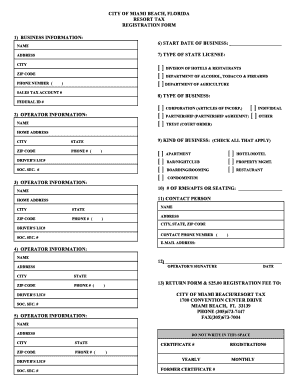

City of Miami Beach Resort Tax Form

What is the City Of Miami Beach Resort Tax

The City of Miami Beach imposes a resort tax on short-term rentals and hotel stays. This tax is applied to accommodations rented for six months or less. The revenue generated from this tax is allocated to various city services, including tourism promotion and infrastructure improvements. Understanding this tax is essential for both visitors and property owners to ensure compliance and proper budgeting during their stay or rental operations.

Key elements of the City Of Miami Beach Resort Tax

The Miami Beach resort tax consists of several key components that every visitor and property owner should be aware of:

- Tax Rate: The standard resort tax rate is typically set at a specific percentage of the rental amount.

- Duration of Stay: The tax applies to stays of six months or less, making it relevant for tourists and short-term renters.

- Exemptions: Certain exemptions may apply, such as for specific types of accommodations or entities.

- Collection Responsibility: Hotels and rental property owners are responsible for collecting and remitting the tax to the city.

Steps to complete the City Of Miami Beach Resort Tax

Completing the Miami Beach resort tax involves several steps to ensure compliance:

- Determine Applicability: Assess whether your rental or stay qualifies for the resort tax based on duration and type.

- Calculate the Tax: Use the applicable tax rate to calculate the total resort tax owed based on the rental amount.

- Collect the Tax: If you are a property owner, ensure that the tax is collected from guests at the time of payment.

- Remit the Tax: Submit the collected tax to the City of Miami Beach by the established deadlines.

How to use the City Of Miami Beach Resort Tax

Utilizing the Miami Beach resort tax correctly is crucial for compliance. Property owners must ensure that the tax is included in rental agreements and communicated clearly to guests. Visitors should be aware of this tax when budgeting for their trip, as it can significantly affect the overall cost of their stay. Understanding how this tax works can enhance the experience for both guests and hosts.

Filing Deadlines / Important Dates

Timely filing and payment of the Miami Beach resort tax are essential to avoid penalties. Key deadlines typically include:

- Monthly Filing: Resort tax returns are generally due on the last day of the month following the reporting period.

- Payment Due Date: Payments for the collected tax must accompany the filing of the return.

Staying informed about these dates helps ensure compliance and avoid any late fees.

Penalties for Non-Compliance

Failure to comply with the Miami Beach resort tax regulations can result in significant penalties. These may include:

- Late Fees: Additional charges may be imposed for late filings or payments.

- Interest Charges: Unpaid taxes may accrue interest until fully paid.

- Legal Action: Continued non-compliance can lead to legal repercussions, including fines or other enforcement actions.

Understanding these penalties emphasizes the importance of timely and accurate tax handling.

Quick guide on how to complete city of miami beach resort tax

Streamline city of miami beach resort tax seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, since you can locate the suitable form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Handle miami beach hotel local taxes breakdown on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign resort tax miami beach with ease

- Locate resort tax and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes necessitating the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign miami beach resort tax while ensuring effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to miami beach hotel local taxes breakdown

Create this form in 5 minutes!

How to create an eSignature for the resort tax miami beach

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask miami beach resort tax

-

What are the local taxes applicable to Miami Beach hotels?

When staying at a Miami Beach hotel, guests should be aware of the local taxes that apply to their stay. These typically include a resort fee, Miami-Dade County hotel tax, and Florida state tax. Understanding the Miami Beach hotel local taxes breakdown helps you budget for your trip and avoid unexpected charges.

-

How can I find a detailed breakdown of Miami Beach hotel local taxes?

Most Miami Beach hotels provide a detailed breakdown of local taxes on their official websites. Additionally, travel booking platforms often include these details during the booking process. Reviewing this Miami Beach hotel local taxes breakdown ensures that you are fully informed before making a reservation.

-

Are local taxes included in the price when booking a Miami Beach hotel?

Local taxes are typically not included in the initial booking price displayed on travel sites. It's important to check the Miami Beach hotel local taxes breakdown separately to understand the total cost of your stay, which may include additional fees and taxes that come into play at checkout.

-

Do different Miami Beach hotels have varying local tax rates?

Yes, the local tax rates can vary across different Miami Beach hotels based on their location and specific amenities. However, the Miami Beach hotel local taxes breakdown typically follows similar guidelines across the city, ensuring that any variation is within standard policies. Always check the specifics with each hotel to confirm their rates.

-

What benefits do I get when I pay local taxes at Miami Beach hotels?

Paying local taxes at Miami Beach hotels helps fund local infrastructure, public services, and tourism-related projects. This means your contribution directly supports the community while enhancing your travel experience. Understanding the benefits associated with the Miami Beach hotel local taxes breakdown can add value to your stay.

-

How can I ensure I am not overcharged on local taxes at Miami Beach hotels?

To avoid overcharging on local taxes, review the Miami Beach hotel local taxes breakdown provided by the hotel or during your reserving process. Always ask for a detailed invoice at checkout to cross-reference what is being charged against the expected rates. This proactive approach can help ensure transparency in your billing.

-

Are local taxes refundable at Miami Beach hotels?

Generally, local taxes paid at Miami Beach hotels are non-refundable. This applies even in cases of cancellations or modifications to your booking, as most local tax policies are firmly established. For a thorough understanding of your potential losses, consult the Miami Beach hotel local taxes breakdown when making your reservation.

Get more for city of miami beach resort tax

Find out other miami beach resort tax login

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe