Distribution Request Form CalPERS Supplemental Income Plans 2014-2026

What is the Distribution Request Form CalPERS Supplemental Income Plans

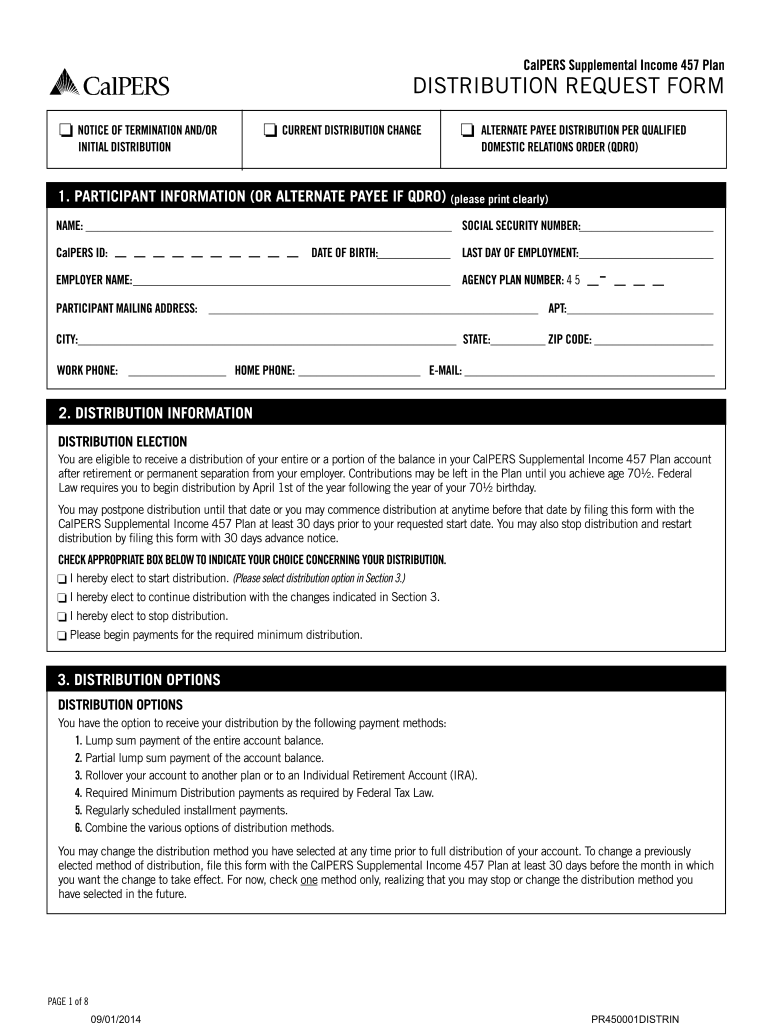

The Distribution Request Form for CalPERS Supplemental Income Plans is a crucial document for individuals seeking to withdraw funds from their 457 plan. This form allows participants to formally request a distribution of their accumulated benefits. It is important for users to understand that the CalPERS Supplemental Income 457 plan is designed to provide additional retirement income, and accessing these funds requires adherence to specific guidelines and regulations. The form captures essential information about the participant, including their account details and the requested distribution amount.

Steps to complete the Distribution Request Form CalPERS Supplemental Income Plans

Completing the Distribution Request Form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your CalPERS identification number and details about your 457 plan. Next, carefully fill out the form, providing clear and precise information regarding the amount you wish to withdraw and the method of distribution. It is essential to review the form for any errors or omissions before submission. Finally, sign and date the form to validate your request. Ensuring that all sections are completed correctly will help expedite the processing of your distribution request.

How to obtain the Distribution Request Form CalPERS Supplemental Income Plans

The Distribution Request Form for CalPERS Supplemental Income Plans can be obtained through multiple channels. Participants can access the form directly from the CalPERS website, where it is typically available as a downloadable PDF. Additionally, individuals may contact CalPERS customer service for assistance in obtaining the form. It is advisable to ensure you are using the most current version of the form to avoid any issues during submission.

Legal use of the Distribution Request Form CalPERS Supplemental Income Plans

The legal use of the Distribution Request Form is essential for ensuring that withdrawals from the CalPERS Supplemental Income 457 plan are processed correctly and in compliance with applicable laws. This form serves as a formal request and must be completed in accordance with the guidelines set forth by CalPERS. Participants should be aware that improper completion or submission of the form may result in delays or denial of the distribution request. Understanding the legal implications of the form can help safeguard your interests and ensure a smooth withdrawal process.

Key elements of the Distribution Request Form CalPERS Supplemental Income Plans

Several key elements must be included in the Distribution Request Form to ensure it is valid and complete. These elements typically include:

- Participant Information: Full name, address, and CalPERS identification number.

- Distribution Amount: The specific amount being requested for withdrawal.

- Distribution Method: Options may include direct deposit, check, or rollover to another retirement account.

- Signature: The participant's signature and date to validate the request.

Ensuring that these elements are accurately filled out is crucial for the timely processing of your distribution request.

Form Submission Methods (Online / Mail / In-Person)

Participants have several options for submitting the Distribution Request Form. The most common methods include:

- Online Submission: If available, submitting the form electronically through the CalPERS website can expedite processing.

