Form on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to amend and eSign Kra Cgt Return Form without any hassle

- Obtain Kra Cgt Return Form and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Modify and eSign Kra Cgt Return Form and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kra cgt return form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the kra cgt return form and why is it important?

The kra cgt return form is a crucial document used in tax reporting for capital gains in various jurisdictions. Understanding its requirements helps businesses and individuals accurately report their earnings, thus avoiding possible penalties. Utilizing airSlate SignNow can streamline this process, ensuring that documents related to the kra cgt return form are completed and signed quickly.

-

How can airSlate SignNow help with the kra cgt return form?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning the kra cgt return form. With its robust features, you can easily upload your documents, gather signatures, and maintain compliance. This simplifies your tax preparation process, allowing you to focus on other important aspects of your business.

-

Is there a cost associated with using airSlate SignNow for the kra cgt return form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan provides features that support the efficient management of the kra cgt return form. You can choose a plan based on your document volume and required functionalities, ensuring you receive value for your investment.

-

What key features does airSlate SignNow offer for managing the kra cgt return form?

Key features of airSlate SignNow include customizable templates, automated reminders, and secure eSignature capabilities tailored for the kra cgt return form. These tools help ensure that your document workflows are streamlined and efficient. Additionally, you can track the status of your forms in real time, enhancing accountability and completion rates.

-

How does airSlate SignNow ensure security for the kra cgt return form?

AirSlate SignNow prioritizes security by employing industry-standard encryption and compliance measures for the kra cgt return form. Your documents are protected throughout the signing process, and access is granted only to authorized users. This ensures that sensitive financial information remains confidential and secure.

-

Can I integrate airSlate SignNow with other software for handling the kra cgt return form?

Absolutely! AirSlate SignNow offers seamless integrations with popular business applications, enhancing the efficiency of managing the kra cgt return form. These integrations facilitate smooth workflows, allowing you to use existing tools while benefiting from the eSignature capabilities of airSlate SignNow.

-

What benefits does airSlate SignNow provide for small businesses managing the kra cgt return form?

Small businesses benefit signNowly from using airSlate SignNow for their kra cgt return form management. The platform's efficiency reduces administrative workload, enabling teams to focus on growth instead of paperwork. Additionally, cost-effectiveness ensures that even startups can afford seamless document handling and compliance.

Get more for Kra Cgt Return Form

- Edc 3 081 03 order confirming plan valuing collateral and avoiding liens for use in chapter 13 cases filed on or after 7103 or form

- State program information

- I served a copy of the following documents list documents form

- Three way paternity affidavit kentucky form

- Sample verdict sheet criminal restraintfalse imprisonment judiciary state nj form

- Appropriate strikethroughs must be made and additional information must be given

- Jfd v jd publication version new york law journal form

- Affidavit of compliance with carbon monoxide detector requirement form

Find out other Kra Cgt Return Form

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe