Life Insurance Form

What is the Life Insurance Form

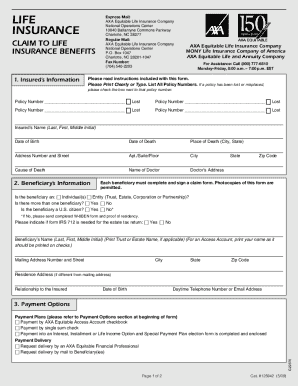

The life insurance form is a crucial document used to initiate the claims process for life insurance policies. This form serves as a formal request for the insurance company to disburse the benefits owed to the beneficiaries upon the policyholder's passing. It typically requires essential details, including the policy number, the insured's information, and the claimant's relationship to the deceased. Understanding the purpose and structure of this form is vital for ensuring a smooth claims process.

How to Use the Life Insurance Form

Using the life insurance form involves several key steps to ensure accurate completion and submission. First, gather all necessary information, such as the policy details and personal identification of the deceased. Next, fill out the form carefully, ensuring that all sections are completed thoroughly. It is important to provide accurate information, as discrepancies can delay the claims process. Once completed, the form can be submitted electronically or via traditional mail, depending on the insurer's requirements.

Steps to Complete the Life Insurance Form

Completing the life insurance form requires careful attention to detail. Follow these steps for a successful submission:

- Gather necessary documentation, including the death certificate and policy details.

- Fill in the claimant's personal information, including name, address, and contact details.

- Provide the insured's information, including their name, date of birth, and policy number.

- Sign and date the form, ensuring that all required signatures are included.

- Submit the form according to the insurer's guidelines, whether online or by mail.

Legal Use of the Life Insurance Form

The legal use of the life insurance form is governed by various regulations that ensure the authenticity and validity of the claims process. For the form to be legally binding, it must be completed accurately and submitted within the stipulated timeframes. Additionally, the form must comply with relevant state and federal laws regarding insurance claims. Understanding these legal requirements is crucial for both the claimant and the insurance provider to avoid potential disputes.

Required Documents

When submitting the life insurance form, certain documents are typically required to support the claim. These may include:

- The original life insurance policy document.

- A certified copy of the death certificate.

- Identification documents for the claimant, such as a driver's license or Social Security card.

- Any additional documentation requested by the insurance company, such as medical records or proof of relationship to the deceased.

Form Submission Methods

The life insurance form can be submitted through various methods, depending on the insurance company's policies. Common submission methods include:

- Online submission via the insurer's secure portal.

- Mailing the completed form to the designated claims department.

- In-person submission at a local insurance office, if applicable.

It is advisable to check with the specific insurer for their preferred submission method to ensure timely processing of the claim.

Quick guide on how to complete life insurance form

Handle Life Insurance Form easily on any device

Digital document administration has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can obtain the necessary template and securely keep it online. airSlate SignNow provides you with all the resources required to create, amend, and electronically sign your documents promptly without interruptions. Manage Life Insurance Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign Life Insurance Form effortlessly

- Find Life Insurance Form and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to confirm your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from a device of your preference. Edit and electronically sign Life Insurance Form and ensure exceptional communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the life insurance form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are AXA life insurance claims?

AXA life insurance claims refer to the process by which policyholders can request benefits from their life insurance policies after a covered event, such as the death of the insured. Ensuring you have the correct documentation ready can streamline your AXA life insurance claims process and help you receive the benefits in a timely manner.

-

How do I file an AXA life insurance claim?

To file AXA life insurance claims, start by contacting AXA's claims department or visiting their website for detailed instructions. You'll typically need to provide necessary documents such as the death certificate and the policy number. Completing this process accurately will aid in the swift handling of your claim.

-

What documents are needed for AXA life insurance claims?

When making AXA life insurance claims, you usually need a copy of the death certificate, the policyholder's identification, and the original policy document. Depending on the circumstances, additional documentation may be required. Be sure to check with AXA for their specific requirements to ensure a smooth claims process.

-

How long does it take to process AXA life insurance claims?

The time it takes to process AXA life insurance claims can vary, but most are resolved within 30 to 60 days once all necessary documents are submitted. Factors such as the complexity of the claim and the completeness of the submitted information can impact processing time. It's advisable to stay in contact with AXA for updates.

-

Are there any fees associated with AXA life insurance claims?

Typically, there are no fees directly associated with filing AXA life insurance claims. However, some ancillary costs may arise, such as fees for obtaining copies of documents like death certificates. It's best to consult with AXA for a clear understanding of any potential charges.

-

What are the benefits of filing AXA life insurance claims promptly?

Filing AXA life insurance claims promptly ensures that beneficiaries receive their benefits more quickly, providing essential financial support during a difficult time. Additionally, early filing can help avoid complications or delays that might arise from extended processing times. Being proactive signNowly enhances the chances of a smooth claims experience.

-

Can I track the status of my AXA life insurance claims?

Yes, AXA allows policyholders to track the status of their life insurance claims through their online portal or by contacting customer support. Keeping tabs on your claim status can provide peace of mind and reassurance that the process is progressing. Regular updates from AXA can help you stay informed.

Get more for Life Insurance Form

- Benevolence request application form

- Open doors application the ymca of delaware ymcade form

- Verification form for participation in mississippi volunteer firefighter

- Unit test 3a form

- Credit union 1 direct deposit form

- Virginia petition rights form

- Virginia subpoena duces tecum attorney fill online form

Find out other Life Insurance Form

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form