- Mail: Participants can print the completed form and send it via postal mail to the designated CalPERS address.

- In-Person: For those who prefer direct interaction, submitting the form in person at a CalPERS office may be an option.

Choosing the appropriate submission method can depend on individual preferences and the urgency of the distribution request.

Quick guide on how to complete distribution request form calpers supplemental income plans

Effortlessly Prepare Distribution Request Form CalPERS Supplemental Income Plans on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any hitches. Handle Distribution Request Form CalPERS Supplemental Income Plans on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

Easily Edit and Electronically Sign Distribution Request Form CalPERS Supplemental Income Plans

- Find Distribution Request Form CalPERS Supplemental Income Plans and click Get Form to start.

- Utilize the tools we provide to complete your form.

- Mark relevant sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Distribution Request Form CalPERS Supplemental Income Plans while ensuring exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How should one account for the value of non-qualified deferred compensation and pension plans and its distributions when filling out the college tuition financial aid forms in FAFSA?

How should one account for the value of non-qualified deferred compensation and pension plans and its distributions when filling out the college tuition financial aid forms in FAFSA?Elective employee contributions to and all distributions from the non-qualified plans during the FAFSA’s base year are reported as income on the FAFSA. Employer contributions are not reported as income. If a reportable contribution or distribution is not reported in adjusted gross income (AGI), it is reported as untaxed income of the FAFSA. This is no different than the treatment of qualified retirement plans.A non-qualified plan should not be reported as an asset, if access to the plan is restricted until the employee signNowes retirement age. But, many non-qualified plans provide the employee with access to the plan after employment is terminated, not just when the employee signNowes retirement age. If so, the non-qualified plan should be reported as an asset on the FAFSA, to the extent that it has vested.

Create this form in 5 minutes!

How to create an eSignature for the distribution request form calpers supplemental income plans

How to generate an eSignature for the Distribution Request Form Calpers Supplemental Income Plans online

How to create an electronic signature for the Distribution Request Form Calpers Supplemental Income Plans in Google Chrome

How to generate an eSignature for signing the Distribution Request Form Calpers Supplemental Income Plans in Gmail

How to make an eSignature for the Distribution Request Form Calpers Supplemental Income Plans straight from your mobile device

How to make an electronic signature for the Distribution Request Form Calpers Supplemental Income Plans on iOS devices

How to create an electronic signature for the Distribution Request Form Calpers Supplemental Income Plans on Android devices

People also ask

-

What is the calpers supplemental income 457 plan?

The calpers supplemental income 457 plan is a retirement savings plan designed to help California Public Employees Retirement System members save additional income for retirement. It offers tax-deferred contributions, allowing employees to enhance their financial security in retirement. Participating in this plan can signNowly increase your overall retirement savings.

-

How do I enroll in the calpers supplemental income 457 plan?

To enroll in the calpers supplemental income 457 plan, you need to visit the official CalPERS website or consult your HR department for specific instructions. Enrollment usually involves filling out an application and selecting your contribution amount. Once enrolled, you can begin to reap the benefits of enhanced savings for retirement.

-

What are the contribution limits for the calpers supplemental income 457 plan?

The IRS sets annual contribution limits for the calpers supplemental income 457 plan, which may vary each year. As of now, participants can contribute up to $19,500 per year, with an additional catch-up contribution for those over 50 years of age. It's essential to stay informed about any changes in these limits.

-

Are there any fees associated with the calpers supplemental income 457 plan?

Yes, there may be specific administrative and investment fees associated with the calpers supplemental income 457 plan. However, these fees tend to be minimal compared to the long-term benefits of tax-deferred savings. It's advisable to review the fee structure provided in the plan documentation carefully.

-

What investment options are available within the calpers supplemental income 457 plan?

The calpers supplemental income 457 plan typically offers a variety of investment options including mutual funds, target-date funds, and fixed income options. Participants can choose investments that align with their risk tolerance and financial goals to maximize their retirement savings. It's crucial to review your options regularly to ensure they continue to meet your investment strategy.

-

What are the tax implications of the calpers supplemental income 457 plan?

Contributions to the calpers supplemental income 457 plan are made on a pre-tax basis, which means you won’t pay federal taxes on the income you contribute until you withdraw it during retirement. This tax-deferred growth can help your savings accumulate faster over time. However, it’s important to consult a tax advisor for personalized advice regarding your situation.

-

How does the calpers supplemental income 457 plan differ from a 401(k)?

The calpers supplemental income 457 plan is designed specifically for state and local government employees, while a 401(k) plan is available to employees of private-sector companies. Both offer tax advantages, but the withdrawal rules and contribution limits may differ, making the 457 plan more flexible for certain withdrawals. Understanding these differences can help you choose the best retirement savings vehicle for your needs.

Get more for Distribution Request Form CalPERS Supplemental Income Plans

- Coec form

- Voters certification sample form

- Online doctors form

- Eeo 1 form pdf 100103334

- Sr 38875bluebadgeappformeng pdf

- Dorel asia toddler bed model no wm3238c wm3238e wm3238w cherry espresso white upc code 065857159530 065857159547 065857159554 form

- Block 55 fields of wellington form

- Application for an aviation document booklet form

Find out other Distribution Request Form CalPERS Supplemental Income Plans

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History