Form 8879 Eo

What is the Form 8879 Eo

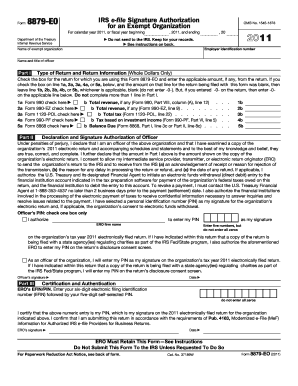

The Form 8879 Eo, also known as the IRS e-file Signature Authorization, is a crucial document for taxpayers who file their taxes electronically. This form allows taxpayers to authorize an electronic return originator (ERO) to file their tax return on their behalf. It serves as a signature substitute, ensuring that the taxpayer's consent is documented and compliant with IRS regulations. The form is particularly relevant for individuals and businesses that prefer the convenience of e-filing while maintaining the necessary legal safeguards.

How to use the Form 8879 Eo

Using the Form 8879 Eo involves a straightforward process. First, taxpayers must complete their tax return using compatible tax software. Once the return is ready for submission, the taxpayer will fill out the Form 8879 Eo, which includes personal information and a declaration of the accuracy of the tax return. After signing the form, it must be provided to the ERO, who will then use it to e-file the tax return with the IRS. It is essential to keep a copy of the signed form for personal records.

Steps to complete the Form 8879 Eo

Completing the Form 8879 Eo requires attention to detail to ensure accuracy. Here are the steps to follow:

- Gather necessary information, including your Social Security number, tax return details, and the ERO's information.

- Fill out the form with accurate personal and tax return information.

- Review the completed form for any errors or omissions.

- Sign the form electronically or by hand, depending on the method used.

- Submit the signed form to your ERO for e-filing.

Legal use of the Form 8879 Eo

The legal use of the Form 8879 Eo is governed by IRS regulations that outline the requirements for electronic signatures. By signing this form, taxpayers provide their consent for the ERO to file their tax return electronically, which is legally binding as long as the form is completed correctly. The form must be securely stored, as it serves as proof of authorization in case of future inquiries or audits by the IRS. Compliance with the eSignature laws ensures that the electronic submission is valid and recognized by the IRS.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form 8879 Eo. Taxpayers must ensure that the form is signed and dated before the ERO files the electronic return. Additionally, the IRS mandates that the ERO retains the signed Form 8879 Eo for at least three years after the tax return is filed. This retention is essential for compliance and may be required during audits or reviews. Familiarizing oneself with these guidelines helps ensure a smooth e-filing process.

Required Documents

To complete the Form 8879 Eo, certain documents and information are required. Taxpayers should have the following on hand:

- Social Security number or Individual Taxpayer Identification Number (ITIN).

- Details of the tax return being filed, including income and deductions.

- Information about the electronic return originator, including their EFIN (Electronic Filing Identification Number).

Having these documents ready will streamline the completion of the form and facilitate the e-filing process.

Examples of using the Form 8879 Eo

There are various scenarios where the Form 8879 Eo is utilized. For instance, self-employed individuals may use this form to authorize their tax preparer to file their business and personal tax returns electronically. Similarly, small business owners who employ an ERO to manage their tax filings will also rely on this form to ensure compliance and facilitate a smooth filing process. Understanding these examples can help taxpayers see the practical applications of the Form 8879 Eo in different tax situations.

Quick guide on how to complete form 8879 eo

Complete Form 8879 Eo effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly and without hold-ups. Handle Form 8879 Eo on any platform using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The easiest way to edit and electronically sign Form 8879 Eo with ease

- Obtain Form 8879 Eo and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

No more missing or lost documents, tedious form searching, or mistakes requiring new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 8879 Eo and ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8879 eo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8879 Eo?

Form 8879 Eo is an e-file signature authorization form that enables taxpayers to electronically sign their tax returns. Utilizing airSlate SignNow, users can easily complete and submit Form 8879 Eo, ensuring compliance with IRS guidelines and streamlining the filing process.

-

How does airSlate SignNow help with Form 8879 Eo?

airSlate SignNow provides a straightforward platform for filling out and eSigning Form 8879 Eo. By simplifying the signing process, businesses can save time and enhance their workflow efficiency while ensuring secure and legally binding signatures.

-

What are the pricing options for using airSlate SignNow with Form 8879 Eo?

airSlate SignNow offers competitive pricing plans designed to suit the needs of businesses of all sizes. Users can access features specific to Form 8879 Eo through various subscription levels, providing flexibility based on usage requirements.

-

Can I integrate airSlate SignNow with other applications while using Form 8879 Eo?

Yes, airSlate SignNow seamlessly integrates with several popular applications, facilitating the use of Form 8879 Eo alongside other tools such as CRMs and document management systems. This integration helps streamline processes and maintain efficiency in overall workflows.

-

What are the main benefits of using airSlate SignNow for Form 8879 Eo?

By using airSlate SignNow for Form 8879 Eo, businesses can achieve faster turnaround times and reduce paper handling, which promotes sustainability. Additionally, it enhances security and accessibility, ensuring that all signers can conveniently complete the form anytime, anywhere.

-

Is it safe to use airSlate SignNow for signing Form 8879 Eo?

Absolutely, airSlate SignNow prioritizes security and compliance when handling sensitive information like Form 8879 Eo. The platform utilizes advanced encryption technologies to protect user data and maintains strict adherence to regulatory requirements.

-

How can I get started with airSlate SignNow to use Form 8879 Eo?

Getting started with airSlate SignNow is easy! Simply sign up for an account, select the option to create or upload your Form 8879 Eo, and follow the intuitive prompts to eSign. Our user-friendly interface ensures a hassle-free experience from start to finish.

Get more for Form 8879 Eo

- A guide to completing the mini nutritional assessment form

- Personal investment contract template form

- Personal lend contract template form

- Personal loan between family contract template form

- Personal loan between friends contract template form

- Personal loan contract template form

- Personal loan repayment contract template form

- Personal money loan contract template form

Find out other Form 8879 Eo

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document