Payroll Calculator Sheet Form

What is the Payroll Calculator Sheet

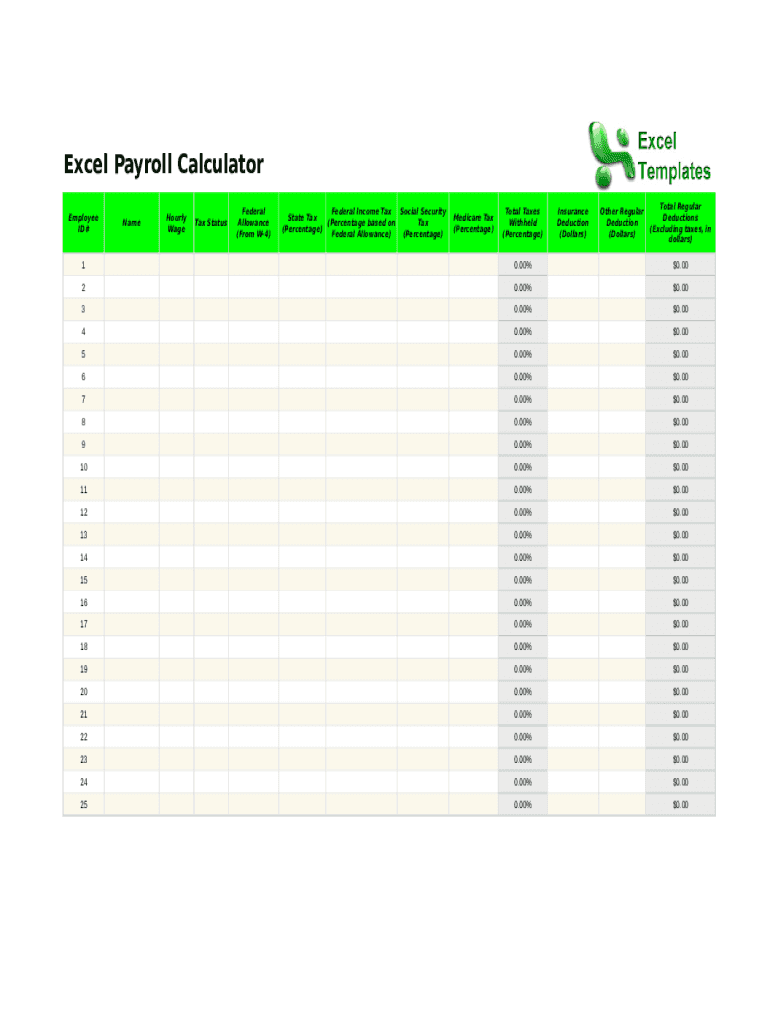

The payroll calculator sheet is a vital tool for businesses and individuals to accurately determine payroll expenses. It allows users to input various employee data, including hours worked, pay rates, and deductions. The resulting calculations provide a clear overview of gross pay, net pay, and applicable taxes. This tool is especially useful for small business owners and freelancers who manage their payroll without dedicated software.

How to Use the Payroll Calculator Sheet

Using the payroll calculator sheet involves a few straightforward steps. First, gather all necessary employee information, such as hourly rates, overtime hours, and any deductions like health insurance or retirement contributions. Next, input this data into the designated fields of the sheet. The calculator will automatically compute the gross pay by multiplying hours worked by the pay rate. After that, it will subtract any deductions to arrive at the net pay. Finally, review the calculations to ensure accuracy before processing payments.

Steps to Complete the Payroll Calculator Sheet

Completing the payroll calculator sheet requires careful attention to detail. Follow these steps:

- Enter the employee's name and identification number.

- Input the hourly wage or salary.

- Record the total hours worked during the pay period.

- Include any overtime hours worked, if applicable.

- List all deductions, such as taxes, insurance, and retirement contributions.

- Calculate gross pay by multiplying the hourly rate by the total hours worked.

- Subtract deductions from gross pay to find the net pay.

Legal Use of the Payroll Calculator Sheet

The payroll calculator sheet must comply with federal and state regulations to ensure its legal use. It is essential to adhere to the Fair Labor Standards Act (FLSA), which governs minimum wage and overtime pay. Additionally, employers must accurately report payroll information for tax purposes, following guidelines set by the IRS. Using a reliable payroll calculator that meets these legal standards helps prevent compliance issues and potential penalties.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding payroll calculations and tax withholdings. Employers must withhold federal income tax, Social Security, and Medicare taxes from employee wages. It's important to stay updated on any changes to tax rates and regulations. The IRS also requires accurate reporting of payroll information on forms such as the W-2 and 941. Familiarity with these guidelines ensures that businesses maintain compliance and avoid costly mistakes.

Examples of Using the Payroll Calculator Sheet

There are various scenarios in which a payroll calculator sheet can be beneficial. For instance, a small business owner may use it to calculate payroll for hourly employees, ensuring they are compensated accurately for overtime. Freelancers might utilize the sheet to determine their earnings after accounting for taxes and deductions. Additionally, non-profit organizations can benefit from using the payroll calculator to manage limited budgets while ensuring staff are paid correctly.

Quick guide on how to complete payroll calculator sheet

Complete Payroll Calculator Sheet effortlessly on any device

Web-based document management has become favored by both businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents promptly without delays. Manage Payroll Calculator Sheet on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Payroll Calculator Sheet with ease

- Find Payroll Calculator Sheet and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive data using the tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Payroll Calculator Sheet to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll calculator sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payroll calculator and how can it benefit my business?

A payroll calculator is a tool that helps businesses accurately calculate employee wages, taxes, and deductions. By using a payroll calculator, you can save time and reduce errors, ensuring that your employees are paid correctly and on time. This ultimately leads to improved employee satisfaction and better overall business efficiency.

-

How does the payroll calculator integrate with airSlate SignNow?

The payroll calculator can seamlessly integrate with airSlate SignNow, allowing you to automate your document signing process for payroll-related documents. This integration enables you to send payroll contracts or tax forms for electronic signature quickly and securely. It streamlines your workflow and enhances document management within your payroll system.

-

Is the payroll calculator feature included in the airSlate SignNow subscription?

Yes, the payroll calculator feature is included in various airSlate SignNow subscription plans, making it accessible to businesses of all sizes. Depending on the plan you choose, you may also benefit from additional features such as document templates and cloud storage. This ensures you have comprehensive tools to manage your payroll efficiently.

-

What types of payroll calculations can I perform with this calculator?

With the payroll calculator, you can perform various payroll calculations including gross pay, net pay, overtime, and tax deductions. It helps you determine employee compensation accurately based on hours worked and complies with tax regulations. This versatility makes it an essential tool for any business that manages payroll.

-

How does using a payroll calculator save time for my HR team?

By using a payroll calculator, your HR team can automate tedious calculations and focus on strategic tasks. The calculator provides quick, accurate results, reducing the likelihood of errors that can lead to time-consuming corrections. This efficiency enables your HR team to manage payroll processes more swiftly and effectively.

-

Can I customize the payroll calculator for my specific business needs?

Absolutely! The payroll calculator can be customized to fit your specific business needs, such as adding custom deductions or setting up different pay schedules. This flexibility allows you to tailor the calculations to match your company's unique payroll structure. Customized features ensure that it meets all your compliance and operational requirements.

-

What security measures are in place for the payroll calculator data?

airSlate SignNow employs robust security measures to protect your payroll calculator data, including encryption and access controls. This ensures that sensitive payroll information, such as employee salaries and personal details, is kept confidential. Your data protection is a top priority, providing peace of mind while managing payroll.

Get more for Payroll Calculator Sheet

- Tax certification statement 256349472 form

- Massachusetts department of revenue form 84 application

- Www templateroller comtemplate2315762form cu 7 ampquotvirginia consumers use tax return for individuals

- Www cityofchesapeake netassetsformsmilitary spouse residency affidavit for tax exemption

- City of chesapeake virginia commissioner of revenue form

- Form vm 2 virginia vending machine dealers sales tax

- Commissioner of the revenuelouisa county vataxeslouisa county vacommissioner of the revenuelouisa county va form

- Tc 899b original mileage schedule b utah state tax commission tax utah form

Find out other Payroll Calculator Sheet

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template