Fillable Money Owed Form

What is the fillable money owed form

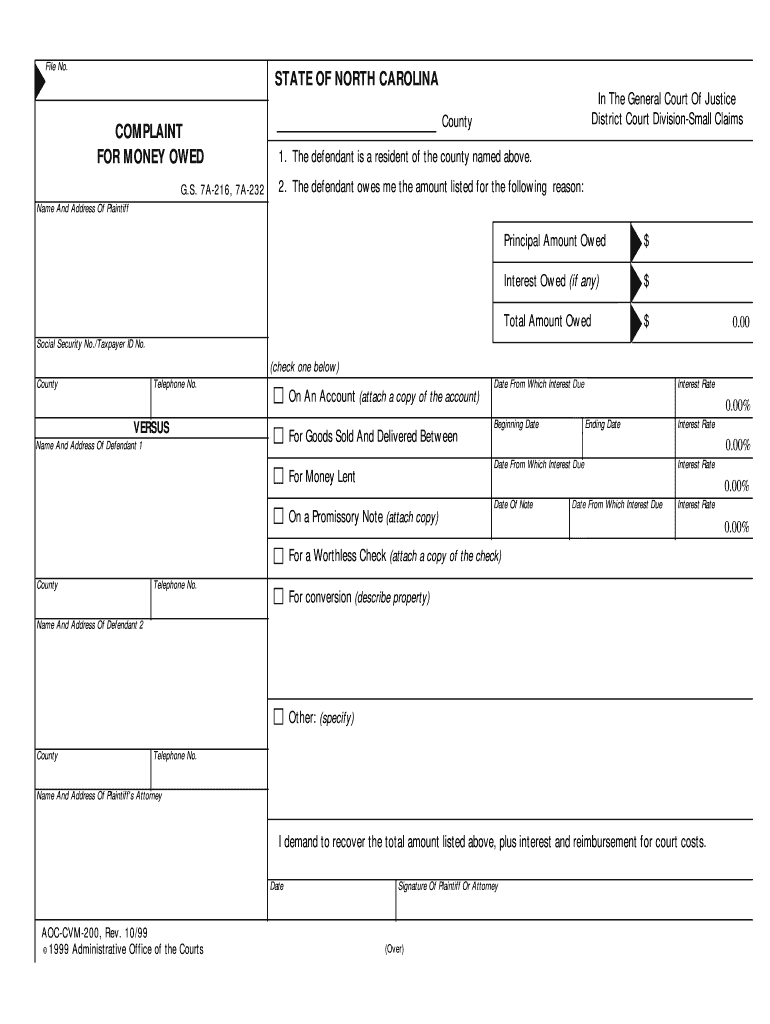

The fillable money owed form is a document used to formally acknowledge a debt between two parties. It serves as a record of the amount owed, the terms of repayment, and any relevant conditions. This form is crucial for ensuring that both the lender and borrower have a clear understanding of their obligations, which can help prevent misunderstandings or disputes in the future. By using a fillable format, users can easily input their information and customize the document to suit their specific needs.

How to use the fillable money owed form

Using the fillable money owed form involves several straightforward steps. First, access the form through a reliable platform that supports electronic signatures. Next, fill in the required fields, including the names of both parties, the amount owed, and the repayment terms. After completing the form, both parties should review the information for accuracy. Once confirmed, the form can be signed electronically, ensuring a legally binding agreement. This digital approach simplifies the process and enhances security.

Key elements of the fillable money owed form

Several key elements must be included in the fillable money owed form to ensure its effectiveness and legal standing. These elements typically include:

- Names and contact information of both the debtor and creditor.

- Amount owed clearly stated in both numerical and written form.

- Repayment terms, including due dates and payment methods.

- Signatures of both parties, which can be obtained electronically.

- Date of agreement to establish a timeline for the debt.

Steps to complete the fillable money owed form

Completing the fillable money owed form involves a few essential steps to ensure accuracy and legality:

- Access the fillable form on a trusted platform.

- Input the names and contact details of both parties.

- Specify the total amount owed and repayment terms.

- Review the completed form for any errors or omissions.

- Sign the document electronically to finalize the agreement.

Legal use of the fillable money owed form

The legal use of the fillable money owed form hinges on its compliance with applicable laws. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, provided that both parties consent to use electronic means for signing. This form can be used in various contexts, such as personal loans, business transactions, or informal agreements. Ensuring that the form is filled out correctly and signed by both parties enhances its validity in legal settings.

State-specific rules for the fillable money owed form

Different states may have specific regulations regarding the use of fillable money owed forms. It is important to be aware of these variations to ensure compliance. For instance, some states may require additional disclosures or specific language to be included in the form. Researching state laws or consulting with a legal professional can help ensure that the form meets all necessary legal requirements, thereby protecting the interests of both parties involved in the agreement.

Quick guide on how to complete fillable money owed form

Complete Fillable Money Owed Form effortlessly on any gadget

Digital document management has become favored by organizations and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Fillable Money Owed Form on any gadget with airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

How to adjust and eSign Fillable Money Owed Form with ease

- Locate Fillable Money Owed Form and click on Get Form to begin.

- Utilize the tools at your disposal to finalize your document.

- Mark essential sections of the documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or shareable link, or download it to your computer.

Eliminate concerns over lost or improperly stored files, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Fillable Money Owed Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable money owed form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable money owed form?

A fillable money owed form is a customizable document that allows you to specify the amount owed and related terms. With airSlate SignNow, you can create this form easily, enabling your clients to fill in the necessary information digitally. This enhances accuracy and ensures that all details are collected efficiently.

-

How can I create a fillable money owed form using airSlate SignNow?

Creating a fillable money owed form with airSlate SignNow is straightforward. You can start by selecting a template that fits your needs or create one from scratch. The drag-and-drop interface allows you to add fields for amounts, signatures, and any additional information required.

-

What features does the fillable money owed form offer?

The fillable money owed form in airSlate SignNow includes features like customizable fields, electronic signatures, and automated reminders for overdue payments. Additionally, you can track the status of the document in real-time, ensuring that both you and your clients are always informed.

-

Is there a cost associated with using the fillable money owed form?

Yes, airSlate SignNow offers various pricing plans that include access to the fillable money owed form feature. You can choose a plan that fits your budget and business needs, with options for monthly or annual billing. Each plan provides a range of functionalities to streamline your document management.

-

Can I integrate the fillable money owed form with other software?

Absolutely! airSlate SignNow supports integrations with various popular software applications. This means you can connect the fillable money owed form with your CRM, accounting software, or any other tools you use, enhancing your workflow and efficiency.

-

What are the benefits of using a fillable money owed form?

Using a fillable money owed form simplifies the process of collecting payments and managing accounts. It minimizes errors related to manual entry, speeds up the payment processing time, and improves communication with clients by providing clear documentation.

-

Is it secure to use the fillable money owed form for sensitive information?

Yes, security is a top priority with airSlate SignNow. The fillable money owed form benefits from encryption protocols and secure cloud storage, ensuring that your sensitive information remains protected. Additional features like access controls further enhance the security of your documents.

Get more for Fillable Money Owed Form

- Nancy hall memorial scholarship application oklahoma state osuokc form

- Bramber popcorn fund application university of wisconsin school vetmed wisc form

- Pie eating contest rules form

- Payroll bcard employeeb application form

- Admissions drexel eduregistervillanova initiative for engaging women view information

- Cser liberty form

- Academic grade grievance appeal form famu edu

- Satisfactory progress appeal form oftc edu oftc

Find out other Fillable Money Owed Form

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now