Irs Gov Form 4852pdf 2013-2026

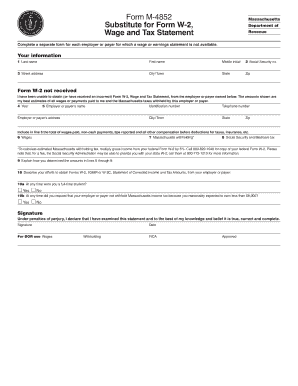

What is the IRS Gov Form 4852?

The IRS Gov Form 4852 is a substitute for the W-2 form, used when an employee does not receive their W-2 from an employer. This form allows taxpayers to report their wages and withholding for the tax year accurately. It is particularly useful for individuals who may have lost their W-2 or when their employer fails to provide it. The form can be essential for ensuring that taxpayers can still file their tax returns on time and claim any refunds they are entitled to.

How to Use the IRS Gov Form 4852

To use the IRS Gov Form 4852, individuals must fill out the form with their personal information, including their name, address, and Social Security number. Additionally, they need to provide details about their employer, such as the name and address, along with the estimated wages earned and taxes withheld. This information should be as accurate as possible, based on pay stubs or other records. Once completed, the form can be submitted along with the individual's tax return.

Steps to Complete the IRS Gov Form 4852

Completing the IRS Gov Form 4852 involves several steps:

- Gather necessary documents, such as previous pay stubs and tax records.

- Provide your personal information, including your name, address, and Social Security number.

- Fill in the employer's details, including their name and address.

- Estimate your total wages and the amount of federal income tax withheld.

- Sign and date the form to certify that the information provided is accurate.

After filling out the form, attach it to your tax return and submit it to the IRS.

Legal Use of the IRS Gov Form 4852

The IRS Gov Form 4852 is legally recognized as a valid substitute for the W-2 form under certain conditions. It must be completed accurately and submitted in a timely manner to avoid penalties. Taxpayers should ensure that they have made a reasonable effort to obtain their W-2 from their employer before resorting to using Form 4852. If the IRS audits the return, having a completed Form 4852 can help substantiate the taxpayer's claims regarding their income and withholding.

Filing Deadlines / Important Dates

When using the IRS Gov Form 4852, it is crucial to adhere to filing deadlines to avoid penalties. Generally, tax returns are due on April fifteenth of each year. If you are using Form 4852, it is advisable to file your return as close to this deadline as possible. If you miss the deadline, you may face late filing penalties. Additionally, if you anticipate owing taxes, filing on time can help mitigate interest and penalties.

Who Issues the Form?

The IRS Gov Form 4852 is not issued by any specific entity but is a form provided by the Internal Revenue Service. Taxpayers can obtain the form directly from the IRS website or through tax preparation software. Employers are responsible for issuing W-2 forms, and if they fail to do so, employees must complete Form 4852 to report their income for tax purposes.

Quick guide on how to complete irs gov form 4852pdf

Effortlessly Prepare Irs Gov Form 4852pdf on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents rapidly without delays. Manage Irs Gov Form 4852pdf on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Irs Gov Form 4852pdf with Ease

- Locate Irs Gov Form 4852pdf and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and eSign Irs Gov Form 4852pdf while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs gov form 4852pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4852 and when do I need it?

Form 4852 is a substitute for a W-2 form used if your employer fails to provide the necessary documentation. You need it when you have not received your W-2 and need to report your income accurately to the IRS. Understanding what is Form 4852 is crucial to ensuring you comply with tax regulations.

-

How does airSlate SignNow assist with filling out Form 4852?

airSlate SignNow offers an intuitive platform that allows you to easily fill out Form 4852 digitally. With features like eSignature and template storage, you can streamline the process of completing and submitting your Form 4852 without hassle. This technology simplifies what is Form 4852 to make your tax filing easier.

-

Is there a cost associated with using airSlate SignNow for Form 4852?

Yes, using airSlate SignNow comes with different pricing plans tailored to your needs, including options for individuals and businesses. Each plan gives you access to features that simplify tasks like filling out Form 4852. It’s a cost-effective solution that adds value to your document management.

-

Can I use airSlate SignNow to store my Form 4852 safely?

Absolutely! airSlate SignNow provides secure cloud storage for your documents including Form 4852. This ensures that sensitive information is protected while allowing you to access it anytime. Understanding what is Form 4852 and keeping it safe has never been easier.

-

What features does airSlate SignNow provide for Form 4852 users?

airSlate SignNow offers features like eSigning, document sharing, and customizable templates specifically designed for Form 4852. This suite of tools empowers users to complete their tax forms efficiently. Each feature is crafted to simplify the process and heighten your productivity.

-

Does airSlate SignNow integrate with accounting software for Form 4852?

Yes, airSlate SignNow integrates seamlessly with popular accounting software to enhance your experience with Form 4852. This integration allows for better data management and minimizes the chances of errors during tax filing. Leveraging these integrations can help streamline your understanding of what is Form 4852.

-

What are the benefits of using airSlate SignNow for tax documents like Form 4852?

Using airSlate SignNow for your tax documents, including Form 4852, offers several benefits like time efficiency, reduced paperwork, and increased accuracy. It eliminates the stress of manual filing and helps ensure compliance with tax laws. With a user-friendly interface, you'll find completing Form 4852 much simpler.

Get more for Irs Gov Form 4852pdf

- Certifications regarding lobbying debarment form

- Ad 1047 certificationpdffillercom 1992 form

- Petition for name change texas 2009 form

- Financial responsibility form charlotte mecklenburg county charmeck

- Kennel club pal form

- 4274 1 form

- How to download income driven plan on nelnet form

- Ibr online application form

Find out other Irs Gov Form 4852pdf

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease