St120 Form

What is the ST120 Form

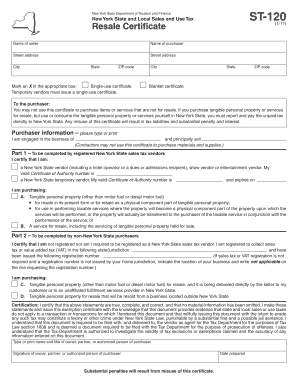

The ST120 form, also known as the Sales Tax Exempt Certificate, is utilized in the United States to certify that certain purchases are exempt from sales tax. This form is essential for businesses and organizations that qualify for tax exemption under specific circumstances, such as non-profit organizations or government entities. By completing the ST120 form, purchasers can provide sellers with the necessary documentation to validate their tax-exempt status, ensuring compliance with state tax laws.

How to use the ST120 Form

Using the ST120 form involves several straightforward steps. First, the purchaser must fill out the form with accurate information, including their name, address, and the reason for the exemption. Next, the seller must retain a copy of the completed form for their records. It is important to ensure that the form is filled out correctly to avoid any potential issues with tax compliance. The ST120 form can be presented to sellers at the time of purchase, either in paper form or electronically, depending on the seller's acceptance of digital documents.

Steps to complete the ST120 Form

Completing the ST120 form requires careful attention to detail. Here are the key steps:

- Gather necessary information: Collect all required details, including the purchaser's name, address, and tax identification number.

- Provide exemption reason: Clearly state the reason for the tax exemption, referencing applicable state laws or regulations.

- Sign and date: Ensure that the form is signed and dated by an authorized representative of the organization claiming the exemption.

- Submit the form: Present the completed form to the seller at the time of purchase.

Legal use of the ST120 Form

The legal use of the ST120 form is governed by state tax laws, which outline the eligibility criteria for tax exemption. When properly completed and submitted, the ST120 form serves as a legally binding document that protects both the purchaser and the seller from potential tax liabilities. It is crucial for users to understand their state's specific regulations regarding sales tax exemptions to ensure compliance and avoid penalties.

Key elements of the ST120 Form

The ST120 form contains several key elements that must be accurately filled out to ensure its validity. These elements include:

- Purchaser's information: Name, address, and tax identification number of the entity claiming the exemption.

- Seller's information: Name and address of the seller receiving the form.

- Exemption reason: A clear explanation of why the purchase is exempt from sales tax.

- Signature: An authorized signature from the purchaser's organization, along with the date of completion.

Form Submission Methods

The ST120 form can be submitted through various methods, depending on the seller's preferences. Common submission methods include:

- In-person: Presenting the completed form directly to the seller at the time of purchase.

- Mail: Sending a physical copy of the form to the seller if required.

- Electronic: Submitting the form digitally if the seller accepts electronic documentation.

Quick guide on how to complete st120 form

Effortlessly prepare St120 Form on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed materials, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage St120 Form on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to edit and eSign St120 Form with ease

- Find St120 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools available from airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign St120 Form and ensure excellent communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st120 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is st120 and how does it relate to airSlate SignNow?

The term st120 refers to a unique identification for documents processed through airSlate SignNow. With st120, users can easily track and manage their digital documents, ensuring compliance and organization. This feature enhances the overall user experience by providing seamless document management capabilities.

-

What are the key features of airSlate SignNow that support st120?

airSlate SignNow includes features such as electronic signatures, document templates, and comprehensive sharing options associated with st120. These tools streamline the signing process and improve efficiency for businesses. Users can also customize their workflows to fit specific needs while utilizing st120 for better document tracking.

-

How much does airSlate SignNow cost for using st120?

Pricing for airSlate SignNow varies based on the plan chosen but remains affordable for small to large businesses utilizing st120. Typically, users can select from different tiers that offer varying features and functionalities. Investing in airSlate SignNow ensures a cost-effective solution for document management and eSigning needs.

-

What types of integrations does airSlate SignNow offer with st120?

airSlate SignNow easily integrates with numerous applications, enhancing the functionality of st120. These integrations include CRM systems, cloud storage services, and productivity tools. This connectivity allows for a seamless flow of information and documentation across platforms.

-

How does airSlate SignNow ensure security for documents identified by st120?

Security is a top priority for airSlate SignNow when handling documents tagged with st120. The platform offers advanced encryption methods and secure data storage to protect business information. Compliance with regulatory standards further ensures that users can safely eSign and manage their documents.

-

Can I use st120 for mobile document signing with airSlate SignNow?

Yes! airSlate SignNow fully supports st120 for mobile document signing, allowing users to execute agreements on the go. The mobile app provides a user-friendly interface for managing, signing, and sending documents effortlessly. This flexibility enhances productivity for busy professionals.

-

What benefits can businesses expect from using st120 with airSlate SignNow?

Businesses utilizing st120 with airSlate SignNow can expect improved efficiency, reduced turnaround times, and enhanced accuracy in document handling. The platform simplifies the signing process and minimizes paper use, contributing to sustainability efforts. Overall, these benefits lead to increased satisfaction for both teams and clients.

Get more for St120 Form

- Property needs assessment form

- Attach patient id sticker hereinsert your nhs l form

- Licensing scotland act sections 29 and 31 bapplicationb bb form

- Pearson btec level 4 hnc certificate in international form

- Sel 351 local recall signature sheet yamhill county oregon form

- Rbs mortgage deed 4 borrowersdoc rbs co form

- Apprenticeship application form harlow collegeacuk harlow college ac

- Tesco pet insurance claim form 80746301

Find out other St120 Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF