Part C Declarations Authorised Recipient Declaration Form

What is the Part C Declarations Authorised Recipient Declaration

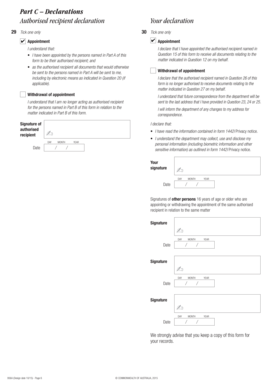

The Part C Declarations Authorised Recipient Declaration is a formal document used primarily in tax-related scenarios. It allows an individual or entity to designate an authorised recipient who can receive specific tax information on their behalf. This form is crucial for ensuring that sensitive tax data is handled appropriately and shared only with designated parties. Understanding the purpose of this declaration is essential for compliance with IRS regulations and for protecting personal information.

How to use the Part C Declarations Authorised Recipient Declaration

Using the Part C Declarations Authorised Recipient Declaration involves several straightforward steps. First, the individual or entity must complete the form by providing necessary details, including the name and contact information of the authorised recipient. It is important to ensure that the information is accurate to avoid any delays in processing. Once completed, the form should be submitted to the relevant tax authority or institution that requires this declaration. This ensures that the authorised recipient can access the necessary tax information without complications.

Steps to complete the Part C Declarations Authorised Recipient Declaration

Completing the Part C Declarations Authorised Recipient Declaration requires careful attention to detail. Follow these steps for accurate completion:

- Gather necessary personal information, including your Social Security number and the recipient's details.

- Fill out the form, ensuring all fields are completed correctly.

- Review the form for accuracy, checking that names and identification numbers are correct.

- Sign and date the form to validate it.

- Submit the form to the appropriate agency or institution as instructed.

Legal use of the Part C Declarations Authorised Recipient Declaration

The legal use of the Part C Declarations Authorised Recipient Declaration is governed by IRS guidelines and state regulations. This form must be filled out accurately to ensure that it is legally binding. The declaration allows for the transfer of sensitive tax information, which is protected under privacy laws. It is essential to comply with all legal requirements when submitting this form to avoid potential penalties or issues with tax authorities.

Key elements of the Part C Declarations Authorised Recipient Declaration

Key elements of the Part C Declarations Authorised Recipient Declaration include:

- Personal Information: The form requires the taxpayer's name, address, and Social Security number.

- Recipient Information: Details of the authorised recipient must be provided, including their name and contact information.

- Scope of Authority: The form should specify the type of information the recipient is authorised to access.

- Signature: The taxpayer's signature is necessary to validate the declaration.

Examples of using the Part C Declarations Authorised Recipient Declaration

Examples of using the Part C Declarations Authorised Recipient Declaration include scenarios where a taxpayer may want to allow their accountant or tax preparer to receive tax documents directly from the IRS. Another example is when a business owner designates a financial advisor to handle tax-related communications. These examples illustrate the importance of the declaration in facilitating efficient communication between taxpayers and tax authorities.

Quick guide on how to complete part c declarations authorised recipient declaration

Effortlessly Prepare Part C Declarations Authorised Recipient Declaration on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow supplies all the resources you require to create, adjust, and electronically sign your documents quickly and without interruptions. Handle Part C Declarations Authorised Recipient Declaration on any device using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

The Easiest Way to Edit and Electronically Sign Part C Declarations Authorised Recipient Declaration Seamlessly

- Obtain Part C Declarations Authorised Recipient Declaration and click Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or mask confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Modify and electronically sign Part C Declarations Authorised Recipient Declaration and guarantee effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the part c declarations authorised recipient declaration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Part C Declarations Authorised Recipient Declaration?

The Part C Declarations Authorised Recipient Declaration is a legal document used to designate an individual or entity authorized to receive correspondence on behalf of another party. This declaration is crucial for ensuring that all parties involved in a transaction have clear communication and are compliant with legal requirements.

-

How can airSlate SignNow facilitate the Part C Declarations Authorised Recipient Declaration process?

airSlate SignNow streamlines the process of creating and signing the Part C Declarations Authorised Recipient Declaration through its user-friendly platform. Users can easily fill out, send, and eSign documents electronically, making the process faster and more efficient.

-

Is airSlate SignNow secure for handling the Part C Declarations Authorised Recipient Declaration?

Yes, airSlate SignNow employs robust security measures to ensure that all documents, including the Part C Declarations Authorised Recipient Declaration, are protected. With features like encrypted data transmission and secure storage, users can trust that their information is safe.

-

What are the pricing options for using airSlate SignNow for Part C Declarations Authorised Recipient Declaration?

airSlate SignNow offers various pricing plans to accommodate different business needs, making it cost-effective for managing documents like the Part C Declarations Authorised Recipient Declaration. Users can choose from monthly or annual subscriptions based on their usage and requirements.

-

Can airSlate SignNow integrate with other software for handling Part C Declarations Authorised Recipient Declaration?

Absolutely! airSlate SignNow integrates with various software applications, enhancing its functionality for managing the Part C Declarations Authorised Recipient Declaration. Users can connect with tools such as CRM systems, cloud storage, and email services to streamline their workflows.

-

What benefits does airSlate SignNow provide for handling the Part C Declarations Authorised Recipient Declaration?

Using airSlate SignNow for the Part C Declarations Authorised Recipient Declaration offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced tracking capabilities. The platform simplifies document management, allowing businesses to focus on what matters most.

-

How can I ensure compliance when using airSlate SignNow for Part C Declarations Authorised Recipient Declaration?

To ensure compliance when using airSlate SignNow for the Part C Declarations Authorised Recipient Declaration, familiarize yourself with the relevant legal requirements. The platform provides guidance and templates that align with regulatory standards, making it easier to stay compliant.

Get more for Part C Declarations Authorised Recipient Declaration

- Beta sigma phi international scholarship form

- Cap application for 2019 form

- Henry fellowship yale university application form this form yale

- Cap standardized application for pathology fellowships form

- Hospital criteria form

- Fill in the blank obituary template form

- Book report form

- Information blank sheet

Find out other Part C Declarations Authorised Recipient Declaration

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney