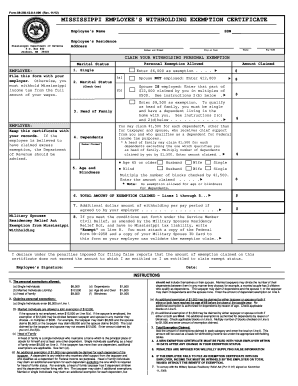

MISSISSIPPI EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE Form

What is the Mississippi Employee's Withholding Exemption Certificate?

The Mississippi Employee's Withholding Exemption Certificate is a crucial document used by employees to claim exemption from state income tax withholding. This certificate allows eligible individuals to avoid having state taxes deducted from their paychecks. To qualify for exemption, employees must meet specific criteria, such as having no tax liability in the previous year and expecting none in the current year. Understanding this form is essential for employees who wish to manage their tax obligations effectively.

Steps to Complete the Mississippi Employee's Withholding Exemption Certificate

Completing the Mississippi Employee's Withholding Exemption Certificate involves several straightforward steps:

- Obtain the certificate form from your employer or the Mississippi Department of Revenue website.

- Provide your personal information, including your name, address, and Social Security number.

- Indicate your eligibility for exemption by checking the appropriate box on the form.

- Sign and date the certificate to validate your claim.

- Submit the completed form to your employer for processing.

It is essential to ensure that all information is accurate to avoid any issues with your tax withholding status.

Eligibility Criteria for Exemption

To qualify for exemption from withholding, employees must meet specific eligibility criteria established by the state of Mississippi. These criteria typically include:

- Having no tax liability in the previous year.

- Expecting to have no tax liability in the current year.

- Being a resident of Mississippi or working in the state.

Employees should review these criteria carefully before submitting their exemption certificate to ensure compliance with state regulations.

Legal Use of the Mississippi Employee's Withholding Exemption Certificate

The Mississippi Employee's Withholding Exemption Certificate is legally binding when completed and submitted correctly. It serves as a formal declaration of an employee's tax status and must be treated with care. Employers are required to maintain these certificates on file and may be subject to penalties if they fail to withhold taxes from employees who do not qualify for exemption. Understanding the legal implications of this form is vital for both employees and employers.

Filing Deadlines and Important Dates

Filing deadlines for the Mississippi Employee's Withholding Exemption Certificate are critical for ensuring that employees receive the correct tax treatment. Typically, employees should submit their exemption certificates at the beginning of the tax year or whenever their tax situation changes. Employers may have specific deadlines for processing these forms, so it is advisable to check with your HR department for any internal timelines that may apply.

Examples of Using the Mississippi Employee's Withholding Exemption Certificate

Understanding how to utilize the Mississippi Employee's Withholding Exemption Certificate can help employees manage their finances effectively. For instance:

- A recent graduate starting a new job may claim exemption if they had no tax liability in the previous year.

- A part-time employee working a seasonal job may also qualify for exemption if they expect to earn below the taxable threshold.

These examples illustrate how different situations can impact an employee's eligibility for exemption from withholding.

Quick guide on how to complete mississippi employeeamp39s withholding exemption certificate

Complete MISSISSIPPI EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE effortlessly on any device

Managing documents online has gained signNow popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle MISSISSIPPI EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE across any platform using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and eSign MISSISSIPPI EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE with ease

- Find MISSISSIPPI EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign MISSISSIPPI EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE and ensure superior communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mississippi employeeamp39s withholding exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to be exempt from withholding in tax terms?

Being exempt from withholding means that the government does not require an employer to withhold taxes from an employee's paycheck. This status can be granted under certain conditions, such as low income or certain tax status. Understanding how being exempt from withholding impacts your overall tax obligations is crucial for effective financial planning.

-

How can airSlate SignNow help businesses manage documents related to tax exemptions?

airSlate SignNow provides a user-friendly platform to send and eSign important tax-related documents, including forms for claiming exempt from withholding. With its cloud-based storage and secure signing processes, businesses can efficiently manage these documents while ensuring compliance with tax regulations. This simplifies the tracking of exemptions and reduces administrative burdens.

-

Is there a cost associated with using airSlate SignNow for exempt from withholding documentation?

Yes, while airSlate SignNow offers a range of pricing plans, the costs are competitive and often lower than traditional methods of document management. Subscribers can benefit from features tailored for complex forms, including those claiming exempt from withholding. Investing in this solution can ultimately save businesses time and resources when processing such important documents.

-

What features does airSlate SignNow offer to streamline the eSigning process?

airSlate SignNow comes with several features designed to enhance the eSigning process, such as customizable templates, automatic reminders, and mobile access. These tools make it easy to obtain signatures on documents related to being exempt from withholding and ensure timely processing. The platform’s intuitive interface aids in quick navigation, making compliance straightforward.

-

Can I integrate airSlate SignNow with other software for better tax management?

Absolutely! airSlate SignNow integrates seamlessly with popular software applications, including CRM systems and accounting software. This integration facilitates smooth workflows for managing tax documents, including those claiming exempt from withholding. By linking these systems, businesses can automate processes and improve accuracy in tracking tax-related activities.

-

How secure is airSlate SignNow when handling sensitive tax documents?

Security is a priority for airSlate SignNow, especially when handling sensitive documents such as tax records claiming exempt from withholding. The platform employs advanced encryption, secure servers, and compliance with data protection regulations to safeguard all information. Users can confidently manage and sign their documents, knowing that their data is protected.

-

What types of businesses benefit from using airSlate SignNow for tax-related processes?

Any business that needs to manage tax-related documents, including those for claiming exempt from withholding, can benefit from airSlate SignNow. This includes small businesses, corporations, freelancers, and non-profits. The platform is designed to ease the administrative load and improve efficiency, making it an excellent choice for any organization.

Get more for MISSISSIPPI EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE

Find out other MISSISSIPPI EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement