Hamilton County Conveyance Form

What is the Hamilton County Conveyance Form

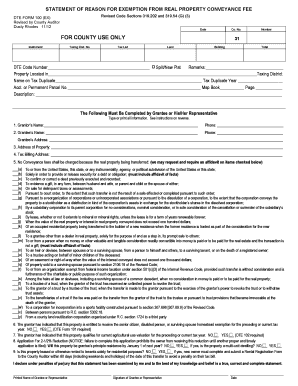

The Hamilton County Conveyance Form is a legal document used to record the transfer of real estate ownership within Hamilton County, Ohio. This form is essential for ensuring that property transactions are officially recognized and documented. It includes vital information such as the names of the buyer and seller, property description, and the conveyance codes specific to Hamilton County. Understanding this form is crucial for anyone involved in real estate transactions in the area.

How to use the Hamilton County Conveyance Form

Using the Hamilton County Conveyance Form involves several steps to ensure proper completion and submission. First, gather all necessary information, including the legal descriptions of the property and the details of the parties involved. Next, fill out the form accurately, ensuring that all sections are complete. Once completed, the form must be signed by both parties. It is advisable to have the signatures notarized to enhance the document's legal standing. Finally, submit the form to the appropriate county office for recording.

Steps to complete the Hamilton County Conveyance Form

Completing the Hamilton County Conveyance Form requires careful attention to detail. Follow these steps:

- Obtain the form from the Hamilton County Auditor’s office or their official website.

- Fill in the property details, including the parcel number and legal description.

- Provide the names and addresses of the grantor (seller) and grantee (buyer).

- Indicate the conveyance code that applies to the transaction.

- Sign the form in the presence of a notary public.

- Submit the completed form to the Hamilton County Recorder’s office for official recording.

Legal use of the Hamilton County Conveyance Form

The Hamilton County Conveyance Form serves a legal purpose in real estate transactions. It is used to document the transfer of property ownership and must comply with Ohio state laws. The form must be accurately completed and filed to ensure that the transfer is legally binding. Failure to use the form correctly may result in disputes over property ownership or issues with title insurance. It is recommended to consult with a legal professional if you have questions regarding the legal implications of the form.

Key elements of the Hamilton County Conveyance Form

Several key elements must be included in the Hamilton County Conveyance Form for it to be valid. These elements include:

- The full names and addresses of both the grantor and grantee.

- A complete legal description of the property being transferred.

- The conveyance codes specific to Hamilton County, which categorize the type of transfer.

- Signatures of both parties, preferably notarized.

- The date of the transaction.

Form Submission Methods

The Hamilton County Conveyance Form can be submitted through various methods. It can be filed in person at the Hamilton County Recorder’s office, where staff can assist with any questions. Alternatively, the form may be mailed to the office, but it is essential to ensure that all required signatures are included. Some counties may also offer online submission options, so checking with the Hamilton County Recorder’s office for current procedures is advisable.

Quick guide on how to complete hamilton county conveyance form

Complete Hamilton County Conveyance Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to obtain the necessary template and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Hamilton County Conveyance Form seamlessly on any platform with airSlate SignNow mobile applications for Android or iOS and enhance any document-related process today.

The simplest way to modify and electronically sign Hamilton County Conveyance Form with ease

- Find Hamilton County Conveyance Form and click on Get Form to initiate the process.

- Utilize the features we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, the frustration of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Hamilton County Conveyance Form and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hamilton county conveyance form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a conveyance form and why is it important?

A conveyance form is a legal document used to transfer ownership of property from one party to another. It is crucial because it ensures that the transfer is documented clearly, providing legal protection for both the buyer and the seller. Using airSlate SignNow, you can easily eSign and manage conveyance forms, making the process seamless and efficient.

-

How can airSlate SignNow help me with conveyance forms?

airSlate SignNow offers a user-friendly platform to create, send, and eSign conveyance forms electronically. This streamlines the process, allowing you to save time and reduce the hassles of paper documentation. With its intuitive interface, you'll be able to manage all your conveyance forms in one place.

-

Is there a cost associated with using airSlate SignNow for conveyance forms?

Yes, airSlate SignNow offers flexible pricing plans to accommodate different needs, which include features for managing conveyance forms. The cost is competitive compared to traditional document management processes, and you'll benefit from cost savings associated with reduced paper and printing materials. You can explore various plans to find the one that fits your budget.

-

What features does airSlate SignNow provide for managing conveyance forms?

airSlate SignNow includes features such as customizable templates for conveyance forms, secure eSigning, and real-time tracking of document status. These features ensure that your conveyance forms are filled out correctly and signed promptly, increasing overall efficiency. Additionally, the platform is equipped with robust security measures to protect your sensitive information.

-

Can I integrate airSlate SignNow with other applications for conveyance forms?

Yes, airSlate SignNow offers various integrations with popular business applications such as Google Drive, Salesforce, and Dropbox, allowing for seamless management of conveyance forms. By integrating with your existing tools, you can enhance your workflow and increase productivity. This ensures that your documents are accessible whenever and wherever you need them.

-

How secure are the conveyance forms I create with airSlate SignNow?

The security of conveyance forms created with airSlate SignNow is a top priority. The platform employs advanced encryption protocols and secure storage to protect your documents from unauthorized access. Additionally, audit trails provide transparency and accountability, ensuring that all actions taken on your conveyance forms are logged and traceable.

-

What benefits can I expect from using airSlate SignNow for conveyance forms?

Using airSlate SignNow for your conveyance forms offers numerous benefits, including increased efficiency, reduced costs, and enhanced security. With electronic signatures, you can expedite the process of document completion and eliminate the need for physical paperwork. This modern approach simplifies your workflow and improves overall satisfaction for all parties involved.

Get more for Hamilton County Conveyance Form

Find out other Hamilton County Conveyance Form

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple